People have forgotten that there are only three ways to create tangible wealth — mine it, grow it, or make it. Manufacturing is the term now used to describe “making it.” The problem with the current economy of the United States is that we have been outsourcing all three ways to create wealth to other countries for the past 25-30 years, primarily to China after the country was granted Most Favored Nation status in the year 2000.

As a result, we are now dependent on other countries for the energy, food, and manufactured good we need to sustain the modern way of life, protect the health and welfare of American citizens, and provide the goods needed to protect the national security of our country.

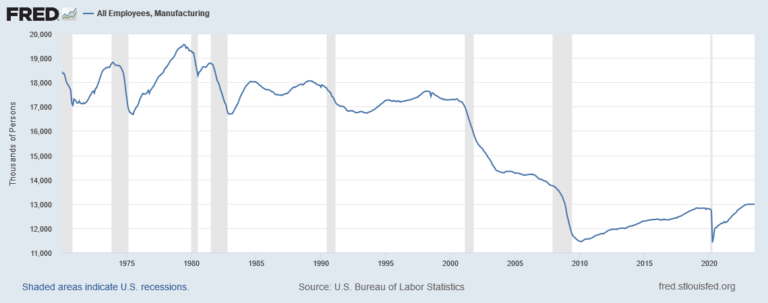

This outsourcing caused a dramatic loss of jobs in the manufacturing industry, namely, 5.8 million high paying jobs from 2000 – 2010.

Let’s consider what progress has been made on a few of the simpler and faster to implement strategies and policies to accelerate the rebuilding process. In my 2017 book Rebuild American Manufacturing – the key to American Prosperity, I quote recommendations made by the Information Technology& Innovation Foundation (ITIF) and the Coalition for a Prosperous America (CPA) and make many my own recommendations of what needs to be done to rebuild American manufacturing.

Two of the ITIF recommendations were: “Create a network of 25 Engineering and Manufacturing Institutes performing applied R&D across a range of advanced technologies and support the designation of at least 20 U.S. manufacturing universities.”

While the Manufacturing USA Network was formally established in 2014 when “Congress passed the Revitalize American Manufacturing and Innovation Act (RAMI Act) into law, it took three years of planning and competition to form the 16 institutes. Each of these institutes has a unique technological concentration, but is also designed to accelerate U.S. advanced manufacturing as a whole. The April 2024 edition of Design2Part magazine provides good description of the technological advances facilitated by several of the institutes.

Another ITIF recommendation was: Lower the effective U. S. corporate tax rate” because at that time, the United States had the highest statutory corporate tax rate at almost 39 percent (when state and federal rates are combined) of any OECD nation.”

The Tax Cuts and Jobs Act (TCJA) of 2017 “reduced the federal top corporate income tax rate from 35 percent to 21 percent, bringing the combined US federal and state rates to about the average for most other Organisation for Economic Co-operation and Development countries, and eliminated the graduated corporate rate schedule (table 1). TCJA also repealed the corporate alternative minimum tax.” However, the TCJA expires in 2026, so Congress will need to address this issue in 2025.

The ITIF also recommended” “Better promotion of reshoring.”

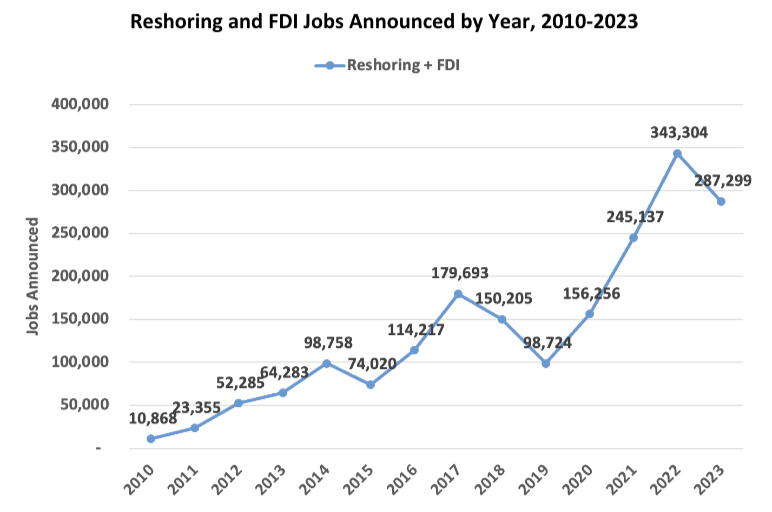

Thanks to changing economic factors and supply chain disruptions caused by the COVID pandemic, the work of Harry Moser of The Reshoring Initiative to help manufacturing companies do a Total Cost of Ownership Analysis to return manufacturing to America, reshoring has dramatically accelerated in the past three years. As the chart below shows, we have been able to reshore nearly two million manufacturing jobs (1,898,404) as shown on the chart below:

However, at this rate, it would take another 20 years to recoup the 5.8 million we lost from 2000 – 2010. To rebuild American manufacturing in a faster way, we must focus on other policies besides reshoring.

The Coalition for a Prosperous America (CPA) released a white paper, titled, “A Competitiveness Strategy for the United States – America at a Crossroads,” in November 2015 that included an even longer list of recommendations. As a member of CPA since 2011, I quoted all of their recommendations in my 2017 book and have written blog articles in the past several years about many of the specific strategies and policies the report included.

- Impose offsetting tariffs to neutralize foreign government subsidies to industries and supply chains that compete with ours.

- Counter foreign government policies that force offshoring by conditioning access to their markets on transfers of technology, research facilities and/or production to their countries, as well as compliance with export performance and domestic content.

- Develop a national trade strategy and increase funding for U.S. trade policymaking and enforcement agencies. (blog article)

- Combat foreign currency manipulation through a Market Access Charge (blog article)

- Congress should strengthen and tighten procurement regulations to enforce “Buy America” for all government agencies, not just the Department of Defense. (blog article)

- Prevent sale of strategic U.S.-owned companies to foreign-owned companies (blog article)

- Ensure that domestic manufacturing and agriculture benefit fully from an expanded supply of low-cost US produced energy” (blog article)

President Trump took action on the tariff recommendation in January 2018 by imposing tariffs on solar panels and washing machines of 30 to 50 percent. In March 2018, he imposed tariffs on steel (25%) and aluminum (10%) from most countries. In June 2018, this was extended to the European Union, Canada, and Mexico. However, with the ratification of the United States–Mexico–Canada Agreement (USMCA), the North American trade deal set to replace the North American Free Trade Agreement (NAFTA), the tariffs on Canada and Mexico were rescinded on steel and aluminum. Since then, Argentina, Australia, Brazil, and South Korea have successfully negotiated a permanent exemption from the steel tariffs. In addition, the Trump Administration Enforced penalties on trans-shipping of steel & aluminum. Thankfully, the Biden administration has kept these tariffs in effect, essentially saving the U.S. steel and aluminum industries.

The Coalition for a Prosperous America (CPA) asserts that further tariffs are needed to balance trade, and on July 24, 2024, CPA “released a new economic analysis showing that a global 10% tariff on all U.S. imports would generate U.S. economic growth, increase real wages, increase employment, and raise additional revenue to lower taxes for lower- and middle-class Americans.

Our analysis finds that a 10% tariff would stimulate domestic production and raise economic growth to produce a 5.7% increase in real income for the average American household,” said CPA Chief Economist Jeff Ferry. “Further, the $263 billion raised in tariff revenue could be used to provide tax refunds to all households with income below $1 million a year, creating a progressive tax refund.”

We have a long way to go on implementing some of the other recommended policies to rebuild American manufacturing.. How these issues should be addressed should be one of the main criteria of who to vote for in November, both for President and Congressional candidates.

Since I started writing the first edition of my previous book, Can American Manufacturing be Saved? Why we should and how we can in 2007, I have made it my mission for the rest of my life to do as much as possible as I can to rebuild American manufacturing to create jobs and prosperity. The future of the American middle class and, more importantly, our national security depends on the choices we make and the actions we take now.