For many years, the Organization for Economic Cooperation and Development (OECD) has been coordinating talks among 140 countries on cross-border tax reform in order to get multi-national corporations to pay their fair share of taxes. Currently, multinational corporations that have subsidiaries or divisions in other countries use legal accounting strategies to reduce their taxes by transferring profits to lower corporate tax rate countries or set up shell corporations in tax haven countries. It’s not fair for multinational firms to sell products in the U.S. market and then pay little or no federal taxes on the resulting profits. Domestic companies bear the brunt of our country’s tax burden, making it more difficult for them to compete in the global marketplace.

On June 5th, the G-7, which is an informal grouping of seven of the world’s advanced countries: Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States, reached an agreement on two pillars of global tax reform.

Pillar One of the agreement “changes allocation of taxing rights. Under the proposal, companies wouldn’t only owe taxes where they’re established and have assets and employees, but would also owe taxes where they have sales.” This new rule would apply to only the world’s 100 largest and most profitable companies.

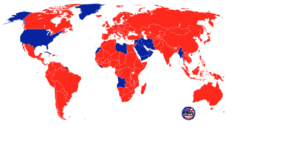

Pillar Two “imposes a global minimum tax on potentially any company that has a low effective tax rate on foreign earnings. If companies pay lower rates in a particular country, their home countries could “top-up” their taxes on foreign earnings to the minimum rate, removing the benefits of shifting profits. A proposed global minimum tax rate of “at least 15 percent on a country by country basis,” is designed to discourage multinational corporations from shifting profits to low-tax countries. Hopefully, a “worldwide minimum corporate tax rate would reduce the attractiveness of tax havens, which have increasingly become a common part of global business practice in the last three decades.”

“Corporate profit shifting into tax havens by U.S. multinationals has jumped from roughly 5 to 10 percent of gross profits in the 1990s to roughly 25 to 30 percent in 2019, according to a report by the International Monetary Fund. And the use of tax havens costs governments $500 billion to $600 billion per year in lost corporate tax revenue, according to a study cited by the IMF.”

Daniel Bunn, vice president of global projects at the Tax Foundation, told the Epoch Times, “This agreement is subject to further agreements, there’s a lot of work still to be done to ensure that the policy works well. “I’m concerned that if policymakers aren’t careful, they could impact global foreign direct investment flows and hurt business investments globally.”

“It is a whole new way of doing tax policy for multinationals. And one of the reasons I think that Treasury has tried to limit this to the 100 largest companies is because it has the potential to be really, really complex,” Bunn said.

One advantage of the proposed global minimum tax is that it could potentially end the discussion of digital services taxes on big tech companies, more of which are in America than any other country.

One potential problem is whether OECD would be the organization that would designate the top 100 companies in the world. If so, what criteria would they use and how often would the rating be updated, as the ranking could fluctuate from year to year.

Another consideration is what would be the impact of a 15 percent global minimum tax on U.S. companies combined with the substantial tax increases proposed by President Joe Biden that includes a 15 percent minimum tax on large corporations’ book income, as well as increases to the tax rates on both domestic and foreign income.

These two pillars will be the subject of the meeting of the G-20 countries scheduled for later this summer.

On June 8th, the Coalition for a Prosperous America (CPA) issued a statement, saying they “support the Organization for Economic Cooperation and Development’s (OECD) efforts ‘to address the tax challenges arising from globalisation and the digitalisation of the economy and to adopt a global minimum tax.’ This represents a positive step towards eliminating the ability of multinational companies to avoid paying U.S. corporate tax by shifting profits offshore to tax havens.”

“While not perfect, the G7 announcement represents a positive step forward, especially for family companies like mine that pay a higher corporate tax rate than foreign and multinational competitors,” CPA Chair Zach Mottl said. “To truly end the game of multinational profit shifting, the OECD should implement Sales Factor Apportionment.”

“For too long, multinational corporations have used an army of lawyers and tax accountants to offshore production and avoid U.S. corporate taxes,” said Michael Stumo, CEO of CPA. “It is welcome news that the G7 economies are supportive of addressing the harm to domestic producers from multinational profit shifting. However, it is concerning that the G7 announcement would allow the first 10 percent of profits to be exempt, which would allow some profit shifting to still occur. The Biden administration, which called for implementing Sales Factor Apportionment for the top 100 multinational corporations, should urge the G7 economies and the OECD to fully implement a sales-based apportionment system for all companies shifting profits.”

This OECD proposal would be similar but more limited in scope to the Sales Factor Tax Apportionment (SFA) framework supported by the Board of the Directors of Coalition for a Prosperous America since 2017. One of CPA’s members, Bill Parks, a retired finance professor and founder of NRS Inc. was the originator of the SFA framework. Mr. Parks stated “Currently MNEs manipulate loopholes in our tax system to avoid paying U. S. taxes…MNEs can legitimately choose a cost that reduces or increases the profits of its subsidiaries in different countries. Because the United States is a relatively high-tax country, MNEs will choose the costs that minimize profits in the United States and maximize them in what are usually lower-tax countries.”

Under SFA, the amount of corporate taxes that a multinational company would pay “would be determined solely on the percent of that company’s world-wide sales made to U. S. customers. Foreign MNEs would also be taxed the same way on their U. S. income leveling the playing field between domestic firms and foreign and domestic MNEs.” Thus, if a company generates $1 billion of profit on its U.S. sales, then it should pay corporate taxes on that $1 billion.

On May 18, 2017, CPA submitted written testimony to the House Ways and Means Committee, stating in part, “The US corporate tax system harms America’s trade competitiveness, overtaxes income from wages, under taxes consumption, and is bad at actually collecting what is owed. It also enables rampant base erosion through transferring profits to tax havens or countries with lower corporate tax rates. Full reform centered around destination based, border adjustment principles can result in an efficient, trade competitive, and largely tamper-proof tax system. SFA is a destination-based profit tax. Pretax income is allocated to the US in proportion to the percentage of a company’s total sales in the U. S. Pre-tax income earned outside the US is not taxed. Tax rates can be lowered substantially while still meeting revenue targets…SFA eliminates the disparate tax treatment between domestic companies (who pay the full income tax burden on worldwide income), multinationals (many of which shift profits to tax havens), and foreign companies (which pay a territorial income tax).”

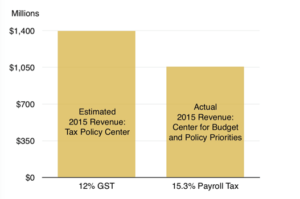

In September 2020, ”CPA published an analysis of the federal corporate tax paid by the S&P 500 companies in 2019 and found they paid on average less than 9% in cash federal tax last year. The analysis also found that by replacing the current corporate tax system with an SFA system at 21 percent, the United States could have expected to earn an additional $97.8 billion in federal corporate tax receipts for 2019.”

If the OECD doesn’t expand Pillar One into a SFA plan for all multinational companies, not just the top 100, then the U. S. Congress should act unilaterally to establish this plan here. Multinationals should no longer be allowed to employ convoluted profit calculations or reincorporate in a tax haven country as a means to avoid U.S. tax obligations. We need to take bold action if we want to rebuild our American manufacturing industry to create jobs and prosperity.