The “kick the can” legislation that passed in the wee hours of January 1st didn’t address the real economic issues threatening a fiscal cliff for the United States ? the massive trade deficit and the rapidly escalating national debt. This article will show how these two economic issues are interrelated.

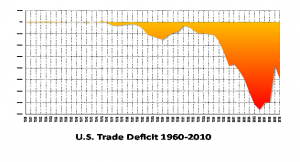

The trade deficit grew from a low of $91 million in 1969 to a peak of $698.3 billion in 2008, dropping down to$379 billion in 2009 due to the worldwide recession before climbing back up to $559.8 billion in 2011. Final figures for 2012 are not available yet, but the trade deficit through the first 11 months of 2012 is running at an annual rate of $546.6 billion.

Our trade deficit with China grew from only $6 million in 1985 to a high of $295.4 billion in 2011, after it had dropped down to $226.8 billion in 2009 during the recession. China’s portion of America’s trade deficit has nearly tripled ? from 22 percent in 2000 to 60 percent in 2009 and 52.7 percent in 2011. In the 11 years since China joined the WTO, the U.S. trade deficit with China has grown by 330 percent.

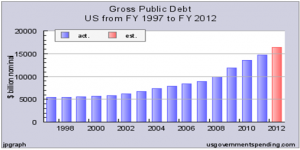

The national debt has grown from $5.6 trillion in 2000 to $16.4 trillion on January 12th. As of July 2012, $5.3 trillion or approximately 48% of the debt held by the public was owned by foreign investors, the largest of which were China and Japan at just over $1.1 trillion each.

“The estimated population of the United States is 314,243,893 so each citizen’s share of this debt is $52,304.77. The National Debt has continued to increase an average of $3.84 billion per day since September 28, 2007!”

As you can see, the debt accelerated after the economic collapse in the fall of 2008 and has continued to accelerate since because of the recession, automatic increases in unemployment benefits, food stamps, and social security payments for early retirement, as well as stimulus spending. The all-time record of increasing the debt by $1.1 trillion was set by President Bush in 100 days between July 30 and Nov 9, 2008 to avert the economic collapse of major banks and Wall Street companies. “Recessions cut tax revenues—in this case, dramatically, which accounts for nearly half of the deficit.”

According to Tom Donohue, head of the U.S. Chamber of Commerce, the nation’s largest business lobbying group, “The single biggest threat to our economic future … is our exploding national debt, driven by runaway deficit spending, changing demographics and unsustainable entitlements,” he said in his annual “State of American Business” address.

The reason why our massive trade deficit and escalating national debt are interrelated is that they share a common factor: the American manufacturing industry and the jobs it generates or the jobs it has lost.

According to the Information Technology and Innovation Foundation report, the U. S lost 5.7 million manufacturing jobs in the decade of 2000 to 2010, more than the total number of manufacturing jobs than the rate of loss in the Great Depression (33.1 % vs. 30.9%). Manufacturing jobs now only make up 9% of the American workforce, down from about 14% in 2000. Two million manufacturing jobs were lost in the Great Recession, adding to the 3.7 million we had already lost. Less than 10% have returned since the end of the recession. The report concludes:

- A large share of manufacturing jobs was lost in the last decade because the United States lost its competitive edge for manufacturing. It was due to a failure of U.S. policy, not superior productivity.

- The loss was cataclysmic and unprecedented, and it continues to severely impact the overall U.S. economy.

- Regaining U.S. manufacturing competitiveness to the point where America has balanced its trade in manufacturing products is critical to restoring U.S. economic vibrancy.

- Regaining manufacturing competitiveness will create millions of higher-than-average-wage manufacturing jobs, as well as an even greater number of jobs from the multiplier effect on other sectors of the economy.

- The United States can restore manufacturing competitiveness and balance manufacturing goods trade within less than a decade if it adopts the right set of policies in what can be termed the “four T’s” (tax, trade, talent, and technology).

The Economic Policy Institute briefing paper, “The China Toll,” written by Robert Scott focuses on the effects of our trade deficit with China. He wrote, “Growing U.S. trade deficit with China cost more than 2.7 million jobs between 2001 and 2011, with job losses in every state.”

“Between 2001 and 2011, the trade deficit with China eliminated or displaced more than 2.7 million U.S. jobs, over 2.1 million of which (76.9 percent) were in manufacturing. These lost manufacturing jobs account for more than half of all U.S. manufacturing jobs lost or displaced between 2001 and 2011.”

The growing trade deficit with China has been a prime contributor to the crisis in U.S. manufacturing employment. When you take into account the multiplier effect of manufacturing jobs creating three to four other jobs, the U. S. has lost six to eight million jobs as a result of the trade deficit with China alone. The Department of Commerce estimates that each $1 billion in trade deficit translates to about 13,000 lost jobs, so the $559.8 billion in the total trade deficit for 2011 represents a loss of 7,277,400 jobs. This explains why we have had a virtually jobless recovery since the end of the recession and why the unemployment rate has stayed high for so long.

The average manufacturing job nationwide pays about $40,000 per year ($20/hour). According to the 2012 federal tax table, a person making that amount of money would pay about $4,000 to $5,000 per year in taxes, depending on whether they are single or have one dependent. Without doing the complicated math to calculate the number of lost manufacturing jobs each year times the taxes those workers would have paid, you can see that the result could be trillions of dollars in lost tax revenue since the year 2000.

Adding this lost tax revenue to the cost of an unemployed worker in the form of unemployment benefits (about $15,000 year for a $40,000/year job) and possibly food stamps, you can understand the major cause of why our national debt has escalated so dramatically in the last ten years. We could raise income taxes to the highest rates of European countries such as Sweden (75%) and still not be able to pay down our national debt. The solution is not raising taxes, it is creating more tax payers, especially those employed in the higher paying jobs of the manufacturing industry. Our trade policies that result in such huge trade deficits and loss of manufacturing jobs have transformed taxpayers into tax consumers.

Because of our trade deficit with China and our national debt, we are essentially writing two checks to China every month: one to pay for the cost of the imports we buy and the other to pay for the cost of borrowing money from China to pay for the cost of running our government. By maintaining this trade deficit, we are sending our tax revenue to China; then, we borrow a portion of it back to pay our expenses. This is unsustainable!

We are at a cross roads in our country. We must change our tax, trade, and regulatory policies to rebuild our manufacturing industry to increase the number of taxpayers if we ever want to pay down our national debt, reduce our unemployment rates, and avoid economic collapse.