On Sunday evening, February 14th, Curtis Ellis passed away from a long struggle with bladder cancer at the age of 67. Curtis was a true patriot and defender of liberty, who believed in all of the greatness our country and devoted much of his life to putting American first in economic policies to benefit American workers and not just Wall Street. Curtis’ career included work as a campaign manager for state and federal elections, working for Congress as a media liaison for the New York State Senate Central Staff and held a senior staff position in the U.S. House of Representatives. He had decades of experience as a journalist, producer, writer and reporter for the New York Times, San Francisco Chronicle, Chicago Tribune, Time magazine and other outlets, such as HuffPost and World Net Daily. He appeared on 60 Minutes, HBO, NBC, CNN, NPR, MSNBC, Fox Business and Fox News, as well as national and regional radio shows.

I had the pleasure of becoming one of his friends when in 2011, I was recruited to join the board of directors for the American Jobs Alliance (AJA). Curtis functioned as the part-time Executive Director from 2011 – 2016 for AJA, an independent non-profit organization promoting American jobs and Buy American policies.

Den Black, President of AJA shared that he first met Curtis Ellis in 2004 in the Buffalo New York region when his good friend, Jack Davis, decided to run for Congress in the New York’s 26th District. He said, “Jack was under attack by the Chinese who were manufacturing his industrial electric furnace, silicon carbide, heating elements in China, and marketing these items in America at prices below Jack Davis’ cost. Curtis, who lived in Manhattan, became aware of Jack’s efforts to ‘take on the Chinese’ and offered to assist Jack with his fight against the Chinese unfair trade practices.

He added, “Jack Davis accepted Curtis’ offer to help on his campaign and based his campaign on the theme of ‘undoing’ the disastrous ‘Free Trade’ practices that had caused the hollowing out of American manufacturing since the 1970’s and 80’s. Curtis came to Buffalo and gave his all for the campaign, but unfortunately, Jack Davis lost the Congressional race. Curtis resumed his life in Manhattan, but our passion to work to ‘undo’ the unfair trade agreements continued unabated, and we continued to stay in touch.”

He explained, “In late 2010, Curtis suggested that Jack Davis and I form the American Jobs Alliance as a non-profit with the mission to educate Americans about the negative impacts of the ‘Free Trade’ agreements, such as NAFTA, on American workers and families and promote Buy American and Hire American policies. We quickly learned that the ‘Free Trade is Good’ ideology was deeply imbedded in the seats of American power, including Wall Street, global manufacturing giants, and the Washington establishment. We realized that causing any real change was huge challenge in the early years; but Curtis never wavered in his single-minded pursuit of putting American workers first. Curtis played a big role in the AJA effort to prevent the Tran-Pacific Partnership (TPP) from being ratified during the Obama Administration.”

He concluded, “Subsequently, Curtis carried his passion for American workers over into the Donald Trump for President campaign, but he continued to support AJA’s work and write articles for our website. It was his idea last year to make and sell window/bumper decals saying ‘Boycott China for Jobs, Human Rights, Peace.’ All working Americans owe a huge debt of gratitude for his steadfast, single-minded, efforts on their behalf over the decades.”

After years of interaction on the AJA board and private phone conversations, I finally got the opportunity to spend time with Curtis when I attended the annual trade conference in Washington, D. C. put on by the Coalition for a Prosperous in March of 2017. Curtis was then working as a special advisor to the Secretary of Labor as part of President Trump’s transition team after working on the presidential campaign. He went back to work full-time as communications consultant and senior policy adviser with America First Policies after his responsibilities on the transition team were finished in September 2017.

Another board member of AJA, Greg Autry, co-author of Death by China and former NASA White House Liaison under President Trump, wrote me the following after I notified him that Curtis had died: “I’m proud to have been able to work with Curtis Ellis for more than a decade in support of American manufacturing jobs and our nation’s future. Curtis was a tough, straight talking man of action with a heart of gold. He genuinely cared about the outcomes for workers, business owners, and those living under the boot heel of China’s authoritarian regime. In the long, hard fight over trade reform, Curtis was always there with a good idea and a supportive comment.”

On February 15th, World Net Daily founder Joseph Farah published an eulogy, “Farewell fellow Traveler, Curtis Ellis.” You can readd his full article here. Farah had known Curtis from when they were both about 16 years old and were left-leaning radical revolutionaries. He reconnected with Curtis several years ago when he was working as a senior policy adviser for America First Policies. Curtis Ellis began writing a weekly exclusive column for WND in 2014, and Farah said “He will be missed.”

On Monday, February 15th, radio talk show host John Fredericks gave his own testimony on his friend Curtis Ellis in the first hour and then had their mutual friend, Steve Bannon (War Room podcasts) as a guest on his show during the second hour. John called Curtis an “American prophet” and said “he had the greatest sense of humor. I had him on my show nearly every week for ten years, and every time I was with him, he made me laugh.”

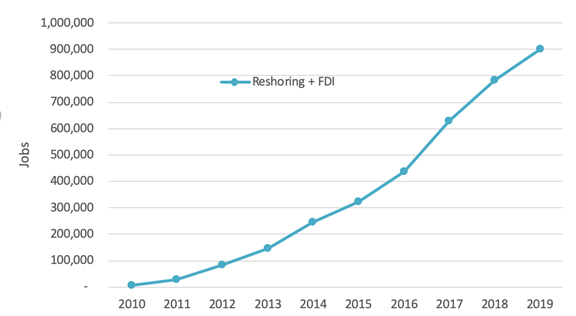

Bannon said, “Curtis had a hand on the pulse of labor which most conservatists don’t. He was the first guy that laid down the planks and fundamental elements of economic nationalism that truly drive the agenda. There are tens of thousands of workers going to plants and factories that have jobs because of the policies and thinking of Curtis that were put in place. He will be remembered in history. Curtis was a legendary guy in the Trump movement. Peter Navarro and Curtis put together the whole economic program that President Trump ran on. He was critical to the 2016 campaign. He always put the American worker first. He was a deep thinker and also an activist.

In the administration, Navarro worked on the inside and Curtis stayed on the outside to work the PACs and policy institutions. He was very early on about the CCP. He understood the world economy and the globalization project, and because he was so close to labor, he understood that the globalization project was built on the backs of slave labor in China and would turn American workers and Western Europe Union into ‘Russian serfs.’ He was relentless and because he was relentless, he cut across the grain, which is why he never had support from the ‘establishment.’ He was one of the first guys to recognize that and the first to point out ‘free trade’ was a fallacy because of the mercantilist, totalitarian dictatorship in. China. He called out the Chinese Communist part, Wall Street, and the City of London. He had a major impact on where we are.”

Michael Stumo, CEO of the Coalition for a Prosperous America, wrote me “Curtis was one of the only political campaign managers to focus upon returning jobs and industry to America. He worked as both a Democrat and a Republican because party affiliation was secondary to his values. Curtis blazed the trail that became both Make America Great Again and Build Back Better. He was one of the very talented few who could quickly transform a complicated economic topic into an easily understandable and compelling narrative that could motivate people to act. Curtis will be missed.”

Curtis had a love affair with America and believed that we have to fight to save America to create jobs and prosperity. We need to “up our game” and bring higher paying manufacturing jobs back to America. This is the best way we can honor his memory and carry on the torch. I will continue to work to do my part by writing and speaking to honor his memory.