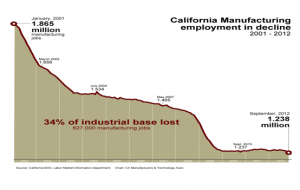

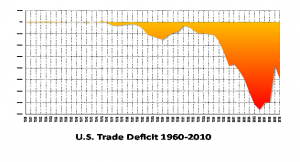

We lost 5.7 million manufacturing jobs between the year 2000 and 2010, and over 57,000 manufacturing companies went out of business. We have only gained about 500,000 manufacturing jobs since January 2010, so some ask why we have nearly 600,00 jobs going unfilled when the unemployment rate for the manufacturing industry jumped is still ranging from 6.4 percent in November 2012 to 7.2 percent in February 2013. The main reasons are:

- Unemployed workers are mainly from industries that have been decimated by trade deficits with China and American manufacturers choosing to outsource manufacturing offshore.

- Fewer young people choosing manufacturing as a career choice because of poor image

- Attrition from retirement that is getting worse as baby boomers started to retire

First, a large percentage of the people who lost their jobs came out of industries that were decimated by Chinese product dumping and the offshoring of manufacturing – textiles, furniture, tires, sporting goods, and the garment industry, to name just a few.

Most of these industries were dominated by large manufacturers employing hundreds to thousands of workers in plants located in the northeast, Midwest, and south. These workers either worked on assembly lines or utilized specific skills suited to their industries. In some cases, a textile plant, furniture plant, or automotive plant was the only large employer in a town. When the plant closed, workers either had to take whatever other job they could find or relocate to another area. In most cases, these workers didn’t have the specific skills needed in high-tech manufacturing industries.

An added blow was the decimation of the automobile and auto parts industry during the Great Recession when North American auto production dropped from a high of 17 million vehicles per year down to below 10 million vehicles in 2008 before climbing back up to about 13 million in 2012.

Second, manufacturing’s tarnished image has led young people entering the workforce to choose other career paths. In an article titled, “What the shortage in skilled manufacturing workers means to a hungry industry” of the e-newsletter Smart Business, Kika Young, human resources director at Forest City Gear Co. Inc. of Rockford, IL, said “Most people in Gen Y out of high school don’t think of manufacturing as a career or as a good option. They don’t think of it as glamorous; they think of it as dark and dingy and dirty and aren’t interested in going into that.”

Emily Stover DeRocco, president of The Manufacturing Institute of Washington, D.C., said, “It’s absolutely true that the image and the definition of manufacturing in this country has not kept up with the industry.” She added, “Companies need to invest more in employee training and make workforce skills a top strategic priority. Our education system must also do a better job aligning education and training to the needs of employers and job seekers. In the face of a global recession and intense international competition, American manufacturers must differentiate themselves through innovation and a highly skilled workforce.”

Third, the attrition of skilled workers through retirement, death, and disability year after year is compounding the problem. Harry Moser, retired president of GF AgieCharmilles and founder of the Reshoring Initiative, estimates that “about 8 percent of the manufacturing workforce is lost each year due to retirement, promotion, career changes, disability, and mortality.” In the machining industry, this means a loss of “about 20,000 to 25,000 skilled machinists per year…In contrast, only about 8,000 per year receive sufficient machining training in high school, community college and apprentice programs to be considered good recruits.”

In 2011, the U.S. Bureau of Labor statistics estimated that 2.8 million, nearly a quarter of all U.S. manufacturing workers, are 55 or older. While manufacturing has led the United States out of the recession, the improvement has been a mixed blessing because as more skilled workers are needed, the supply is limited because baby boomers are retiring or getting close to retirement. What makes the situation worse is that there are not enough new ones to replace them because the subsequent generations were smaller and fewer chose manufacturing as a career.

The convergence of all of these factors has resulted in an insufficient number of workers trained for advanced manufacturing jobs. It is more of a skills gap in the specific skills needed by today’s manufacturers than a shortage of skilled workers. In the past 15 years, the manufacturing industry has evolved from needing low-skilled production-type assembly workers to being highly technology-infused.

The 2012 ManpowerGroup annual Talent Shortage Survey revealed that 49 percent of U.S. employers are experiencing difficulty filling mission-critical positions within their organizations despite continued high unemployment. According to the more than 1,300 U.S. employers surveyed, the positions that

are most difficult to fill include Skilled Trades, Engineers and IT Staff, all of which have appeared on the U.S. list multiple times since the survey began in 2006.

Jonas Prising, ManpowerGroup president of the Americas, said, “This skills mismatch has major ramifications on employment and business success in the U.S and around the globe. Wise corporate leaders are doing something about it, and we increasingly see that they’re developing workforce strategies and partnerships with local educational institutions to train their next generation of workers.”

Training to Address Skills Shortage:

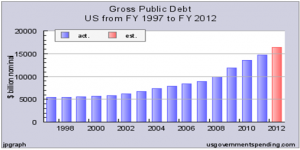

According to a 2011 U.S. Government Accountability Office study of fiscal year 2009, the federal government had 47 programs run by nine different agencies. The GAO noted that more information is needed to measure the true effectiveness of the programs. “Almost all of the 47 programs tracked multiple outcome measures related to employment and training, and the most frequently tracked outcome measure was ‘entered employment,’ “the agency stated. “ However, little is known about the effectiveness of employment and training programs because, since 2004, only five reported conducting an impact study, and about half of all the remaining programs have not had a performance review of any kind.”

Obviously, we could make government work better and save money in the process by consolidating some of these programs and giving some of the money to the states for programs that work best for their workers. However, it doesn’t necessarily mean programs can be combined. It might not make sense, for example, to combine the “Disabled Veterans’ Outreach Program” with the “Migrant and Seasonal Farmworkers Program,” or the “Native American Employment and Training Program” with the “National Guard Youth Challenge Program.” In addition, the programs are not equal in size or scope. The GAO reported that seven programs accounted for 75 percent of the $18 billion spent on job training, while two programs (“Wagner-Peyser funded Employment Service” and “Workforce Investment Act Adult”) served about 77 percent of all participants.

However, we don’t need to rely solely on government-funded training for manufacturing jobs. A great deal has already been done industry, trade and professional organizations, colleges, and universities to train and retrain today’s workers and prepare the next generation of manufacturing workers.

For example, the National Institute for Metalworking Skills (NIMS) was formed in 1995 by the metalworking trade associations to develop and maintain a globally competitive American workforce. NIMS sets skills standards for the industry, certifies individual skills against the standards, and accredits training programs that meet NIMS quality requirements. NIMS operates under rigorous and highly disciplined processes as the only developer of American National Standards for the nation’s metalworking industry accredited by the American National Standards Institute (ANSI).

NIMS has a stakeholder base of over 6,000 metalworking companies and major trade associations in the industry. The Association for Manufacturing Technology, the American Machine Tool Distributors’ Association, the National Tooling & Machining Association, the Precision Machine Products Association, the Precision Metalforming Association, and the Tooling and Manufacturing Association have invested over $7.5 million in private funds for the development of the NIMS standards and its credentials. The associations also contribute annually to sustain NIMS operations and are committed to the upgrading and maintenance of the standards.

NIMS has developed skills standards in 24 operational areas covering the breadth of metalworking operations, and there are 52 distinct NIMS skill certifications. The Standards range from entry to a master level. All NIMS standards are industry-written and industry-validated, and are subject to regular, periodic reviews under the procedures accredited and audited by ANSI. NIMS certifies individual skills against the national standards and requires that the candidate meets both performance and theory requirements that are industry-designed and industry-piloted.

NIMS accredits training programs that meet its quality requirements. The NIMS accreditation requirements include an on-site audit and evaluation by a NIMS industry team that reviews and conducts on-site inspections of all aspects of the training programs, including administrative support, curriculum, plant, equipment and tooling, student and trainee progress, industry involvement, instructor qualifications and safety. Officials governing NIMS accredited programs report annually on progress and are subject to re-accreditation on a five-year cycle.

The Society of Manufacturing Engineers (SME), the world’s leading professional society advancing manufacturing knowledge, also provides the following professional certifications: Manufacturing Technologist, Manufacturing Engineering, Engineering Manager, Lean Certification (Bronze, Silver, and Gold), and Six Sigma. SME’s Certified Manufacturing Technologist program is utilized as an outcome assessment by numerous colleges and universities with Manufacturing, Manufacturing Engineering or Engineering Technology programs.

In 2010, the Society of Manufacturing acquired Tooling University LLC (Tooling U) based in Cleveland, Ohio to provide online, onsite, and webinar training for manufacturing companies and educational institutions. With more than 400 unique titles, Tooling U offers a full range of content to train machine operators, welders, assemblers, inspectors, and maintenance professionals. These classes are delivered through a custom learning management system (LMS), which provides extensive tracking and reporting capabilities. The competencies tie the online curriculum to matching hands-on tasks that put the theory to practice.

The Fabricators and Manufacturers Association, International (FMA) champions the success of the metal processing, forming, and fabricating industry. FMA educates the industry through the following programs:

FabCast – FMA’s webinar platform utilizes Internet connection and telephone to deliver live, interactive technical education programs directly to manufacturers on such topics as laser cutting, roll forming, metal stamping, etc. Companies can train their whole team at once, even from multiple locations. Companies can break up full days of instruction into modules and spread out over a period of time (i.e. two hours four days a week, four hours once a week for a month, etc.).

FMA also offers on-site, live training conducted at companies on their equipment as well as on-line training (e-Fab) that allows a company to get the training that they need, when they need it. E-Fab courses combine a full day’s worth of instruction by FMA’s leading subject matter experts with the flexibility of online delivery, available 24/7, 365 days a year.

FMA provides a Precision Sheet Metal Operator (PSMO) Certification – the metal fabricating industry’s only comprehensive exam designed to assess a candidate’s knowledge of fundamental precision sheet metal operations. Fabrication processes covered in the exam include shearing, sawing, press brake, turret punch press, laser cutting, and mechanical finishing.

Attracting the Next Generation of Manufacturing Workers:

If we want to attract today’s youth to manufacturing careers, we need to change their perceptions about what the manufacturing industry is like and show them what great career opportunities exist in the industry. We need to expose them to the variety of career opportunities in manufacturing and help them realize that manufacturing careers pay 25-50 percent higher than non-manufacturing jobs, so they will choose to be part of modern manufacturing.

We need to reacquaint youth with the process of designing and building products from an early age and provide them with the opportunities to learn in both traditional and non-traditional ways. Here are some suggestions:

Conduct manufacturing summer camps – In 2011, the Fabricators and Manufacturers Association, International (FMA) Nuts, Bolts and Thingamajigs Foundation (NBT) and the National Association for Community College Entrepreneurship (NACCE) partnered to launch a unique summer camp program called Gadget Camp, where teenagers learn how to build things from concept to creation. Attendees are required to design a product through computer-aided design (CAD) technology and oversee the design to completion. The initial summer camp will eventually develop into a national program with as many as 300 locations across the United States.

Restore shop classes to our high schools – The elimination of these courses from our school systems has inevitably had a negative impact on the way we view making a living with our hands. Project Lead The Way® (PLTW) has been working since 1997 to promote pre-engineering courses for middle and high school students. PLTW forms partnerships with public schools, higher education institutions, and the private sector to increase the quantity and quality of engineers and engineering technologists graduating from our educational system. The PLTW curriculum was first introduced to 12 New York State high schools in the 1997-98 school years, and today, the programs are offered in over 1,300 schools in 45 states and the District of Columbia.

Improve the image of manufacturing careers – The National Tooling and Machining Association (NTMA) is another trade association that has a program to encourage youth to consider manufacturing as a career. NTMA is the Founding Sponsor of an exciting educational program that provides unlimited career awareness experiences in advanced manufacturing technology for students from middle school through college age. The approach has three components: a robotics curriculum based on national standards, teacher training workshops, and competitive events where students showcase their custom-built machines and compete for top honors. NTMA has six active regional leagues in their National Robotics League, a competition of battling robots that generates huge excitement among high school students.

Establish Apprenticeship Programs – In 2011, NIMS launched a new Competency-based Apprenticeship System for the nation’s metalworking industry. Employers are able to customize training to meet their own needs while maintaining the national integrity of apprenticeship training. Developed in partnership with the United States Department of Labor, the new system is the result of two years of work. Over 300 companies participated in the deliberations and design. The new National Guideline Standards for NIMS Competency-based Apprenticeship have been approved by the Department of Labor. NIMS has trained Department of Labor apprenticeship staff at the national and state level in the new system.

Portray manufacturing careers as fun and exciting – the convergence of cloud computing, mobile apps, and gamification within the manufacturing sector is in its infancy. Gamification is the use of game thinking and game mechanics in a non-game context to capitalize on youth’s obsession with video games. The best example is Plantville, a new online gaming platform that simulates the experience of being a plant manager, introduced by Siemens Industry, Inc. in March 2011. Players are faced with the challenge of maintaining the operation of their plant while trying to improve the productivity, efficiency, sustainability and overall health of their facility.

The existing programs described and recommendations outlined in this article are a good start to ensure that we have enough skilled workers for manufacturers to employ as more and more companies return manufacturing to America from outsourcing offshore and replace the “baby boomers” as they retire over the next 20 years.