On February 14, about 135 business, civic, academic, and labor leaders met at the conference facilities of AMN Healthcare for the “Manufacturing in California – Making California Thrive” economic summit. Comments to welcome attendees were made in turn by San Diego City Councilman Mark Kersey, Assembly member Marie Waldron, Dale Bankhead from Assembly member Toni Atkins office, and Senator Mark Wyland.

Then, Michael Stumo, president of the Coalition for a Prosperous America, provided an overview of the schedule for the day that included an overview of manufacturing in California, a panel of local manufacturers, a panel of national presenters, and breakout sessions after lunch.

I provided the overview of California manufacturing in which I briefly discussed the history of manufacturing in California that I wrote about in a previous blog and pointed out that even though California is perceived as bad for manufacturing, it is the 8th largest market in world and ranks first in manufacturing for both jobs and output. Manufacturing in California accounts for 11.7% of Gross State Product and 9% of workforce. California leads the nation in monies spent on R&D, and California companies received over 50% of all Venture Capital dollars invested in the U. S. in 2011. California high-tech exports also ranked first nationwide, totaling $48 billion in 2011.

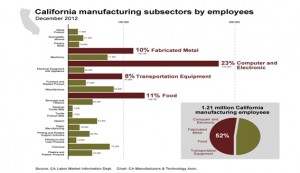

The major manufacturing industries are shown by the following chart:

Besides the great weather, California also has world-famous research institutions and research universities, a skilled, educated workforce, a large pool of inventors/entrepreneurs, and strong networks of “angel” investors and venture capitalists. California inventors and entrepreneurs are supported by more than 20 business incubators throughout the state, including two incubator facilities in San Diego – EvoNexus and the San Diego Technology Incubator, as well as the incubator-without-walls, CONNECT’s Springboard program.

In addition, California has 40 Enterprise Zones throughout the state, two of which are in San Diego’s south county. Enterprise Zone companies are eligible for substantial tax credits:

- Hiring Credits – Firms can earn $37,440 or more in state tax credits for each qualified employee hired

- Up to 100% Net Operating Loss (NOL) carry-forward for up to 15 years under most circumstances.

- Sales tax credits on purchases of up to $20 million per year of qualified machinery and machinery parts;

- Up-front expensing of certain depreciable property

- Unused tax credits can be applied to future tax years

- Enterprise Zone companies can earn preference points on state contracts.

There are also 17 Foreign Trade Zones (FTZs) in California that are sites in or near a U.S. Customs port of entry where foreign and domestic goods are considered to be in international trade. Goods can be brought into zone without formal Customs entry or without incurring Customs duties/excise taxes until they are imported into the U. S. FTZs are intended to promote U.S. participation in trade and commerce by eliminating or reducing the unintended costs associated with U.S. trade laws

Of course, no overview would be complete without mentioning the disadvantages of manufacturing in California. In the Small Business Entrepreneur Council Survival Index of 2011, California ranks 46th for its business climate because of the following:

- Highest personal income & capital gains taxes

- Highest corporate income & capital gains taxes

- Highest gas and diesel taxes

- High state minimum wage

- High electric utility costs

- High workers’ compensation costs

- More stringent Cal OSHA & Cal EPA regulations

- Stringent Air Quality Monitoring District rules

- Large number of health insurance mandates

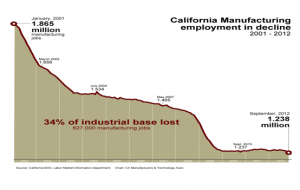

As a result, California has lost over 500,000 manufacturing jobs since the year 2001 as shown by the chart below.

No state, county, or city agency keeps track of the number of manufacturing companies leaving California, but there are frequent anecdotal stories in the news. Of course, everyone had seen or heard one of the ads by Texas Governor Rick Perry to woo California companies to relocate to Texas, as well as the fact that he was in California that very week to meet with some California companies.

I then moderated a panel of the following local manufacturers, who gave their viewpoints of the challenges of doing business in California:

- Karl Friedrich Haarburger – VP, Solar Energy Industrial Operations, SOITEC

- Neal Nordstrom – COO, PureForge

- Rick Urban – COO, Quality Controlled Manufacturing, Inc.

- Paul Brown – CFO, The Wheat Group

- Craig Anderson – EHS Director, Solar Turbines, Inc.

Their comments provided examples of most of the above-cited disadvantages of doing business in California with particular emphasis on the problems of raising taxes retroactively in the last election by the passage of Proposition 30. Neal Nordstrom said, “It isn’t just the increase in income taxes and sales taxes, it’s the cumulative effect of all of the taxes and the uncertainty of what is happening next.” Businesses need to be able to have some certainty in their planning, so passing retroactive taxes makes planning for the future difficult and hurts their profitability greatly.

Mr. Anderson commented that there biggest problem was caused by the passage of AB 32. He stated, “The technology to comply with AB 32 does not currently exist, so there is great uncertainty as to whether Solar Turbines will be able to comply with the law by the deadline for compliance.”

Greg Autry, School of Business and Economics, Chapman University, led off the national panel with the topic of Trade Policy. The U. S. had a trade deficit $559.8 billion in 2011, of which over half ($295.4 billion) was with China. Every trade agreement signed in the past 20 years has resulted in an increase trade deficit with our trading partners. The U. S. already has an increased trade deficit with Korea and Columbia from the recently signed trade agreements. He said, “States need to stop trying to “poach” companies from other states and work together against our common adversary, China. States cannot compete against another country where the government is subsidizing manufacturing companies to take control of markets.” Mr. Autry showed a video he had taped during a visit to China in which an employee of Foxconn stated that the Chinese government had provided the land and built the facility where the iPads and iPhone are being manufactured without cost to Foxconn, as well as covering all of the expenses for running the facility for three years. He also showed a video interview with an executive of CODA Automotive Inc. that has opened its HQ in Los Angeles and claims to be making their electric car in the U. S. when, in fact, they are importing the “glider” (a car without the drive train) from China. Miles Automotive partnered with China-based Hafei Saibao Electric Motor Car and Qingyuan Electric Vehicle Co. to establish Coda Automotive as an affiliate company. Mr. Autry opined that federal tax rebates should not be going to purchase an electric car for essentially a Chinese import to the detriment of American car manufacturers like General Motors.

Pat Choate – Economist; Author, Saving Capitalism: Keeping America Strong, covered the importance of the protection of Intellectual Property to the future of American manufacturing. He said that the U. S. is the most innovative country in the world and issues more patents than any other country. However, the recent passage of the America Invents Act converting the U. S. from a “first-to-invent” to “first-to-file” is hurting our innovation. Most growth comes from “disruptive” technology developed by inventors/entrepreneurs of small companies, and the “first-to-file favors large companies that can file a challenge against these small companies in the hopes of bankrupting them to avoid disruptive technology from harming their business. The length of time for the Patent Office to issue a patent has increased from an average of 18 months to 36 months, which is hurting startup companies. The share of patents granted to U. S. residents and small entities has dropped several percentage points since 2007.1988. He concluded by saying that the constitutionality of the America Invents Act is being challenged, and he hopes that it will be deemed unconstitutional.

Michael Stumo – CEO, Coalition for a Prosperous America, described the math about how a consumption tax could reduce the domestic tax burden, include imports in our tax base, and narrow the trade deficit, increase U.S. production, and fund reductions in the income tax while maintaining progressivity. He explained that our national Gross Domestic Product (GDP) equals of Consumption plus Investment plus Government Procurement plus Net Exports (Total exports minus Total Imports). Every one of our trading partners (150 countries) has a form of consumption tax, including value added taxes (VATs), with an average 17% level. These countries rebate these taxes on their exports, while the U. S. does not add a tax on its imports. The taxes are “border adjustable” because they act as a tariff on our goods sent to them and charged the VAT. This has created our more than $500 billion trade deficit with our trading partners, $298 billion with China alone. CPA advocates changes in U. S. trade policy to address this unfairness which tremendously distorts trade flows.

Thea Lee – Deputy Chief of Staff, President’s Office at AFL-CIO spoke passionately on the need to have a national manufacturing strategy that will create good paying jobs for American workers. Key points that she made were: We need to have a longer-term goal of what kind of country we want to be and how to achieve it. It will require some strategic investment in infrastructure. We need to figure out what kind of trade we want and what other countries are doing. Having an ideological position that free trade is good when other countries are pursuing mercantilism is harmful. We need to be responsive to what other countries are doing. We need to have a competitive trade policy. The ultimate goal is not to have more free trade but more prosperity at home. We need to get back into a job creation policy. We haven’t done trade policy very well, and we need to rethink our trade policies. We don’t need more dopey free trade agreements (taken from notes but not verbatim quotes.)

After lunch, the attendees were split into three groups for the breakout session, in which five issues were discussed and voted against each other, one pair at a time, to determine the top two issues. The five issues were:

- Trade Reform

- Tax Reform

- Intellectual Property

- Regulatory Reform

- Manufacturing Strategy

After voting, the groups reconvened to share the outcome of their voting. The top two issues voted as most critical to be addressed were: Regulatory Reform and Manufacturing Strategy. Regulatory Reform was chosen as the top issue by all three groups because they felt manufacturers needed to have their immediate “pain” alleviated before other issues could be considered. A manufacturing strategy was deemed the second most important issue because if you have a strategy that supports manufacturing, it will encompass intellectual property protection and trade reform. Attendees were invited to sign up to participate in a Task Force to be formed. I will be chairing the Task Force, so please contact me at michele@savingusmanufacturing.com if you would like to participate.

If our elected representatives will work with business, civic, academic, and labor leaders, I believe we can make manufacturing in California thrive again and once more be the “Golden State” of opportunity.