A long-time acquaintance of mine, Charles Shor, contacted me recently to inform me that he had founded a new non-profit organization, Blue Collar Dollar Institute. Charlie has been a long-time reader of my blog articles, and we share a common concern — the shrinking middle class. We also shared the same opinion of the main reason for the cause of the shrinking middle class: the loss of higher-paying manufacturing jobs by American manufacturers outsourcing manufacturing to foreign countries, particularly China.

We agreed that the problem is, “By offshoring much of our manufacturing base, the United States has developed a dependency on importing consumer goods, amassing debt in the private and public sectors, and relying on critical goods from abroad in times of crisis such as pandemics and wars.”

We both feel that the middle class is in trouble. “The Blue Collar Dollar Institute aims to understand how the United States’ decision to subsidize foreign manufacturing is decreasing the size of our middle class, increasing the amount of Americans in poverty and catapulting forward the wealth in both the top 5% and foreign competitors.”

The Institute’s Mission Statement is: “The Blue Collar Dollar Institute believes that the United States cannot offer a middle-class lifestyle to a large majority of Americans without possessing a strong and vibrant manufacturing sector. Our non-partisan mission is to research data, inform the public, and advocate for policy in order to help strengthen US manufacturing and goods-producing sectors.

Prior to founding Blue Collar Dollar Institute, Charlie’s original foundation, The Charles Shor Foundation, collaborated with Dr. David Perkis, Purdue Center for Economic Education, Krannert School of Management, to prepare a 200-page Economic Indicators Report.

Charlie encouraged me to contact Dr. Perkis, and we had a long conversation when I connected with him last week. He explained that the report’s purpose “is to provide a picture of the economic and social wellbeing of the United States in comparison to five other industrialized nations: China, Japan, Germany, South Korea, and Singapore… Special attention is given to the manufacturing sector due to its perceived ability to offer high paying jobs and to create additional jobs in communities.”

One of the most serious facts the report reveals is: “Since 1945, the percentage of jobs in manufacturing, construction, and mining has dropped from 40% to 14%, eliminating some of the highest paying jobs for high school graduates.”

The result is: “The dreams of Americans obtaining the basics of a middle-class lifestyle, such as owning a home, sending their kids to college, and obtaining affordable housing, have become more and more out of reach for the average household.” I’ve seen this in my own family as my two adult children have not been able to buy homes in San Diego, CA.

The results of the research revealed that “Although the United States is still the world leader in total output, it has some dubious distinctions in comparison to the other countries of this study.” The other countries are China, France, Germany, Japan, South Korea, and the United Kingdom. In comparison to these countries, the United States has:

- The least amount of trade as a share of GDP

- The largest trade deficits

- The highest level of adult wealth

- The most significant wealth inequality

- The highest level of health care spending (without the best outcomes).

- The largest level of military spending

- The lowest GDP share of manufacturing

Needless to say, I only had time to read through the first 40 pages of the lengthy report, so I will only point out some key findings related to manufacturing and trade issues.

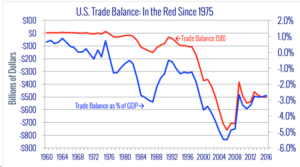

As I have written previously in my books and blog articles, the U.S. has trade deficits since 1976, so it was no surprise to me that the report states: “From 1992 – 2019, deficits in manufactured goods have totaled $16.3 trillion (2010 USD), with the bulk of the deficit occurring since 1992 ($15.5 trillion). Since 1992, our largest deficits in manufactured goods have been with China ($4.6 trillion) and Japan ($2.5 trillion).”

Another noteworthy point is “The United States is still the world leader in output as measured by Gross

Domestic Product (Figure 1). In 2019, GDP measured $21.4 trillion USD, compared to $14.4 trillion from its next closest rival, China.”

I’ve long said and wrote that manufacturing jobs are the foundation of the middle class, and if we lose sufficient manufacturing jobs, we will lose the middle class. The loss of middle-class jobs in the U.S. is demonstrated by the fact that “the United States is no longer the leader in average income ($62 thousand USD). That distinction belongs to Singapore ($101 thousand USD).” The result has been “Income inequality in the US has increased significantly over the past 50 years (Figure 10). Income growth for the lowest 60% of income earners fell from the late 1990s through 2015.”

This may be due to the fact that the percentage of jobs in producing goods went down from 39% in 1964 to 15% in 2019, while the percentage of jobs in services increased from 62% in 1964 to 85% in 2019. The average non-supervisory wage of goods jobs was $944/week I 2019, while the services wage was $699. However, service jobs in retail paid even lower in 2019 —$594/week.

With regard to budgets and deficits, “Except for a four-year period at the end of the Clinton administration, the United States has run a national budget deficit every year since 1970…The governments of Japan and the US carry the most debt…Japan has managed to accumulate the largest government debt as a percentage of GDP, totaling 232% (Figure 22). The United States is a distant

second carrying debt just over 100% of GDP…However, total government debt does not tell the whole story as some may be owed to a country’s own citizens while some will be due to foreign entities. For

instance, of Japan’s 232% debt, 208% is owed to domestic entities with a small portion due overseas (Figure 23). Within our comparison group, the United States government maintains the greatest holdings of debt to foreigners (37%).”

As I have written in previous articles, there is a relationship between budget deficits and trade deficits. When a country is buying more imports than selling exports, this produces less revenue for the government, so the country goes into debt to pay its expenses. We lost 5.8 million manufacturing jobs between 2000 and 2010, and have only added back 1.2 million manufacturing jobs from reshoring and Foreign Direct Investment. If these manufacturing workers had to get service jobs, they would be receiving lower wages and thus paying lower taxes. In addition, the higher percentage of workers being paid lower wages for a service job results in their paying less taxes, again reducing the government’s revenue.

The report also mentions the benefits of manufacturing for a town, region, state, and the country as a whole. This is because

1) “Most goods can be traded anywhere in the world, creating more exports and

generating income from overseas, whereas services are typically limited to

local markets.

2) Manufacturing positions create more additional jobs in the local community

than do service oriented positions. This is the multiplier effect of manufacturing.”

The report explains, “Job multipliers indicate how many total jobs will be created within a region due

to a new position in a particular industry.” The job multiplier effect for manufacturing jobs ranges from 2.2 to 4.0, whereas the multiplier effect for service jobs ranges from 1.3 to 1.9.

The goals of the Blue Collar Dollar Institute to have strong manufacturing, construction, and mining sectors would help middle-class households have a prosperous life in the following ways:

- “By creating high-paying jobs for individuals without a college education.

- By selling more products overseas than we buy overseas, bringing net funds into the country.

- By making our nation less dependent on foreign countries for critical goods in times of crisis such as pandemics and wars, thus reducing risk for the average American.”

I look forward to continuing my discussions with Dr. Perkis to explore ways in which Industry Reimagined 2030 can collaborate to achieve the goals we have in common, such as adding 5 million middle-income manufacturing jobs and $1 trillion to the economy by 2030.

Source: Coalition for a Prosperous America

Source: Coalition for a Prosperous America