We Americans blithely ignore the long-term effects of allowing foreign corporations to purchase the assets of our country in the form of companies, land, and resources. We are selling off our ability to produce wealth by allowing many American corporations to be purchased by foreign corporations. It is not just foreign companies buying our assets that is the problem ? it is the state-owned and massively subsidized companies of China that are the dangerous because China uses its state-owned enterprises as a strategic tool of the state. By pretending they are private companies abiding by free-market rules makes us the biggest chumps on the planet.

How many Americans paid attention to the news that the world’s largest pork producer, American company Smithfield Foods, was acquired by a Chinese corporation in 2013? Shareholders approved the sale of the company to Shuanghui International Holdings Limited, the biggest meat processor in China.

Very few paid any attention to one of the earliest acquisitions by a Chinese corporation — when the Hoover brand was sold to Hong Kong, China-based firm Techtronic Industries in 2006 after Maytag that owned Hoover was acquired by Whirlpool.

In January 2014, Motorola Mobility was sold by Google to Chinese computer corporation, Lenovo, which means that the nation that invented smart phones is just about entirely out of the business of producing smart phones in America. This acquisition will give one of China’s most prominent technology companies a broader foothold in the U. S. Lenovo is the same company that bought IBM’s line of personal computers in 2004.

Through strategic purchases, China is positioning itself to be our energy supplier as well. Since 2009, Chinese companies have invested billions of dollars acquiring significant percentages of shares of energy companies, such as The AES Corporation, Chesapeake Energy, and Oil & Gas Assets. In 2010, China Communications Construction Company bought 100% of Friede Goldman United, and in 2012, A-Tech Wind Power (Jiangxi) bought 100% of Cirrus Wind Energy.

In a Fortune article titled “The Biggest American Companies Now Owned by the Chinese” Stephen Gandel provides the following list of American companies acquired by Chinese investors in 2016:

- Starwood Hotels acquired by Anbang Insurance, a Chinese insurance company that is rapidly buying up U.S. hotels…It is the latest hotel acquisition by the Chinese insurer, which last year bought the company that owns New York’s Waldorf-Astoria. “Starwood would add 1,300 hotels around the world to Anbang’s portfolio.”

- Ingram Micro, which is No. 62 on the Fortune 500, was bought by Tianjin Tianhai Investement Development Co., “a Chinese firm that specializes in aviation and logistics.”

- General Electric Appliance Business was bought by Qingdao Haier Co.

- Terex Corporation, an 83-year-old Connecticut-based company that “makes machinery for construction, agricultural, and industrial purposes,” was bought by Zoomlion Heavy Industry Science.

- Legendary Entertainment Group, which has co-financed a number of major movies like Jurassic Park, Godzilla, and Pacific Rim, was bought by Dalian Wanda

- Dalian Wanda also bought AMC Entertainment Holdings, the U.S.’s second largest movie chain at the time of purchase, but now #1.

The acquisition of American companies by foreign corporations isn’t something new. Many prominent companies founded in America were bought by corporations from the United Kingdom, France, Germany, Italy, and other European countries in the latter half of the 20th Century. Most Americans don’t realize that such iconic American companies as BF Goodrich and RCA are now owned by French corporations, and that Carnation and Gerber are now owned by Swiss corporations.

Many foreign countries don’t allow 100% foreign ownership of their businesses, but sadly, the United States does not exercise the same prudence. We allow sales of U. S. companies to foreign companies unless there are national security issues, and they almost never sell theirs to us. The Chinese government limits foreign ownership to very few selected industry sectors, that can change annually, and requires joint ventures with Chinese corporations for most industry sectors.

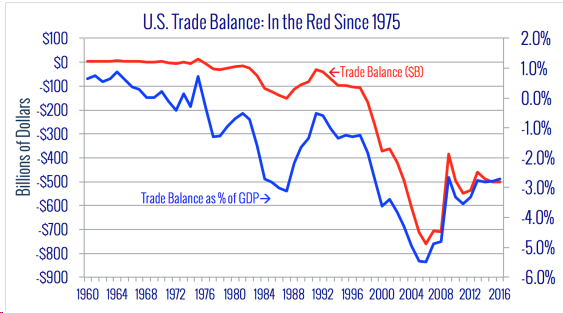

What is enabling Chinese companies to go on a buying spree of American assets? Trade deficits – our ever-increasing trade deficit with China over the past 20 years is transferring America’s wealth to China and making millionaires out of many Chinese. In 1994, our trade deficit with China was $29.5 billion, and it grew to $83.8 by 2001 when China was granted “Most Favored Nation” status and admitted to the World Trade Organization. By 2004, it had doubled to $162.3 billion. After a slight dip in 2009 during the depths of the Great Recession, the trade deficit grew to $347 billion in 2016. If you add the annual trade deficits with China alone for the past 20 years, it totals $4.22 trillion. China now has over one billion serious savers and more than a million millionaires whose assets when combined provide billions to spend to buy our assets.

In theory, we have the means to protect ourselves from this. CFIUS, the Committee on Foreign Investment in the United States, has the power to regulate, approve and deny these purchases. Unfortunately, it has been rare for CFIUS to block deals that don’t directly pose a threat to our national security.

The last time CFIUS reviews were expanded was July 26, 2007 when the President signed H.R. 556, Foreign Investment and National Security Act of 2007 (FINSA) “after the Dubai Ports World transaction passed through CFIUS without a formal investigation, leaving a surprised and angry Congress determined to avoid a repetition of that scenario.”

However, this new Act didn’t stop recommendations for expanding the scope of CFIUS reviews. Diane Francis, author of “Merger of the Century: Why Canada and America Should Become One Country, wrote expressed her opinion of why CFIUS reviews should be expanded in an article in the December 15, 2013, New York Post: “Currently, American authorities only evaluate foreign takeovers on the basis of national-security issues or shareholder rights and securities laws. But these criteria are inadequate. A fairer test in the case of Smithfield, and future buyout attempts by China, should also require reciprocity: Only corporations from countries that allow Americans to buy large companies should be allowed to buy large American companies. That is why Washington must impose new foreign ownership restrictions based on the principle of reciprocity. The rule must be that foreigners can only buy companies if Americans can make similar buyouts in their countries.”

The dangers of these foreign acquisitions were also mentioned in the 2013 Annual Report to Congress by the U.S.-China Economic and Security Review Commission, which states, “China presents new challenges for CFIUS, because investment by SOEs can blur the line between national security and economic security. The possibility of government intent or coordinated strategy behind Chinese investments raises national security concerns. For example, Chinese companies’ attempts to acquire technology track closely the government’s plan to move up the value-added chain. There is also an inherent tension among state and federal agencies in the United States regarding FDI from China. The federal government tends to be concerned with maintaining national security and protecting a rules-based, nondiscriminatory investment regime. The state governments are more concerned with local economic benefits, such as an expanded tax base and increased local employment, rather than a national strategic issue, especially as job growth has stagnated.”

This report, continues, “China has amassed the world’s largest trove of dollar-denominated assets. Although the true composition of China’s foreign exchange reserves, valued at $3.66 trillion, is a state secret, outside observers estimate that about 70 percent is in dollars. In recent years, China has become less risk averse and more willing to invest directly in U.S. land, factories, and businesses.”

On January 26, 2017, Robert D. Atkinson, President of the Information Technology and Innovation Foundation, testified at a hearing on “Chinese Investment in the United States: Impacts and Issues for Policymakers” before the U.S.-China Economic and Security Review Commission. He testified: “For many years, China has recycled the earnings from its large and sustained trade deficit with the United States into U.S. Treasury bills. But the last few years have seen a marked increase in the amount of inward foreign direct investment (FDI) from China to the United States, across a range of industries. While the underlying motivation for some of this investment is commercial, at least one-third is from Chinese state-owned enterprises, and it is likely that considerably more is guided and supported by the Chinese government, specifically targeting sectors that are strategically important for U.S. national security or economic leadership.“

After ten years, there is finally action on expanding the scope of CFIUS reviews. On November 8, 2017, Congressman Robert Pittenger (R-NC) and Senate Majority Whip John Cornyn (R-TX) “introduced bipartisan, bicameral legislation to modernize the national security review of potential foreign investments in the United States, Foreign Investment Risk Review Modernization Act (“FIRRMA).”

The Press Release stated, “Chinese investment in the United States increased more than 900 percent between 2010 and 2016. Much of this investment was part of a strategic, coordinated, Chinese government effort to target critical American infrastructure…China is buying American companies at a breathtaking pace. While some are legitimate business investments, many others are part of a backdoor effort to compromise U.S. national security,” said Congressman Pittenger. “For example, China recently attempted to purchase a U.S. missile defense supplier using a shell company to evade detection. The global economy presents new security risks, and so our bipartisan legislation provides Washington the necessary tools to better track and evaluate Chinese investment…”

In a letter to Senator Cornyn, Attorney General Jeff Sessions wrote, “I am particularly supportive of the goals of several aspects of your proposed legislation, including but not limited to (1) the expansion of CFIUS’s authority to review certain transactions that may pose national security concerns; (2) an expanded list of national security factors that CFIUS should consider; and (3) mandatory disclosures of certain investments by state-owned enterprises.”

Earlier this year, the Coalition for a Prosperous America (CPA) published an issue flyer titled “America Must Modernize its Foreign Investment Rules.” It states:

“A wave of strategic foreign acquisitions of U.S. companies threatens our security and future prosperity. The U.S. liberalized rules on incoming foreign investment believing others would follow our lead. That belief was wrong. freely invest here while severely restricting U.S. investment there. America’s trade deficits result in a tsunami of incoming foreign investment, a change from when the US was the world’s sole superpower. The Committee on Foreign Investment in the U.S. (CFIUS) can block incoming investment based upon national security concerns, but not for economic strategy reasons as other countries do.”

The Coalition proposed the follow remedies:

- Expand consideration beyond national security to include economic security

- Allow longer review periods, beyond 30 days, for CFIUS to review proposed investments

- Include a “net benefit” test to encompass American economic interests where proposed

- Acquisitions of companies important to future U.S. technology and employment, both civilian and defense related

- Gauge systemic threats to U.S. interests in addition to individual cases

- Require country by country reciprocity to allow foreign investment in U.S. companies and technology only to the extent they allow incoming US investment there

- Prescribe heightened scrutiny of investments by state-influenced enterprises

CPA CEO Michael Stumo stated, “We must ensure that foreign greenfield investments in the US and acquisitions of existing US companies provide a clear ‘net benefit’ to the US with special scrutiny in cases of state influenced foreign entities.”

My question is: Did we let the USSR buy our companies during the Cold War? No, we didn’t! We realized that we would be helping our enemy. This was pretty simple, common sense, but we don’t seem to have this same common sense when dealing with China.

It is time to wake up to the real dangers of our relationship with China. The Communist Chinese government is not our friend. China a geopolitical rival that has a written plan to become the Super Power of the 21st Century. Letting Chinese corporations acquire American companies, especially energy or technology-based companies is the biggest threat to rebuilding American manufacturing. With regard to China’s military buildup, the U.S.-China Commission report states, “PLA modernization is altering the security balance in the Asia Pacific, challenging decades of U.S. military preeminence in the region…The PLA is rapidly expanding and diversifying its ability to strike U.S. bases, ships, and aircraft throughout the Asia Pacific region, including those that it previously could not reach, such as U.S. military facilities on Guam.” We must not allow this policy to continue if we want to maintain our national sovereignty.

Source: Coalition for a Prosperous America

Source: Coalition for a Prosperous America