Now that we have re-elected President Trump for a second term to work on achieving his goal of Making America Great Again, it’s time to focus on how to rebuild America’s manufacturing industry because we can’t be great again without a strong domestic manufacturing industry.

My book, Rebuild Manufacturing – the Key to American Prosperity, provides detailed ways to rebuild American manufacturing based on my over 40 years in the manufacturing industry. As a start on the path to rebuilding American manufacturing, here are a few suggestions on what manufacturers need to succeed and grow:

Restoration of Patent Rights

Manufacturers mainly fall into one of three groups:

Original Equipment Manufacturers – selling a finished product such as a motor vehicle, ship, airplane, satellite, etc.

Suppliers – manufacturing a component, subsystem, or assembly for a finished product, such as a motor, power supply, semiconductor, etc.

Fabricators – perform a manufacturing process to make a particular part or assembly for a finished product such as an enclosure, bracket, panel, gasket, seal, etc.

During my career, I have worked for OEMs and suppliers, but currently represent fabricators as a sales rep. Each of these manufacturers requires a unique selling point (USP) or unique value proposition (UVP) that is part of a company’s marketing strategy to inform customers about how their brand, product, or service is superior to its competitors.

One or more patents are often an important component of the USP/UVP for products, components, and subsystems incorporating new technologies. While fabricators rarely have patents, many have trade secrets covering their manufacturing processes.

My previous blog articles have shown how patent rights have been eroded by the America Invents Act (AIA) of 2011 and why patent rights must be restored to help technology-based companies have the strong patent protection they need to be successful. The threat of having their patent invalidated by the Patent Review and Trial Board (PTAB) established by the AIA is discouraging inventors from applying for a patent, and they are going to other countries to get their patents. In addition, the lack of secure patent rights is also hindering the willingness of angel investors to invest in new technologies for startup companies. We must also continue to protect trade secrets because China uses espionage to steal both patented technologies and trade secrets.

Protection from Unfair Trade Practices

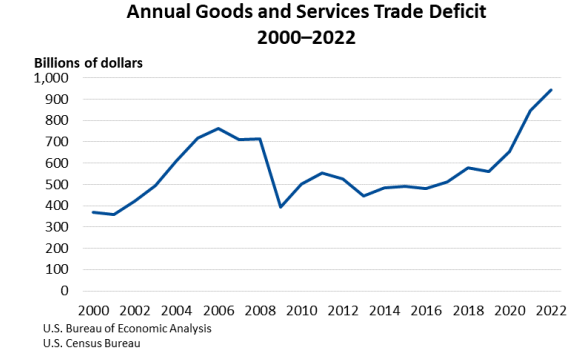

In an increasingly interconnected global economy, American manufacturers face significant challenges, particularly from China’s trade practices. As concerns over unfair trade continue to rise, it’s crucial to understand the implications these practices have on U.S. businesses and the broader economy. Common examples of mercantilist trade practices by China are: currency manipulation, rampant intellectual property theft, product dumping (selling products at below-market prices), and government subsidies for Chinese companies. These unfair trade practices have created an uneven playing field. According to the U.S. Trade Representative, these practices have contributed to a substantial trade deficit with China, severely impacting American manufacturing sectors.

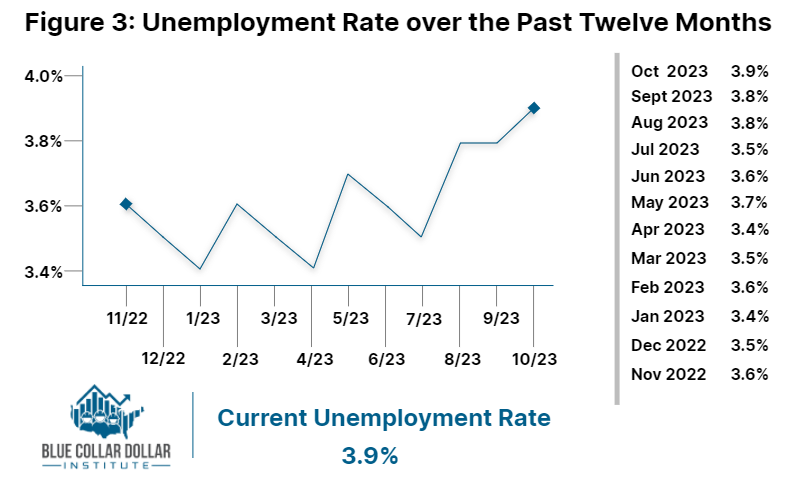

Several industries have borne the brunt of these practices. For instance, the U.S. steel industry has faced aggressive pricing from Chinese manufacturers, which has led to factory closures and job losses across the country. In the textile sector, similar patterns have emerged, where Chinese imports flood the market at prices that domestic producers cannot match, resulting in significant downturns in American jobs.

The U.S. government has implemented various measures to counteract these unfair practices, such as tariffs and trade negotiations to foster fair competition. Addressing unfair trade practices is essential for the survival and growth of American manufacturing. We need fewer imports and more domestic production. Now is the time to take a stand and implement strategies that ensure a fair playing field for American manufacturers. The following strategies should be considered:

- Establish Tariffs on all Chinese Products – read my previous article on “Why we Need Tariffs on Chinese Products”

- Strengthening Enforcement of Trade Laws: Increasing the capacity of trade enforcement agencies to investigate and combat unfair practices can deter such actions.

- Promoting Domestic Production: Incentives for manufacturers to produce locally can help rebuild industries affected by unfair competition.

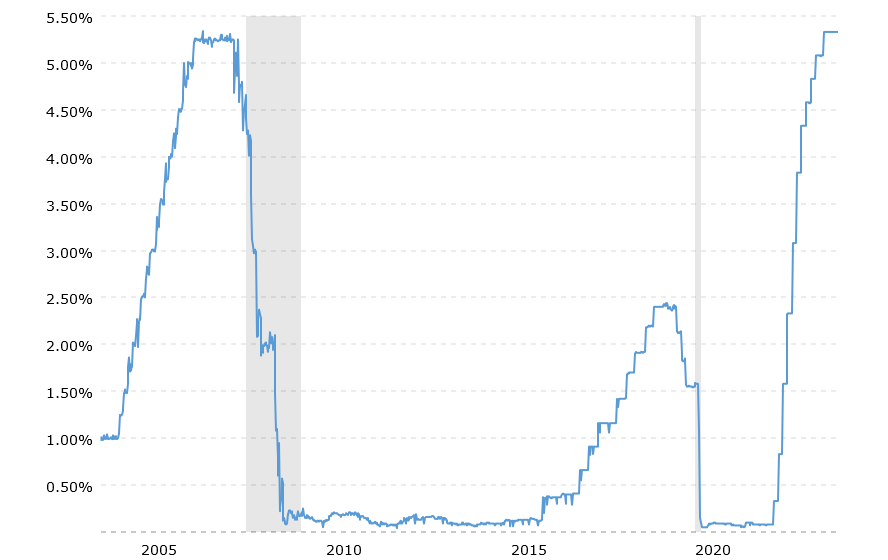

Access to Affordable Energy

In the modern manufacturing landscape, access to affordable energy is not just a necessity; it is a fundamental pillar of success. As industries strive to remain competitive in a global market, the cost of energy can significantly impact operational efficiency, profitability, and innovation. Energy costs represent a substantial portion of manufacturing expenses. From powering machinery to heating facilities, energy consumption is intrinsic to production processes. When energy prices rise, manufacturers face difficult choices: pass costs onto consumers, reduce labor, or cut back on investment in technology and innovation. These decisions can hinder growth and competitiveness.

Lower energy costs can lead to reduced overall production expenses, enabling companies to offer more competitive pricing and improve profit margins. For example, industries such as steel and chemicals, which are energy-intensive, benefit tremendously from stable, low-cost energy sources. This advantage can be a deciding factor for companies considering where to locate new facilities or expand existing operations.

Affordable energy is also crucial for fostering innovation. Manufacturers need access to reliable energy sources to invest in new technologies and processes that enhance efficiency and reduce waste. By keeping energy costs low, regions can attract and retain manufacturing businesses, leading to job creation and economic development.

Access to affordable energy is vital for the health and growth of the manufacturing industry. It influences operational efficiency, competitive advantage, innovation, and job creation. Policymakers, industry leaders, and communities must work together to foster an environment where affordable energy is a reality for all manufacturers.

Reasonable Corporate Tax Rates

Tax policies that govern businesses can significantly influence manufacturers’ operational success and growth potential. Reasonable corporate tax rates are essential not only for maintaining profitability but also for fostering innovation and job creation. Manufacturers often operate on thin margins, making it crucial to manage costs effectively. Lower tax liabilities provide manufacturers with the capital needed to expand operations, upgrade equipment, and develop new products.

High corporate tax rates can place an additional financial burden on these businesses, reducing their ability to reinvest profits into operations, technology, and workforce development. When manufacturers are forced to allocate a significant portion of their earnings to taxes, they may struggle to remain competitive, especially against international rivals with lower tax obligations. In a global marketplace, manufacturers often compete not only with domestic companies but also with foreign firms that may benefit from more favorable tax regimes.

By implementing reasonable corporate tax rates, governments can level the playing field, allowing American manufacturers to compete effectively against their international counterparts. This is particularly important in industries where price competitiveness is key to success.

Reasonable corporate tax rates can stimulate investment in the manufacturing sector. For example, when businesses have more disposable income, they are more likely to invest in research and development, which is essential for driving innovation and maintaining a competitive edge in the market.

To support the manufacturing sector, policymakers must consider tax reforms that prioritize reasonable corporate tax rates. This can include reducing rates, closing loopholes that disproportionately benefit large corporations, and creating incentives for small and medium-sized manufacturers. A balanced approach to taxation can foster a more equitable environment that encourages growth and investment across the sector.

Reasonable corporate tax rates are crucial for the health and vitality of the manufacturing industry. They enable manufacturers to invest in growth, create jobs, and compete effectively on a global scale. As policymakers consider tax reforms, it is essential to recognize the significant role that reasonable taxation plays in supporting American manufacturers and, by extension, the broader economy. A commitment to fair corporate tax rates will help ensure a robust and thriving manufacturing sector for years to come.

Regulatory Relief in Manufacturing

The burden of overregulation can stifle the potential of manufacturers, hindering productivity and competitiveness. Overregulation refers to the imposition of excessive or unnecessarily complex rules and standards that can burden businesses. For manufacturers, compliance with these regulations often requires significant time, resources, and financial investment. This can divert attention away from core operations, stifling creativity and limiting growth opportunities.

Excessive regulations can make it difficult for U.S. manufacturers to keep pace with competitors who operate in more business-friendly environments. Lowering the regulatory burden can enhance competitiveness, allowing manufacturers to focus on innovation and efficiency.

The costs associated with compliance can be substantial. From hiring specialized staff to implementing new technologies for regulatory adherence, manufacturers often find their budgets stretched thin. This financial strain can lead to higher product prices, which may result in lost sales and reduced market share. A more streamlined regulatory environment can foster a culture of innovation, allowing companies to focus on creating cutting-edge solutions that meet market demands.

While regulations are essential for ensuring safety, environmental protection, and fair labor practices, it is crucial to strike a balance. Policymakers should engage with industry leaders to understand the unique challenges manufacturers face and develop regulations that protect public interests without imposing undue burdens. Streamlining regulatory processes, simplifying compliance requirements, and providing clarity in regulations can significantly benefit manufacturers. A collaborative approach to regulation that prioritizes both public welfare and the needs of manufacturers will pave the way for a robust and resilient manufacturing sector.

Manufacturing is not only vital for the U.S. economy but also plays a crucial role in driving innovation, job creation, and economic prosperity. Manufacturing provides millions of Americans with jobs, both directly in manufacturing plants and indirectly through supporting industries such as logistics, finance, and technology. Manufacturing has a vast supply chain that includes raw materials, components, and finished goods, supporting a wide range of businesses and services across the country. The manufacturing sector is a hub of innovation and research and development (R&D), driving technological advancements and creating new products and processes that can benefit various industries.

Manufacturing exports contribute significantly to the U.S. trade balance, helping to generate revenue and create a favorable balance of trade. The manufacturing sector often leads to economic growth by attracting investment, generating tax revenue, and increasing productivity. Most importantly, a robust manufacturing sector is essential for national security, as it ensures domestic production of critical goods and reduces reliance on foreign sources during times of crisis.