We are now nearing the end of the second year of high inflation, and many are wondering why has it been so hard for the Fed to kill inflation. Could the Fed improve the efficiency of its inflation fighting and avoid causing a recession? Could it do so in a way that balances both foreign trade and the federal budget?

“Yes” is the answer given by one of my fellow members of the Coalition for a Prosperous American, John R. Hansen, PhD, Economic Advisor, The World Bank (retd.) and Founding Director of Americans Backing a Competitive Dollar (ABCD), He wrote me that he believes the Fed could do all of this plus fulfill its mandate of economic growth with stable prices more successfully – and brighten the future for all Americans, both now and for generations to come with only a small policy tweak.”

He explained that “each of America’s ten recessions since the late 1950s has been preceded by inflation and significant increases in the Fed Funds Rate (FFR). Higher interest rates and tighter credit obviously increase costs and reduce demand for American goods resulting in inflation. Reduced demand reduces both output from U.S. producers and growth. By increasing the cost of doing business, higher Fed interest rates force businesses to reduce output and fire workers, leading to recessions.”

In his opinion, “today’s Fed faces a key challenge because when the Fed raises the Fed Funds Rate, inflows of foreign-source money dilute the Fed’s efforts to reduce the availability and increase the cost of capital. This makes it harder for the Fed to control inflation. Also, excessive stocks of domestic credit tend to reduce the Fed’s ability to raise banks’ lending rates by normal margins.

He added, “When foreign speculators buy up dollars, they raise the dollar’s exchange rate. This makes foreign goods cheaper than those produced in America, destroying demand for American products both here and abroad. U.S. producers find it increasingly difficult to compete with foreign-made goods and many may go out of business.”

Dr. Hansen has developed a solution to moderate inflows of foreign money to make the Fed’s traditional inflation-fighting tools more effective. — a Market Access Charge (MAC) “on any purchase of U.S. dollar financial assets by a foreign entity or individual. As a one-time charge, the MAC would discourage short-term investors, overseas private investors, and return-sensitive official investors such as sovereign wealth fund managers from excessive speculation and trading in U.S. dollar assets.”

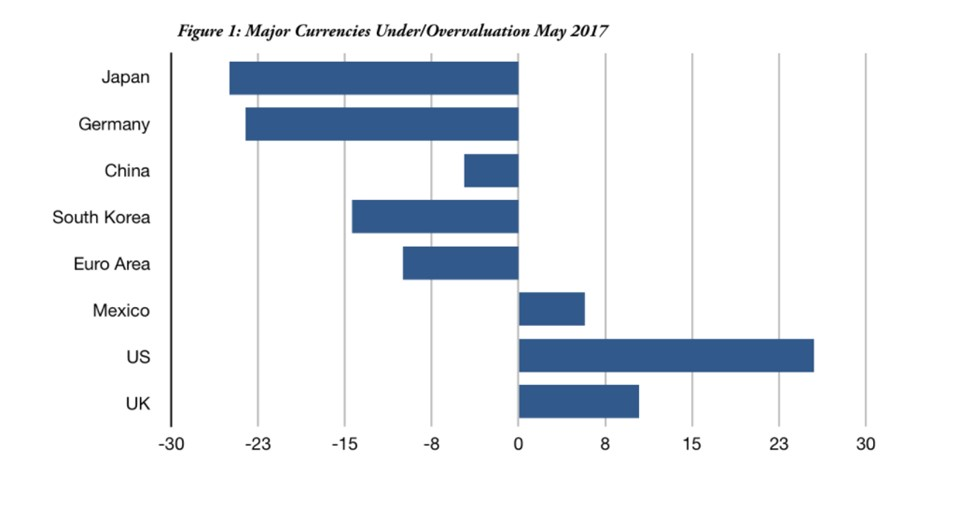

He believes that the Fed “can efficiently and effectively use the MAC as a tool to fix the undervaluation of foreign currencies against the dollar. Implementing the MAC could eliminate the U.S. budget deficit, sharply reduce the threat of future debt-ceiling crises, and increase resources available for important industrial policy initiatives, especially those related to national security such as chip manufacturing.”

Furthermore, he wrote that “implementing the MAC would markedly increase the Fed’s ability to control inflation with higher interest rates and tighter monetary policies. With the MAC in place, the Fed’s efforts would no longer generate the massive inflows of foreign-source money inflows that today are triggered by high U.S./foreign interest rate spreads.”

The MAC would be a small fee that would be collected by U.S. banks on all foreign-source money seeking entry to America’s financial markets. The fee, which would be adjusted periodically to eliminate the spread between higher average U.S. interest rates and lower average foreign interest rates, would sharply reduce the speculative gains of foreign-source money. Last year, $90 trillion worth came into America’s capital markets, which was about four times GDP!

Dr. Hansen’s latest calculations indicate that “a 2% MAC charge – about half the spread between U.S. and foreign interest rates that is drawing in foreign cash and making U.S. goods and workers too pricy to compete internationally – would generate about $1.8 trillion of new net revenues per year out of the pockets of foreign speculators – enough to eliminate the U.S. budget deficit and to allow America to start paying down its largest-in-the-world national debt.”

Such revenues would have fully covered the $1.4 trillion deficit for FY2022 with $400 billion left over to support important services, cut taxes, and/or pay down the national debt. Fewer Fed interest rate increases would lower the cost of borrowing for the government. Implementing the MAC tomorrow might not save America from defaulting on its debt this year, but doing so would greatly improve America’s fiscal position, sharply reduce the risk of a recession, stimulate economies of scale, reduce inflation, and reduce America’s growing debt.

Here are a few of the many benefits that America would enjoy if Congress were to approve this trade policy initiative – a policy based on 21st century realities, not 18th century theories.

- Reduce the incentives of foreign countries like China and Japan to manipulate the value of their currencies against the dollar.

- Increase domestic and foreign demand for Made-in-America goods, thereby creating at least 3-5 million well-paying middle-class jobs, mainly in manufacturing and associated sectors.

- Trigger domestic and foreign investments in American manufacturing that would increase output and productive efficiency.

- Generate about ten times as much Government revenue per year as import duties on merchandise trade currently generate. And unlike import duties, the MAC would be paid by foreigners, not by people living in America.

- Be far more effective than tariffs in reducing overall U.S. trade deficits with countries like China. Tariffs can be evaded rather easily with a large number of widely known tricks like shipping through third countries, rebranding, and under-invoicing.

- Make it possible for the U.S. Government to implement important national security, infrastructure, environmental protection, and social investments without raising taxes or increasing the public debt.

- Reducing America’s debt service burden would further increase the Government’s ability to invest in high priority programs such as skills training, childcare, and other initiatives that would help the average American and increase America’s productivity without increasing the public debt.

- By implementing the MAC, America could roughly double its current rate of economic growth. The MAC would stimulate domestic production and exports while reducing our excessive dependence on imports.

Dr. Hansen and the Coalition for a Prosperous America believe that the MAC would be sufficient to discourage foreign inflows of investment with no material impact on foreign direct investment in factories and other directly productive activities. The MAC or something like it is urgently needed. Implementing the MAC would greatly improve America’s fiscal position, sharply reduce the risk of a recession, stimulate economies of scale, reduce inflation, and reduce America’s growing debt. Our top priority today should be to protect our national security to remain a free country to ensure the well-being and safety of our children and grandchildren in the future.