For more than the first 150 years of its history, the United States was a protectionist country in order to protect its fledgling manufacturing industries and then gain preeminence as an industrial nation in the 20th century. We had secure supply chain until after WWII because we imported very little and were pretty much self-sufficient for consumer goods as well as good for our national defense.

After World War II, the U.S. switched from protectionism to free trade in order to rebuild the economies of Europe and Japan through the Marshall Plan and bind the economies of the non-Communist world to the United States for geopolitical reasons.

To accomplish these objectives, the General Agreement on Tariffs and Trade (GATT) was negotiated during the UN Conference on Trade and Employment. Originally signed by 23 countries at Geneva in 1947, GATT became the most effective instrument in the massive expansion of world trade in the second half of the 20th century.

GATT’s most important principle was trade without discrimination, in which member nations opened their markets equally to one another. Once a country and one of its trading partners agreed to reduce a tariff, that tariff cut was automatically extended to all GATT members. GATT also established uniform customs regulations and sought to eliminate import quotas.

Unfortunately, our government leaders didn’t pay attention to the effect this was having on American businesses, and we started having a trade deficit in 1980 because of greater imports from Japan, Germany, South Korea, Taiwan, and the Philippines.

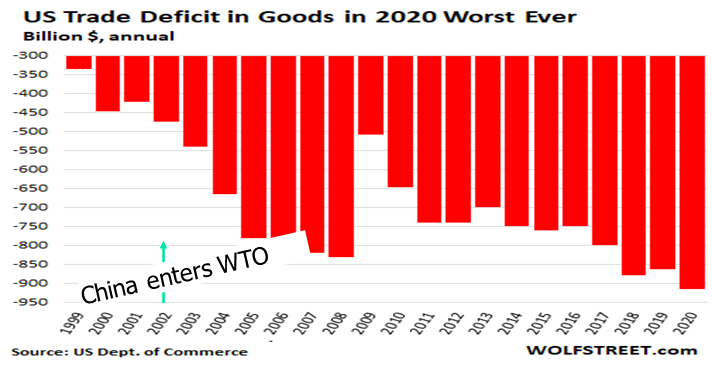

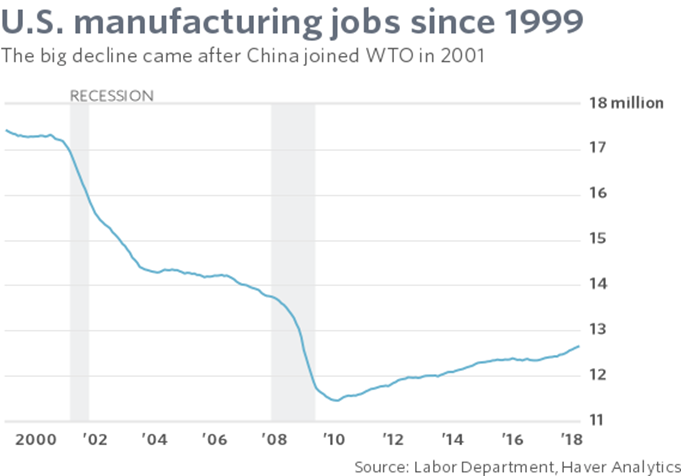

When NAFTA went into effect in 1994, it started the trend of moving manufacturing outside the U.S. When the World Trade Organization was formed in 1995, tariffs were reduced between all member countries. However, after President Clinton granted China Most Favored Nation status in the year 2000 and China was allowed to become a member of the WTO, the great exodus to setting up manufacturing in China began, and the trade deficit sky rocketed. According to Alan Uke’s book, Buying Back America, the United States has a trade deficit with 88 countries—some deficits are small, but some are enormous, such as China.

As a result, over 70,000 manufacturing sites closed in the past 25 years, and at the low point in 2010, we had lost 5.8 million lost middle-income manufacturing jobs.

Globalization of U.S. Supply Chains Failed

When the COVID pandemic hit, it sent shock waves throughout the world of manufacturing. Too late, we realized that we had become 70 to 95% import dependent, primarily on China. It was impossible to scale up our domestic supply chain fast enough for PPE goods and pharmaceuticals.

In an article, “It’s About Time to Build Regional Supply Chains,” on March 30, 2022 on Industry Week, Christopher S. Tang wrote, “I do believe most global supply chains are going to end. They had a good run over the last few decades, enabling Western companies to grow profitably and helping developing countries alleviate poverty. But concurrent and unprecedented events have blown apart their cost efficiency…Decades of outsourcing and offshoring have hollowed out the U.S. manufacturing sector. Building domestic supply chains in the U.S. can be time-consuming and cost-ineffective…Small and medium-sized manufacturers are facing the reality that there will inevitably be more disruptions in the future and they must prepare themselves now by strategically evaluating and mitigating their supply chain risks.”

This crisis could have been prevented if more American Manufacturers had utilized Total Cost of Ownership Estimator™ that Harry Moser made available for free in 2010 when he founded the Reshoring Initiative. Mr. Moser’s TCO Estimator has been the right tool to facilitate returning manufacturing to America. It actually includes calculations for the “hidden costs of doing business offshore,” such as Intellectual Property risk, political instability risk, effect on innovation, product liability risk, annual wage inflation, and currency appreciation.

In my experience as a sales rep, most companies only consider the quoted piece price or landed cost, at best. Because of inaccurate data, many companies make the decision to offshore on the basis of faulty assumptions. Some faulty assumptions are: Overseas laws will protect IP, longer lead times won’t affect costs much, travel costs won’t be significant, communication won’t be a problem, and quality will be just as good as USA. The reality is that many companies are saving less than they expected, and in some cases, the hidden costs exceed the anticipated cost savings.

We need to change the main considerations for selecting suppliers from one based on the lowest price to other considerations, such as

- Location

- Transportation alternatives

- Inventory costs and control

- Quality controls

- Reserve capacity of supplier

- Responsiveness of supplier

- Technological depth of supplier

Choosing the right location is the most critical choice. The choices are: Made in USA, “Offshoring” to China or another location in Asia, or nearsourcing to Mexico or Canada. The location of your customers influences the choice of manufacturing location. Here are some variables to consider:

- Where are your customers? USA, Asia, Europe, Latin America

- How high is your labor content?

- Is your annual production volume forecast low, medium, or high?

- Do you have low vs. high product mix?

- What certifications are required? Example: FDA, U/L, Mil Spec, ISO 9100, AS9100, etc.

There are current manufacturing trends that are also influencing supplier choice. Some of these are:

- Wages rising in China

- Increased “Made in USA” demand by government agencies and American consumers

- Additive Manufacturing

- Use of Industry 4.0 by suppliers (Automation, Robotics, Industrial Internet of Things (IIOT)

Some of the advantages of sourcing in the USA are:

- No Intellectual Property infringement

- Ease of communication

- Flexible delivery by means of reliable transportation

- Smoother design changes

- Lower cost of inventory

- Higher quality parts

- Lower travel expenses

- Favorable Purchase Order and Credit Terms

In today’s manufacturing supply chain, Reshoring helps companies have:

- Faster lead times: 49-50% reduction

- Delivery accuracy: 30-40% improved

- Ability to respond swiftly to unforeseen disruptions

- Handle volatile demand as closer proximity to customers drives agility

- Increased competitiveness

- Better serving local markets while maintaining low costs

I strongly believe that if more companies would learn to understand and utilize the Reshoring Initiative’s TCO estimator (free at www.reshorenow.org), they would realize that the best value for their company is to source their parts, assemblies, and products in America.

America is at a crossroads. We can either continue down the path of increasing trade deficits, increasing national debt, and loss of manufacturing jobs by allowing anything mined, manufactured, grown, or serviced to be outsourced to countries with predatory trade policies. Or, we can forge a new path by developing and implementing a national strategy to win the international competition for good jobs, sustained economic growth, and create a strong, secure domestic supply chain.

Doing this will help us achieve the vision of Industry Reimagined 2030 to change the national narrative of American manufacturing from a prevailing worldview of “inevitable decline” to one of “vibrant opportunity.”

If enough manufacturing is “reshored” from China, we would drastically reduce our national average annual trade deficit of more than $700 billion. By 2030, we could also add five million middle-income manufacturing workers to the American workforce.