In my January article titled, “What Legislation Should Congress Pass to Help Rebuild American Manufacturing?” I made several recommendations. Now, we will examine what provisions the One Big Beautiful Bill (OBBB) included that would help achieve the goal of rebuilding American manufacturing.

I asked one of my long-time business colleagues, Bruce Knowlton, to examine what tax benefits the OBBB provides for American manufacturers. Bruce recently retired from being a long-time partner at Moss Adams LLP in San Diego and will begin teaching tax accounting at San Diego State University this fall. He provided his analysis of the OBBB provisions with regard to the following tax-related recommendations I made in my article:

1. Immediate cost recovery for investments in the types of machinery and equipment:

Bruce said “this was enacted and made permanent and called ‘bonus depreciation.’ It also increased the Section 179 expensing for companies that buy assets up from $1 million to $2.5 million. This is now phased out when assets purchased exceed $4 million. Please note that Section 179 expensing requires a business tax profit to the extent of the expensing but bonus depreciation does not. A new provision was added to award manufacturers who build new manufacturing facilities (i.e. building structures) in terms of their “Qualifying Production Property” with 100% depreciation vs. a normal 39-year tax life. This generally covers facilities used directly in the manufacturing process with construction starting in the U.S. after 1/19/25 and finished by 12/31/28 with a placed in-service date of after July 4, 2025 and before January 1, 2029.”

2. Immediate write-offs for investments in research and development:

Buce said this was enacted. “The research credits also remain as is. That said now a manufacturer that has gross revenue of no more than $31 million can go back and amend returns starting with their 2022 return to expense their previously capitalized R&D costs to get refunds. Further, larger companies can elect to amortize the remaining capitalized R&D costs for 2022-2024 over a one- or two-year period.”

3. Reduce corporate tax rate to 15% from the 21% of the TCJA

Bruce said, “The corporate tax rate remains at 21% as it has been under TCJA. There was a permanent extension of the 20% qualifying business tax deduction which applies to closely held business (nonpublic companies) organized as S corporations or LLCs to continue their top marginal rate at 29.6% versus 37% for their individual U.S. resident owners.

There was also a change in the business interest expensing rule that limits that deduction to 30% of EBITDA (earnings before income tax, depreciation and amortization) vs. EBIT (earnings before interest and taxes) currently. Smaller companies with revenue of $31 million or less are still exempt from this rule. There were reductions for international companies as well to potentially lower the overall foreign intangible income tax.”

He added, “There were also a couple of indirect benefits. One was the carve out reporting of overtime for their employees who receive overtime pay to qualify them for the new tax deduction of overtime pay. The other was to expand the eligibility for qualified small business stock issued after 7/24/25 and the income exemption amounts on a sale of that stock as well as a shorter vesting period vs. the previous 5-year cliff vesting that was required.”

An article titled, “One Big Beautiful Bill Act” Tax Policies: Details and Analysis,” published on July 4, 2025 by the Tax Foundation stated the OBBB Act would:

- Permanently restore immediate expensing for domestic research and development (R&D) expenses; small businesses with gross receipts of $31 million or less can retroactively expense R&D back to after 12/31/21; all other domestic R&D between 12/21/21 and 1/1/25 can accelerate remaining deductions over a one- or two-year period.

- Permanently reinstate the EBITDA-based limitation on business net interest deductions.

- Permanently restore 100 percent bonus depreciation for short-lived investments.

- Temporarily provide 100 percent expensing of qualifying structures, with the beginning of construction occurring after Jan. 19, 2025, and before Jan. 19, 2029, and placed in service before Jan. 1, 2031.

- Make the Section 199A pass-through deduction permanent; increase phase-in range of limitation by $50,000 for non-joint returns and $100,000 for joint returns; create a minimum deduction of $400 for taxpayers with $1,000 or more of qualified business income (QBI) for material participants.

- Implement a 1 percent floor on deduction of charitable contributions made by corporations.

- Eliminate clean electricity production credit (45Y) and investment credit (48E) for projects placed in service after 2027, except for projects that begin construction within 12 months of passage and baseload power sources such as nuclear, hydropower, geothermal, and battery storage; introduce restrictions related to foreign entities of concern (FEOC).

- Extend the clean fuel production credit (45Z) until 2030 and expand eligibility.

- Introduce FEOC restrictions for several other credits, including the nuclear production credit (45U), the clean fuel production credit (45Z), the carbon oxide sequestration credit (45Q), and the advanced manufacturing production credit (45X); alter phaseouts and eligibility for 45X and 45Q.

- Require intangible drilling and development costs to be taken into account for the purposes of computing adjusted financial statement income.

- Add income from hydrogen storage, carbon capture, advanced nuclear, hydropower, and geothermal energy to qualifying income of certain publicly traded partnerships treated as C corporations.”

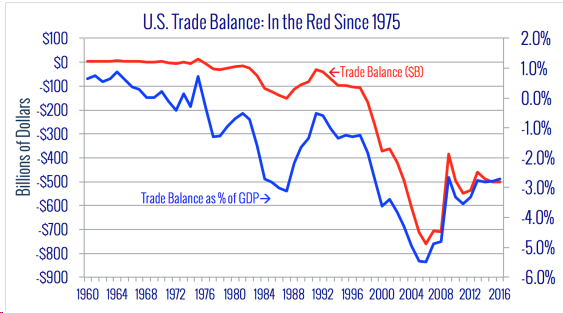

It is anticipated that these tax changes will help American manufacturers be more competitive in the global economy, but they do not specifically address the unfair trade practices, currency manipulation, product dumping, and Intellectual Property Theft done by China. It would take passage of other bills to fulfill some of the other recommendations I made in my January article, namely:

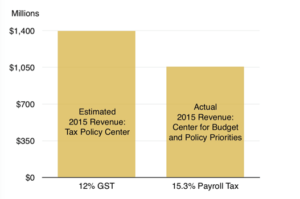

Impose a Market Access Charge (MAC) as proposed by Dr. John R Hansen, (PhD economist and Economic Advisor, The World Bank (retd.) “Forcing foreigners to pay a market access charge (MAC) if they want to dump their speculative money into America’s financial markets when US trade deficits show that the global demand for dollars and dollar-based assets like stocks and bonds is already excessive. In addition to encouraging the dollar to move to a more competitive level, thus boosting economic growth and family incomes, the MAC could also generate hundreds of billion dollars of new government revenue per year.

Pass a Patent Reform Bill to restore inventors’ rights and end abuses by the Patent Trial and Appeal Board (PTAB).

A new bill similar to HR 8134, the Restoring America’s Leadership in Innovation Act (RALIA), introduced by Rep. Thomas Massie (R-KY) and Rep. Marcy Kaptur (D-OH) in the previous session of Congress would be supported by the largest inventors’ organization, US Inventors.

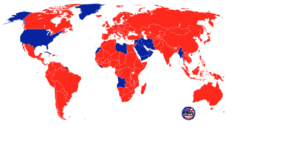

Revoke China’s Most Favored Nation Status (aka Permanent Normal Trade Relations (PNTR) that was granted by President Clinton on October 10th, 2000 when he signed the U.S.-China Relations Act of 2000 into law.

“Passing such a bill should be a major priority for the 119th Congress as soon as possible. Without PNTR status, all products from China would by default be subject to higher tariffs. This would reduce off-shoring by discouraging American investors and corporations from doing business in China. It would increase reshoring and diminish demand for Chinese goods, bolstering the sales of American manufactured products.”

Reduce the Allowed Value of De Minimis imports from the $800 allowed by the Trade Facilitation and Trade Enforcement Act of 2015 to a lower de minimis threshold.

The Coalition for a Prosperous America states: “U.S. companies and workers are subjected to a new level of job-destroying competition. Illicit drugs, such as fentanyl, and counterfeit goods are shipped directly to US consumers while evading detection. The predictable result is a major calamity putting U.S. producers and traditional retailers out of business and destroying jobs.” CPA urges “Congress to lower the de minimis threshold to $9 among other reforms.”

The One Big Beautiful Bill is a first step in passing legislation that would help in rebuilding American manufacturing’s capacity and eliminate dependence on China and other adversarial nations. Passing the other bills recommended by this article would especially help rebuild manufacturing capacity in industries that are critical to U.S. economic and national security. They would stop the destruction of American industry and innovation, the loss of high-paying manufacturing jobs, and the collapse of communities. They would help to create prosperity for our children and grandchildren and ensure that they will continue to live in a free country.