On the second day of the Lean Accounting Summit, August 26th, The ATC story was the Keynote, presented by Steve Brenneman, President, and Duane Yoder, Production Manager.

Their story was so impressive that it justified being told in an article instead of a brief summary in my previous article about the summit. Steve titled his presentation, “It’s a lean life!” His definition of lean is “using the scientific method to continuously improve the business and other related parts of the entire value stream. Also, it is a complete change of the way that we work as human beings. We go from individual heroes to strong teams.”

From the ATC website, I learned that ATC is a privately held company with eleven owners, 9 of whom “are involved in and manage every aspect of the company…Each owner contributes to the company in almost every phase of the business by doubling their duties as both Owner and CEO, CFO, Production Manager, Engineering Manager, Sales/Marketing Director.” The company was founded in 1999 and is located in Nappanee, IN, within Elkhart County, which is touted to be the Trailer Capital of the U. S. for RVs and Cargo Trailers.

Their website states, “ATC is one of the only manufacturers who can build all models and custom trailers in, both, steel and aluminum…This can range from a barebones 5’ x 8’ trailer up to a mobile command center fully fit up with dual slide outs, custom finishes and 60 KW power generation. ATC produces a wide array of trailers to meet every customer request.”

ATC is very vertically integrated in their manufacturing processes, as the website states, “Our system of material handling and placement on the production floor ensures that your workers’ time is spent building your trailer and not searching for material, tools and fixing errors. By fabricating and building components on site, we eliminate the overhead costs that come from outsourcing. Every hour spent and piece of material used is transparent and reflected in the pricing you are quoted.”

This is where ATC is now, but they have come a long way since the economic crash in the fall of 2008 that led to a near collapse of the trailer and RV industry in 2009. ATC owned a window manufacturing company, Nappanee Window, that provided windows for their trailers, as well as trailers and RVs made by other companies.

Because of the steep industry downturn, Steve said, “We had to shut down Nappenee Window in 2009 and sell off the assets. We had also built ATC up from scratch in 1999 to $26 million business in 2006. From 2007 to 2009 sales dropped 60%, and we were in survival mode.”

This dire situation led to a serious examination of where they were headed. Steve said, “We had only dabbled with lean previously. After reading Lean Thinking, we saw all of our mistakes at Nappenee Window and saw many of the same issues at ATC, but now we saw them through lean eyes.”

Steve said, “We had relied heavily on tribal knowledge, and as a result our average vendor was paid 25 days late. We had negative equity, and we only did five raw material inventory turns/year. We started practicing lean and changed to building a standard line of trailers.

Duane took over as presenter and explained that they separated into three lines based on work content and complexity of the trailers:

- Line 1 (Raven)

- Line 2 (Midline)

- Line 3 (Custom/Large).

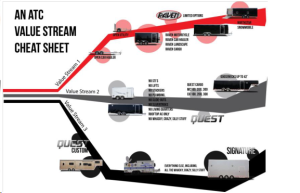

Duane said, “We set up three Value Stream teams, composed of trailer design, Inside Sales, Value Stream Leader, and the Value Stream team members. We created a lean office for each value stream. Steve and I became a leader for two of the value streams. We now have five value streams and are trying to change the mindset of everyone.” Then, he shared the following slide showing their Value Stream reorganization:

When Steve took over again as presenter, he said, “We were profitable the first year after starting to practice lean. Our sales went from $10 million in 2009 to $42 million in 2015, and our net income has grown dramatically as well. Our inventory turns tripled from 2010 to 2014. Our long term debt has dropped by over 50%.”

Steve said, “After seven years of hard work, we have:

- Improved flow – went to one building from two

- Cleaned up the mess

- Did 5S for maintenance department

- Established a supermarket/material supply system

- Use a Materials/Kanban to all lines

- Changed to Value Stream Management since 2012

We are working with Joe Murli (CEO of The Murli Group). We follow Joe’s definition of a Lean Management System – “everybody, everywhere, every day comes together in small teams and reflects on how we did yesterday, where the waste was, and how we can do better today.”

In the Murli Group’s Lean Management system, True North is the unifying, overarching purpose for the entire organization and keeps the individuals and organization all pulling in the same direction. True North equals:

- Zero Defects

- 15% Productivity Improvement year over year

- 100% value-added activity

- 100% on time delivery

- Respect for People

“We use visual controls on the shop floor. Standard work was the most difficult to do. We developed a Leader Standard Work Bus schedule.

From January 2015 to February 2016, we reduced labor time from 181 min down to 84 minutes for our simplest trailer (Line 1). On our Open Utility line, we reduced labor minutes from 360 min. in January 2015 to 248 minutes by mid April 2016. We use “kitting” and improved cell arrangement to eliminate as much walking as possible.

With regard to talent development, we are training leaders to lead in a new way. We do daily reflection team leader meetings at end of day. There are five tier 2 meetings per day, two tier 3 meetings per day, and one tier 4 meeting per day.

The change took nine months ? three months longer than we had planned. It took four years to gradually switch over to Lean accounting. It is simple and just makes sense to lean organizations. Now we get P & L weekly.”

In an interview after the summit, I asked Steve a few clarifying questions:

In answer to why they chose to transform their company into a Lean company instead of using some more traditional turn-around methods, he said, “Lean just seemed like a better way to think about operational excellence. It was more of a method rather than just trying harder or doing what everyone else was already doing. It felt right for some reason.”

When asked what was their biggest stumbling block in their Lean transformation, he said, “We tried to do too much too fast before allowing people to start to understand these new concepts with us. We tried to just be the experts and do the thinking for everyone.”

In answer to my inquiry about how becoming a Lean company changed the culture of the company, he replied, “Lean has really helped us to have a unified concept that everyone could get behind. It provided a common framework that we could point out to people as to where we were headed and why.”

Finally, I asked what have been the biggest benefits of becoming a Lean company, and he replied, “We get to involve everyone in the process of making things better. Then, we all get to share in the proceeds. I like that a lot. It seems to fit within my view of how the world should work.”

Hearing stories like this is one of the reasons I enjoy attending and presenting at the Lean Accounting Summit put on by Lean Frontiers. It is another example of how transforming into a Lean Company can make the difference between success and failure as a company. Have you made this transformation? If not, start learning and practicing now!