Recently, John R. Hansen, PhD, Founding Editor of Making America Competitive Again, emailed me his latest white paper titled, “To Fight Inflation, Avoid a Recession, and Stop the Coming Budget Crisis, Implement the MAC – NOW” to review. Dr. Hansen is the creator of the Market Access Charge (MAC) about which I have written previously in articles and my book, “Rebuilding Manufacturing – the key to American Prosperity.

In his latest white paper, he explains that the MAC is “a small charge that would be collected on all foreign-source money entering America’s financial markets…which would probably start at two percent (about half the Fed Funds Rate at the beginning of 2024) would be collected by US banks receiving foreign money transfer orders via systems like SWIFT.” [The fee] would be adjusted periodically to reduce or eliminate the spread between higher US interest rates and the lower foreign interest rates that attract foreign money.”

Previously, I have explained that Dr. Hansen believes that the overvalued U.S. dollar has caused a currency misalignment with other currencies since the 1970s and “has thus been a major factor causing America’s rising trade deficits, increasing burden of debt to foreigners, lost jobs, slowing growth, increased budget deficits, and socio-economic polarization.”

Other countries such as China, Vietnam, Korea, and Japan have undervalued their currencies, making their products more competitive in the global marketplace, while our overvalued dollar makes American products more expensive in the global marketplace. As a result, we import more products than we export, causing the increasingly large trade deficits in the past 20 years. Trade deficits have grown from $451 B in the year 2000 to more than double at $945 B for 2022 (2023 data not released yet).

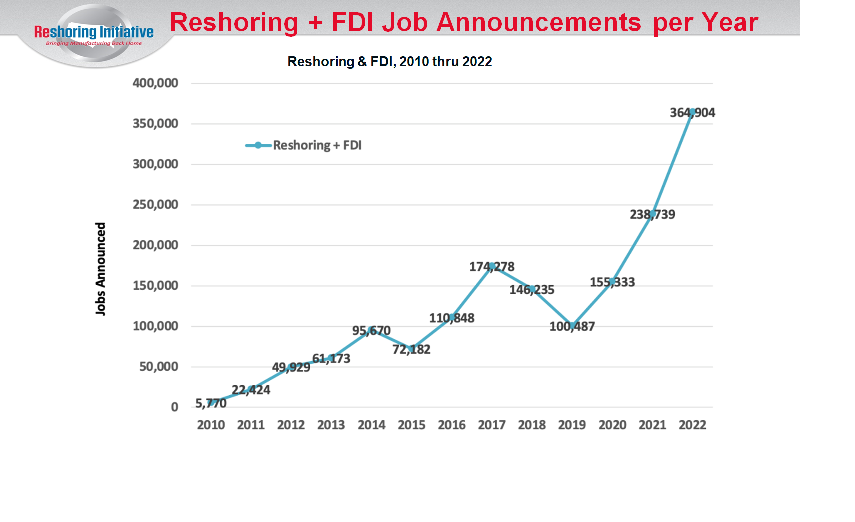

In turn, when we import goods from foreign countries instead of buying American made products, we hurt American manufacturers by reducing their sales of goods, and this has greatly contributed to the closing of over 70,000 manufacturing firms in the past 20 years and the loss of 5.8 million manufacturing jobs between 2000 – 2010. While we have regained over a million manufacturing jobs due to the efforts of the Reshoring Initiative that I mentioned in my last article, we haven’t been creating new manufacturing companies to replace the thousands we lost.

Dr. Hansen stresses the urgent need to adopt a MAC in order to make “a major contribution to balancing the US budget, thus reducing the risk that Congress fails to reach a budget agreement in time to avoid another disastrous Government shutdown [as well as] “reducing the inflow of over $90 trillion of foreign-source money into America would also make it far easier for the Fed to kill inflation without killing the economy.”

Dr. Hansen believes that by “Reducing the interest rate spread would sharply reduce the speculative gains that currently attract tens of trillions of foreign-source money into America each year [so that] the Fed could to set domestic interest rates high enough to control inflation without causing a recession.”

He provides the following ten reasons why a MAC should be urgently adopted:

- Fight Currency Misalignment – “the MAC would control the currency inflows that destroy the competitiveness of Made-in-America goods both here and abroad.”

- Potentially eliminate US budget deficits, reduce America’s outstanding national debt, and reduce interest payments on debt – “Interest payments alone currently drain nearly two billion dollars per day out of our national budget…. about forty percent of America’s total public debt was owed to foreigners. “

- Make it possible for the US Government to implement and sustain important programs – “investments in better national security, infrastructure, environmental protection, and social programs… without raising taxes or increasing the public debt.

4. Fight inflation with less risk of causing a recession – “When the Fed raises interest rates to fight inflation, the spread between average interest rates here and abroad widens, creating an irresistible incentive for foreign speculators to bring their money into America’s financial markets and purchase dollars and dollar-based assets.”

5. Increase domestic and foreign demand for Made-in-America goods – “A more competitive dollar would create at least 3-5 million well-paying middle-class jobs, not only in manufacturing and associated sectors, but also in sectors producing internationally traded products such as agricultural and other natural resource products, as well as services such as movies and other intellectual property.”

6. Trigger real domestic and foreign investments in American manufacturing – “97 percent of net foreign investment flows into the US last year went into portfolio investments – the purchase of existing financial assets such as stocks, bonds, and derivatives. Only 3 percent of net annual direct foreign investment went into the creation and expansion of real physical capacity that improves America’s productivity, leading to lower prices, less inflation, greater competitiveness, more rapid economic growth, higher living standards, increased revenues, and balanced budgets.”

7. Be far more effective than tariffs in reducing overall US trade deficits with countries like China – “Tariffs can be evaded rather easily with widely known tricks like shipping through third countries, rebranding, and under-invoicing. In contrast, evading an exchange rate is virtually impossible.”

8. Reduce America’s debt service burden.

9. Increase economic growth – “The MAC would stimulate domestic production and exports while reducing our excessive dependence on imports. With the MAC in place, America could roughly double its current rate of economic growth.”

10. Put America back onto the path to the American Dream – “the dream of sustained economic growth based on rising productivity, not rising debt, with benefits shared more equitably by all Americans.”

Dr. Hansen states that “The MAC, which is fully legal under US and IMF rules, could be implemented in a matter of weeks by legislative action or by the President under the International Emergency Economic Powers Act (IEEPA). No new administrative structures would be needed. Existing US correspondent banks would be directed (a) to collect the MAC as a routine part of processing SWIFT and similar international payment orders and (b) to immediately send the proceeds minus a modest processing fee for the bank to the US Treasury. As a single MAC rate would apply to all inflows, no additional time or skill would be required for processing at the border.”

The Coalition for a Prosperous America supports the Dr. Hansen’s Market Access Charge as a strategy to balance the overvalued dollar, stating online: “Persistent U.S. dollar overvaluation fuels much of America’s global trade deficit by raising the price of U.S. goods and services in global markets. While the United States has an array of fiscal and monetary tools to manage its internal economy, it lacks effective exchange rate management tools to manage trade flows that have a powerful effect on the domestic economy.

For this reason, CPA advocates for The Competitive Dollar For Jobs And Prosperity Act, introduced by Senator Baldwin & Senator Hawley. This bill tasks the Federal Reserve with achieving and maintaining a current account balancing price for the dollar within five years.”

This bill, S. 2357, was introduced on July 31, 2019 by Senator Tammy Baldwin (D-WI) in the 116th Congress (2019-2020), but it died in committee without receiving a vote. This Bill would have implemented the “Market Access Charge.” CPA continues to advocate for this strategy to be included in new bills introduced into Congress.

More recently, American Compass, a 501(c)(3) non-profit organization, issued Policy Brief No. 5 v.1.1 on October 19, 2022, supporting The Market Access Charge – Make American Goods More Attractive to Foreigners Than American Assets. The brief states, “This approach addresses a root cause of America’s trade deficit: its capital account surplus. America only runs a trade deficit because its trading partners prefer to exchange their goods for our assets rather than our own goods. By raising the cost to foreigners of purchasing American assets, such as stocks and bonds, foreign demand would shift toward American goods. “Trade” would shift toward genuine trade, of one country’s product for another’s, in exchanges beneficial to both.”

It’s time to stop the destruction of American industry and innovation, the loss of high-paying manufacturing jobs, and the collapse of communities. We must stop importing more goods than we export, leaving us deeply indebted to our trading partners. I urge Congress to urgently pass a bill that would implement the Market Access Charge. Call your Congressman and Senator today to urge them to introduce such a bill.