This question is answered by Robert D. Atkinson, President of the Information Technology & Innovation Foundation (ITIF) in Part II of the report, “Think Like an Enterprise: Why Nations Need Comprehensive Productivity Strategies.” He states, “Rather than think of an economy as a large market with self-interested actors transacting on the basis of price and seeking to maximize productivity, it is more accurate to conceive of an economy as a large, integrated enterprise that requires coordination of activities that individual enterprises will not effectively undertake on their own.”

His opinion is contradictory to that of most Anglo-Saxon nation economists, whose policies are based on two major competing doctrines vying for influence: “neoclassical and neo-Keynesian economics, neither of which supports a national productivity policy.” In a nutshell, he states, “the neoclassical economic doctrine is focused on limiting government’s role in the economy, even as neo-Keynesians see the government’s main role as managing the business cycle and supporting a fairer distribution of income.” His definitions were so simple that even non-economists like me could understand them:

Neoclassical ? focuses on the “managing scarce resources in such a way that maximizes the net benefit from their use, and that produces the quantity and mix of goods and services most beneficial to society.”

Neo-Keynesian ? is “grounded in the core belief that demand for goods and services from business investment, government spending, and consumer spending drives growth.”

Atkinson particularly criticizes neoclassical economists because they “do not study how societies create new forms of production, products, and business models to expand productivity; rather, they study markets to see how commodities are exchanged.”

He criticizes neo-Keynesian economic policy prescriptions because they “revolve around increasing government spending to keep the economy at full employment and ensuring economic fairness and redistribution, because…their goal is not productivity growth, it is full employment.”

Atkinson states. “Thus, the first step for any policymaker seeking to maximize the economy’s productivity is to reject the conventional neoclassical and neo-Keynesian economic advice and embrace an alternative economic doctrine grounded in an understanding of the economy as an integrated, complex enterprise.”

He adds, “This approach is grounded in understanding that productivity is less about markets and more about organizations and systems, in particular about how technology is developed and deployed to drive productivity.”

Atkinson concludes, “Few conventional economists bother to “look inside the black box” of actual organizations or industries and crossindustry systems. Yet it is there that the keys to raising productivity and the keys to the right productivity policy will be found.” He comments that “conventional economics is of little help in understanding the sources of productivity growth, much less in providing useful or actionable advice on productivity policy.”

The rest of Part II discusses how “public goods, externalities and other enterprise failures, and system interdependencies for development and adoption of productivity-enhancing tools all mean that markets alone will not maximize productivity.”

Public goods are “a good or service provided without profit to all members of a society—to increase their productivity.” Some examples are transportation infrastructure such as roads, highways, bridges, airports, seaports or the education infrastructure for K–12 and higher education. Atkinson comments,”… though public goods are necessary, they are not sufficient.”

Atkinson comments that rather than maximizing productivity companies “can maximize profits from increasing revenues or reducing costs. Many companies focus less on boosting productivity and more on increasing revenues, either by getting more customers or increasing revenue per customer by selling products or services with higher margins.”

What he does not cover is that the best way for companies to boost productivity is to transform themselves into lean companies through the adoption and implementation of lean principles, tools, and strategies.

In addition, “some industries do not have strong incentives for driving productivity because “productivity increases hurt its implementers…In such industries, workers ‘control the means of Production’ and therefore productivity is a direct threat to their jobs.”

I found his brief discussion on the effect of system interdependencies on productivity interesting in how he shows that there is a relationship between product innovation and “interdependencies that are only observable and actionable at the industry or economy level.” For example, “when Apple developed the iPod, it needed customers with broadband Internet access and it needed music to be available for purchase online. Without either, the iPod would have gone the way of the Newton (an earlier, failed Apple attempt at creating a PDA).”

Market failure can stem “from markets tending to be poor at coordinating action when multiple parties need to act together synergistically and simultaneously. These chicken-or egg challenges must be overcome for productivity-enhancing innovation to occur in many technology platforms…Unless government plays a facilitating role, relying on markets alone can mean significantly delayed implementation.”

Atkinson identifies another challenge: “Many technology solutions require mutual adoption and coordination for them to be effectively deployed… For example, when automobiles were first developed few paved roads had been built. Only after a certain number of autos were sold was demand strong enough that the government needed to build roads. But initially cars could be driven on dirt roads that horses used, so adoption could grow gradually in the absence of government construction

In Part III, Atkins lays out a comprehensive and actionable agenda for spurring productivity growth, which can be used as a guide to tailor national productivity policy policies. This agenda includes policy recommendations…and the ways in which governments need to organize themselves to advance effective productivity policies.”

He states, “The conventional theory holds that the only thing government can do is to remove barriers and fix policy failures so that firms reacting to price signals can do whatever they may choose to drive productivity. This overly passive framework ignores the complexity and enterprise-like nature of economies, which actually require more strategic productivity policies.” He recommends that an “effective productivity policy needs to go beyond the standard limits to embrace four other key components:”

- Incentives, including tax policies, to encourage organizations to adopt more and newer “tools” to drive productivity…In particular, governments should use the tax code to provide incentives for acquisition of new capital equipment

- .Policies to spur the advance and take-up of systemic, platform technologies that accelerate productivity across industries. Many of the information technologies central to driving future productivity have chicken-or-egg network effects which mean that adoption will lag unless governments adopt smart, technology-specific policies.

- A research and development strategy focused on spurring the development of productivity-enabling technologies, such as robotics…Governments need to focus a much larger share of their R&D budgets on advancing technologies that will reduce the need for labor.

- Sectoral productivity policies that reflect the unique differences between industries. In terms of productivity and productivity policy, industries differ in significant ways…Any effective national productivity policy will need to be grounded in analysis-based, sector-based productivity strategies.

Within these four policy components, Atkinson makes some recommendations that are more controversial, such as:

Roll back policies favoring small business – “special benefits to small business and discriminatory policies that place tax and regulatory burdens only on large businesses. He recommends, “To boost productivity, governments should embrace firm-size agnosticism in all policies.” (pages 70-73)

Replace the term informal with the accurate term the illegal economy – “individuals are breaking the law by not registering their businesses and paying taxes. Informality is a drag on productivity growth, not a progressive force.” (pages 73-74)

Set a reasonable set minimum wage indexed to inflation – this helps make it more economical for organizations to substitute capital for labor” and “in some sectors may expedite the adoption of automated equipment and new technology to increase labor productivity.” (page 81)

Atkinson warns, “Countries that protect entrenched, incumbent, or politically favored industries from market-based competition only damage their own country’s productivity and economic growth potential… This limits the ability of firms at the productivity frontier to take market share away from firms with lower productivity.”

Atkinson acknowledges that “The challenge is that few governments have designed their scientific research programs explicitly around advancing technologies to drive productivity. Instead, they follow the advice of neoclassical economists that governments should not pick particular technology areas and should focus on curiosity-directed basic science… if economies are to maximize productivity growth, they need to craft technology research agendas specifically around productivity.”

In fact, Atkinson recommends that “Governments need to focus on identifying and funding many more research and engineering projects that are specifically targeted to developing Technology that can replace human labor.”

He explains, “Productivity policy cannot be fully effective unless it is grounded in a sophisticated understanding that industries differ significantly with regard to their productivity dynamics… Three key factors differentiate industries when it comes to considering productivity policy.” They are

- Scale ? Industries differ in terms of average firm size.

- Competition ? Industries differ in the extent to which they face competition.

- Incentives ? The third factor is intensity of incentives for an industry to increase productivity.

This is why Atkinson recommends that “An effective national productivity policy needs to be based on an analysis of individual industries and when appropriate, broader production systems.”

In his conclusion, Atkinson recommends, “The single most important step governments can take to boost productivity is to make higher productivity the principal goal of economic policy, more important than managing the business cycle, defending liberty, or promoting equality.”

He adds, “National governments should also identify or establish one agency or laboratory whose main mission is to support development and adoption of productivity technology as well as of platform and sectoral productivity strategies. In the United States, this might be the National Institute of Standards and Technology.”

Finally, Atkinson states: “Productivity is the key to improving living standards—so policymakers should ignore conventional economists who say there is little government can do about it and instead make it the principal goal of economic policy.”

Even if you do not agree with all of his premises, recommendations, and conclusions, this is an important report that should be widely read and debated for some time to come.

This question is answered by Robert D. Atkinson, President of the Information Technology & Innovation Foundation (ITIF) in Part II of the report, “Think Like an Enterprise: Why Nations Need Comprehensive Productivity Strategies.” He states, “Rather than think of an economy as a large market with self-interested actors transacting on the basis of price and seeking to maximize productivity, it is more accurate to conceive of an economy as a large, integrated enterprise that requires coordination of activities that individual enterprises will not effectively undertake on their own.”

His opinion is contradictory to that of most Anglo-Saxon nation economists, whose policies are based on two major competing doctrines vying for influence: “neoclassical and neo-Keynesian economics, neither of which supports a national productivity policy.” In a nutshell, he states, “the neoclassical economic doctrine is focused on limiting government’s role in the economy, even as neo-Keynesians see the government’s main role as managing the business cycle and supporting a fairer distribution of income.” His definitions were so simple that even non-economists like me could understand them:

Neoclassical ? focuses on the “managing scarce resources in such a way that maximizes the net benefit from their use, and that produces the quantity and mix of goods and services most beneficial to society.”

Neo-Keynesian ? is “grounded in the core belief that demand for goods and services from business investment, government spending, and consumer spending drives growth.”

Atkinson particularly criticizes neoclassical economists because they “do not study how societies create new forms of production, products, and business models to expand productivity; rather, they study markets to see how commodities are exchanged.”

He criticizes neo-Keynesian economic policy prescriptions because they “revolve around increasing government spending to keep the economy at full employment and ensuring economic fairness and redistribution, because…their goal is not productivity growth, it is full employment.”

Atkinson states. “Thus, the first step for any policymaker seeking to maximize the economy’s productivity is to reject the conventional neoclassical and neo-Keynesian economic advice and embrace an alternative economic doctrine grounded in an understanding of the economy as an integrated, complex enterprise.”

He adds, “This approach is grounded in understanding that productivity is less about markets and more about organizations and systems, in particular about how technology is developed and deployed to drive productivity.”

Atkinson concludes, “Few conventional economists bother to “look inside the black box” of actual organizations or industries and crossindustry systems. Yet it is there that the keys to raising productivity and the keys to the right productivity policy will be found.” He comments that “conventional economics is of little help in understanding the sources of productivity growth, much less in providing useful or actionable advice on productivity policy.”

The rest of Part II discusses how “public goods, externalities and other enterprise failures, and system interdependencies for development and adoption of productivity-enhancing tools all mean that markets alone will not maximize productivity.”

Public goods are “a good or service provided without profit to all members of a society—to increase their productivity.” Some examples are transportation infrastructure such as roads, highways, bridges, airports, seaports or the education infrastructure for K–12 and higher education. Atkinson comments,”… though public goods are necessary, they are not sufficient.”

Atkinson comments that rather than maximizing productivity companies “can maximize profits from increasing revenues or reducing costs. Many companies focus less on boosting productivity and more on increasing revenues, either by getting more customers or increasing revenue per customer by selling products or services with higher margins.”

What he does not cover is that the best way for companies to boost productivity is to transform themselves into lean companies through the adoption and implementation of lean principles, tools, and strategies.

In addition, “some industries do not have strong incentives for driving productivity because “productivity increases hurt its implementers…In such industries, workers ‘control the means of

Production’ and therefore productivity is a direct threat to their jobs.”

I found his brief discussion on the effect of system interdependencies on productivity interesting in how he shows that there is a relationship between product innovation and “interdependencies that are only observable and actionable at the industry or economy level.” For example, “when Apple developed the iPod, it needed customers with broadband Internet access and it needed music to be available for purchase online. Without either, the iPod would have gone the way of the Newton (an earlier, failed Apple attempt at creating a PDA).”

Market failure can stem “from markets tending to be poor at coordinating action when multiple parties need to act together synergistically and simultaneously. These chicken-or egg challenges must be overcome for productivity-enhancing innovation to occur in many technology platforms…Unless government plays a facilitating role, relying on markets alone can mean significantly delayed implementation.”

Atkinson identifies another challenge: “Many technology solutions require mutual adoption and coordination for them to be effectively deployed… For example, when automobiles were first developed few paved roads had been built. Only after a certain number of autos were sold was demand strong enough that the government needed to build roads. But initially cars could be driven on dirt roads that horses used, so adoption could grow gradually in the absence of government construction

In Part III, Atkins lays out a comprehensive and actionable agenda for spurring productivity growth, which can be used as a guide to tailor national productivity policy policies. This agenda includes policy recommendations…and the ways in which governments need to organize themselves to advance effective productivity policies.”

He states, “The conventional theory holds that the only thing government can do is to remove barriers and fix policy failures so that firms reacting to price signals can do whatever they may choose to drive productivity. This overly passive framework ignores the complexity and enterprise-like nature of economies, which actually require more strategic productivity policies.” He recommends that an “effective productivity policy needs to go beyond the standard limits to embrace four other key components:”

- Incentives, including tax policies, to encourage organizations to adopt more and newer “tools” to drive productivity…In particular, governments should use the tax code to provide incentives for acquisition of new capital equipment.

- Policies to spur the advance and take-up of systemic, platform technologies that accelerate productivity across industries. Many of the information technologies central to driving future productivity have chicken-or-egg network effects which mean that adoption will lag unless governments adopt smart, technology-specific policies.

- A research and development strategy focused on spurring the development of productivity-enabling technologies, such as robotics…Governments need to focus a much larger share of their R&D budgets on advancing technologies that will reduce the need for labor.

- Sectoral productivity policies that reflect the unique differences between industries. In terms of productivity and productivity policy, industries differ in significant ways…Any effective national productivity policy will need to be grounded in analysis-based, sector-based productivity strategies.

Within these four policy components, Atkinson makes some recommendations that are more controversial, such as:

Roll back policies favoring small business – “special benefits to small business and discriminatory policies that place tax and regulatory burdens only on large businesses. He recommends, “To boost productivity, governments should embrace firm-size agnosticism in all policies.” (pages 70-73)

Replace the term informal with the accurate term the illegal economy – “individuals are breaking the law by not registering their businesses and paying taxes. Informality is a drag on productivity growth, not a progressive force.” (pages 73-74)

Set a reasonable set minimum wage indexed to inflation – this helps make it more economical for organizations to substitute capital for labor” and “in some sectors may expedite the adoption of automated equipment and new technology to increase labor productivity.” (page 81)

Atkinson warns, “Countries that protect entrenched, incumbent, or politically favored industries from market-based competition only damage their own country’s productivity and economic growth potential… This limits the ability of firms at the productivity frontier to take market share away from firms with lower productivity.”

Atkinson acknowledges that “The challenge is that few governments have designed their scientific research programs explicitly around advancing technologies to drive productivity. Instead, they follow the advice of neoclassical economists that governments should not pick particular technology

areas and should focus on curiosity-directed basic science… if economies are to maximize productivity growth, they need to craft technology research agendas specifically around productivity.”

In fact, Atkinson recommends that “Governments need to focus on identifying and funding many more research and engineering projects that are specifically targeted to developing Technology that can replace human labor.”

He explains, “Productivity policy cannot be fully effective unless it is grounded in a sophisticated understanding that industries differ significantly with regard to their productivity dynamics… Three key factors differentiate industries when it comes to considering productivity policy.” They are

- Scale ? Industries differ in terms of average firm size.

- Competition ? Industries differ in the extent to which they face competition.

- Incentives ? The third factor is intensity of incentives for an industry to increase productivity.

This is why Atkinson recommends that “An effective national productivity policy needs to be based on an analysis of individual industries and when appropriate, broader production systems.”

In his conclusion, Atkinson recommends, “The single most important step governments can take to boost productivity is to make higher productivity the principal goal of economic policy, more important than managing the business cycle, defending liberty, or promoting equality.”

He adds, “National governments should also identify or establish one agency or laboratory whose main mission is to support development and adoption of productivity technology as well as of platform and sectoral productivity strategies. In the United States, this might be the National Institute of Standards and Technology.”

Finally, Atkinson states: “Productivity is the key to improving living standards—so policymakers should ignore conventional economists who say there is little government can do about it and instead make it the principal goal of economic policy.”

Even if you do not agree with all of his premises, recommendations, and conclusions, this is an important report that should be widely read and debated for some time to come.

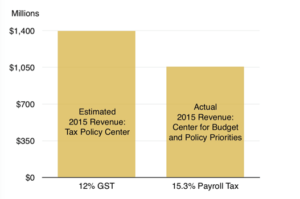

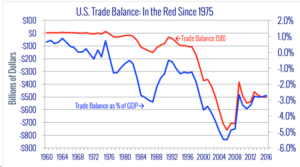

Source: Coalition for a Prosperous America

Source: Coalition for a Prosperous America