Last November, I watched a video interview on LinkedIn where Drew Greenblatt, President of Marlin Steel Wire Products, was talking about how he was investing in his companies located in rural areas of Indiana and Michigan. I connected with him and asked him if he would be willing to let me interview him about his company’s success as I like to write articles about successful American manufacturers.

Our schedules final coincided last Friday, and to start the interview, I asked Drew to provide a brief history of Marlin Steel. He said, “The company was founded in 1968 by another fellow. I owned a company that made medical devices and burglar alarms. I did very nicely with it. It was hard hours, early in the morning appointments, late in the night appointments, and it was a business selling to consumers. It didn’t match my personal deportment. I like dealing and working with engineers that are very black and white, that are very precise. So, I craved working with more scientifically bent people.

We got an offer to buy my company, and I used the proceeds of the sale to buy Marlin Steel in 1998 when it was in a 3,000 sq. ft. building, The newest piece of equipment was from the 1950s. The company had no health insurance plan. The health insurance plan was going to the emergency room. They had no retirement plan. The retirement plan was Social Security. So, we’ve come a long way. Everybody has the same health insurance plan my wife and I have, and my three boys have. And we’re very fortunate. More than half the employees own a home. Most employees own at least one car, most have two cars, and they all have 401ks, and they’re very well paid. Manufacturing is fabulous for American workers, and they’re feeling it at Marlin. It’s great stuff. I moved the company to Baltimore, MD, and the plant is now 37 times bigger than the Brooklyn plant.”

I asked Drew what kind of equipment he has now. He said, “We have press brakes up to 230 tons and 10 ft. wide, laser cutting machines, and we just acquired a new Trumatic 3000 robotic laser punch combo machine that is 10x faster than our other machines. It’s going to enable us to cut brass, cut copper, as well as stainless steel, aluminum, and sheet metal like we’ve done in the past. Separately, in our Indiana plant, we also have a lot of wire equipment, three-dimensional benders. We have automated mesh welders. We do cable access trays, wire baskets, carts, point of purchase displays. We do a tremendous amount of Top-of-the-line quality production out of all these three facilities.”

I asked Drew when he acquired the plant in Orland, IN, and he answered, “Marsden Steel Wire Products was established in 1938, and it was a fabulous company in the rural Indiana. We I heard through the grapevine in 2021 that it was available for sale. We bought the company and put over $5 million dollars of cash into it: brand new bathrooms, brand new break rooms, brand new offices, brand new roof, just made the building sparkle. We now have 100,000 sq. ft. of manufacturing space and took the company from 33 employees to 80 employees We have wire fabrication equipment, 3D benders, and automated mesh welder. We are hiring people there, and we’re growing. “

I next asked Drew when he expanded to having a plant in Bronson, MI., and he responded, “In March 2023, we wanted Marsden Steel to have their own powder coating plant, and we heard about a building ten miles north of Orland in Bronson that was available. The building had been empty since the recession of 2008 when the company closed down after being the major employer of this small rural community. We bought this decrepit building and had a career fair where 350 people applied for jobs. We put millions of dollars into the plant buying equipment, modernizing the bathrooms, lunch break room, and offices. We are hiring more people and growing to become the major manufacturer in the community. We pay good wages and provide good benefits to our employees. We’re very excited. We love Michigan. We love Indiana. They have great manufacturing communities. We look at how fabulous the workforce is. It’s just tremendous. We’re just so fortunate and blessed to be in these communities.

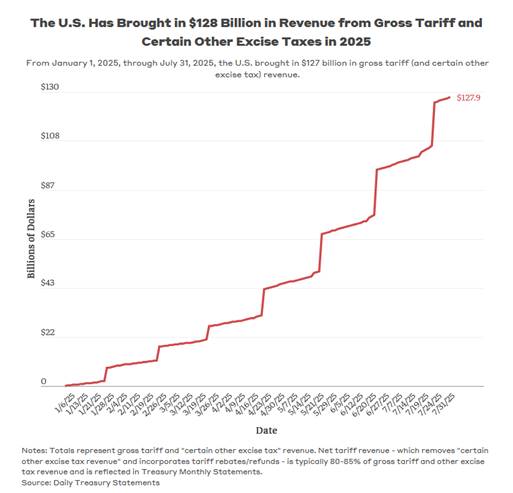

I changed the subject to ask how tariffs are affecting his company. He responded, “Tariffs are fabulous for Marlin and Madsen Steel Wire because we only make in America and we only use American steel. So, entities that build in America don’t have a tariff problem. I would recommend to people that are having a hardship with tariffs, build in America, and then you don’t have to pay a tariff.

It’s really good for the local community because what happens is you hire locals. And then these locals buy homes, and they buy cars, and they go to the local dry cleaner, and they go to the local barbershop, and they’re gainfully employed, and they’re making a nice middle-class living. I implore communities to encourage manufacturing. This policy is about time because it gives us an opportunity to make a level playing field with people that have been subsidizing their steel, subsidizing their currency, despoiling their environment. You know, we treat our environment A++. I live right by the Chesapeake Bay in Baltimore. I love eating Maryland crabs. We want to have a clean environment. It’s not right that people bring in things from dirty factories that are putting smog in the world and despoiling the Yangtze River and their environment, and then shipping to us for a ‘low price.’ The low price is despoiling our environment. They’re using slave labor, and it’s just not a fair fight competing with state-owned enterprises over in China. I believe that we have to recalibrate our thought process, buy from the hometown heroes in Maryland, Indiana, Michigan, and other American local communities so that they can support a middle-class lifestyle.”

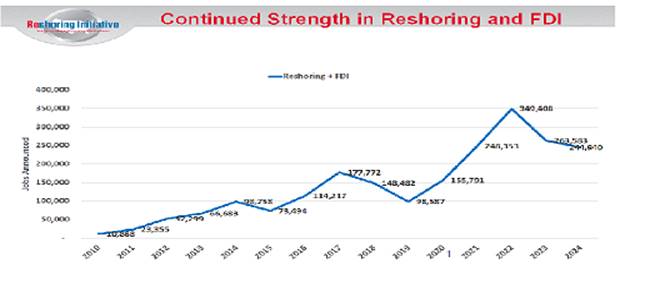

Drew said, “I think there’s a dramatic change that’s about to happen. We are right now at a junction point. I contend that we are right now de-risking as a nation and decoupling from China. For decades, we’ve had a very poor policy description of outsourcing all of our factories to China and not making things as much as we used to. And that was a foolish policy.

We are now pivoting, thankfully, to a policy where we embrace American manufacturing because we need to make things here. We can’t be beholden to outsiders that they will make us ships and they will make us shoes and they will make us baskets and they will make us racks and they will make us carts when times get tough. We have to be self-sufficient. We have to make our own printed circuit boards. We have to make our own silicon chips. We have to make things here in America. I think there’s a realization by our policymakers that we have to re-look at how we did things in the past, and there is a fabulous, bright opportunity for the American people because there’s going to be a lot of new avenues to make a decent, solid, middle-class living again in our country. We can’t just be a nation of baristas and housekeepers and service workers at restaurants. We have to have very fulfilling jobs, jobs with dignity, making high-end pay with great benefits.”

I told him that couldn’t have said it better and have said it similarly in my books and articles. We have been outsourcing our pollution by sourcing manufacturing in China and other Asian countries. China is one of the most polluted countries in the world. What China and India have done to their countries is criminal. I agree that we need to make things in America because we make them in a non-polluting way because of beneficial environmental regulations.

Next, I asked if he was involved in any kind of industry association, and he answered, “Yes,

I’m a proud member of the National Association of Manufacturers and the Regional Manufacturing Institute. I am a former member of the NAM Executive Board, and I was the chairman of the small and medium-sized manufacturers comprising 14,000 members. I love NAM. I think they’re fabulous. I think there are discussions at NAM about the right way to approach the tariffs and some of these other policies. I think NAM is an important advocate for American manufacturing and think they’re doing a great job for our country.”

Finally, I asked him if his company practiced the principles of Lean manufacturing and done any training in lean. He replied, “I had the honor and privilege as the chairman of the Regional Manufacturing Institute here in Baltimore to introduce Ellie Goldratt on his last speech in public to a huge crowd in Baltimore, Maryland. He spoke at a local community college in a huge auditorium, and I was privileged to introduce him before his speech. He was unfortunately dying of lung cancer, and he gave a most beautiful speech for his class public speech.

Afterwards, he pulled me aside, and he said that he was touched by my intro because I expressed to the crowd that his book had changed my life and changed how we ran the business and saved my business because we followed his methods. He said that he was heading back to the hotel before he went to the airport and invited me to ride in his limo to talk. I accepted his offer even though I had my own car in the parking lot because I realized that this was one of the greatest opportunities of my life. For the next 20 minutes, he basically did an autopsy on me even though I was alive. All of his piercing, smart questions really dove deep into Marlon Steele and gave me some great ideas. Unfortunately, he soon passed after returning to Israel. It was a touching moment in my life, and we changed our business because of him. A lot of my success is because of his great advice.”

In conclusion, I asked him if he has any plans to expand to any other locations in the future. He responded, “Yes, absolutely. We are going to be growing in America, only in America. We need more thriving small and medium-sized manufacturers, but we also need big ones because, you know, I hope to be one of the big boys and keep on growing. We’re 37 times bigger than the day I bought the factory in 1998, and I want to be 37 times bigger than I am today. We are having discussions with several other entities. We are aggressively looking to acquire other manufacturers that make wire fabrications and sheet metal fabrications. We’re very optimistic about the future. We’re very bullish on America.”

I told him that his company was definitely the kind of company that I like to write about and he is the type of company owner we need to have more of in America — people that appreciate our country, appreciate making things in America in the communities in which they live, appreciate the people that work for them by giving them the right kind of benefits and safe working conditions, and training. I want more companies to be successful like his company because it’s beneficial to the communities you’re in and beneficial to our economy because manufacturing jobs create taxpayers instead of people who receive benefits.