Rising interest rates have been making frequent headlines since they started rising in 2022 when inflation reached the historic level of 8% for a sustained period of time. When inflation rates rise substantially, the Federal Reserve raises interest rates as part of their aggressive monetary policy to bring it down.

The effect on manufacturing is serious because manufacturing is an asset-driven industry sector, and assets are expensive. It is necessary for manufacturing companies to finance the cost of new machinery, equipment, vehicles, and infrastructure. As interest rates rise, the cost of financing grows higher, which means manufacturers end up paying significantly more to expand operations.

This creates a dilemma for manufacturers: They must either spend more to borrow or spend more to maintain assets beyond their original life expectancy. This is an added expense for the industry when they are already facing significant increases in material prices. It also comes at a time when manufacturers are being pressured by the market to implement Industry 4.0 technologies, such as sensors, automation, robotics, new ERP software, and AI, all of which require capital expenditures.

The inflation of the past couple of years was mainly caused by supply chain shortages and disruptions due to the COVID pandemic shutdowns. Once the supply chain recovered, the supply of goods would have increased, reducing inflation. Instead, the Fed raised interest rates, causing business contraction and less consumer spending.

I’ve never been able to understand the rationale for raising interest rate to reduce inflation. Raising interest rates only adds to the cost of doing business, reduces capital expenditures and investment by companies, and reduces consumer spending. Reducing industrial and consumer spending causes businesses to contract, which leads to layoffs. Layoffs cause less consumer spending leading to more business contraction. It becomes a vicious cycle.

Confirming my opinion about the negative effect of high interest rates, the August 28, 2023 article by Matthew Fox in Business Insider titled “’Interest rates are killing our industry’: Here’s what businesses are saying about the Fed’s impact on the economy” states:

“’High interest rates are affecting industrial production like never before… interest rates have placed an inverted incentive to grow due to a major slowdown in capital equipment expenditures. This is the time to stop raising interest rates,’ one survey respondent in the computer and electronic product manufacturing industry said.”

“For the first time in a long time, we are seeing customers reduce or cancel orders due to softening end-use demand. We expect this trend to continue over the next few months” and “Customer orders came to a sudden halt. The overall volume dropped 51% year-over-year.”

“A respondent from that sector [machinery manufacturing industry] said, “The phone is not ringing. Our sales team is working harder with less results. Projects are being postponed and, perhaps even more telling, payments are increasingly protracted.”

The latest press release from The Association For Manufacturing Technology (AMT) reported: “Orders in 2023 totaled $4.94 billion, 11.2% behind the $5.56 billion recorded in 2022… Contract machine shops decreased their 2023 orders just over 21% compared to 2022… aerospace sector’s 2023 orders decreased nearly 9% from 2022.”

My sales agency, ElectroFab Sales represents small American manufacturers that perform fabrication services for Original Equipment Manufacturers in a variety of industries in southern California, and I can confirm that business started contracting significantly in the third quarter of last year and hasn’t rebounded so far this year.

We’ve also had significant layoffs in the past two years. The February 12, 2024 article in TechCrunch reports “The final total of layoffs for 2023 ended up being 262,735, according to Layoffs.fyi. Tech layoffs conducted in 2023 were 59% higher than 2022’s total, according to the data in the tracker. And 2024 is off to a rough start despite not reaching the peak of last year’s first quarter cutbacks.:

A review of Historical Data

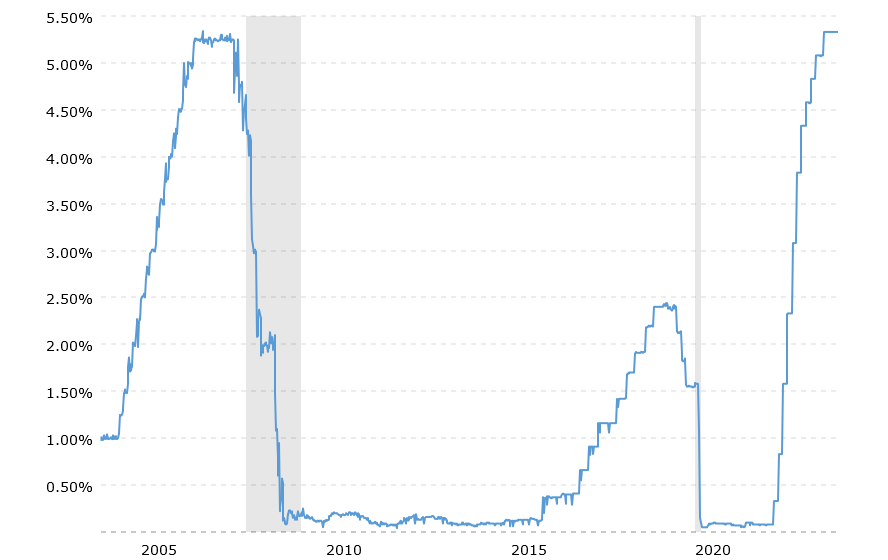

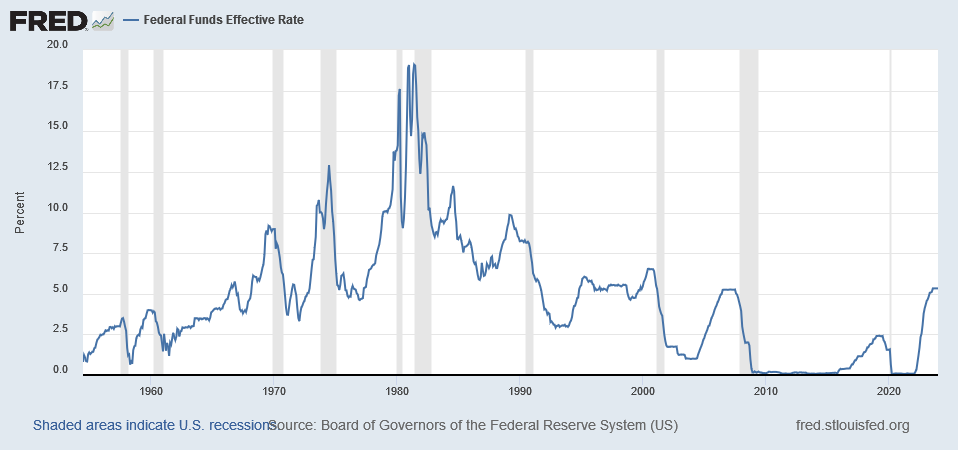

The following chart shows the relationship between Fed rates and recessions (shaded vertical lines show recessions).

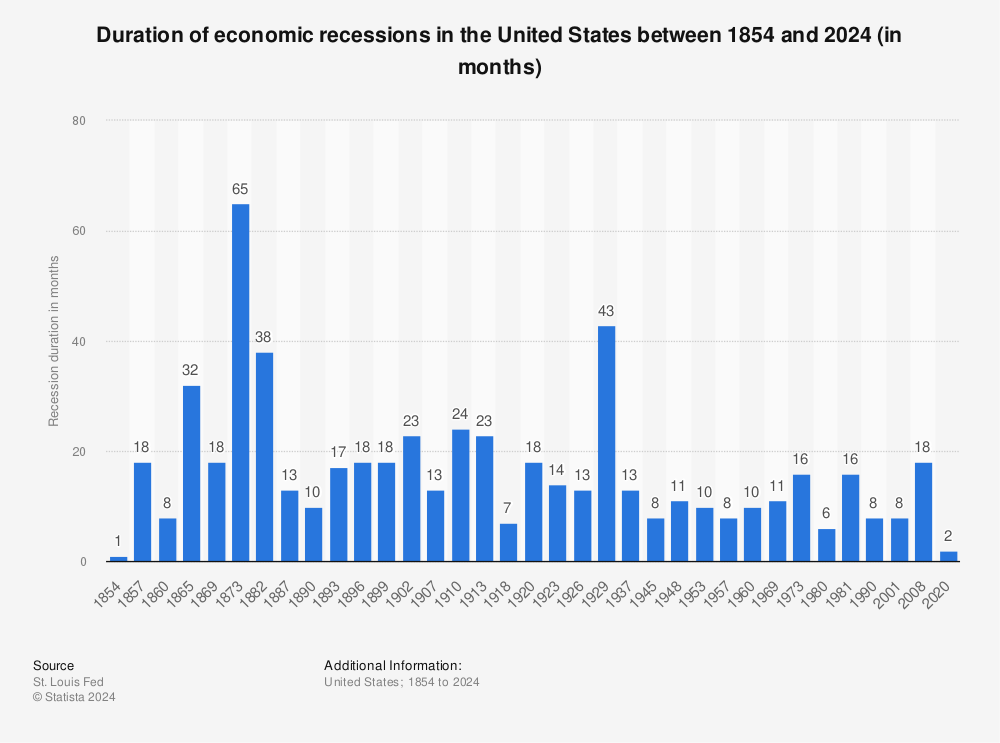

While some of the recessions started after the Fed started to reduce rates from being high, there may be a lag time in the effect of high interest rates and the start of a recession. When businesses have contracted significantly, it takes a period of time to turn the economy around towards expansion, depending on how significantly the economy has contracted. I believe there is evidence to indicate that the longer the duration of high Fed rates, the longer the recession lasts. The following chart shows the duration of the recessions:

People think that the “Roaring 20s” was a period of prosperity and expansion, but there were actually three recessions in the 1920s prior to the crash of the stock market in 1929, leading to the Great Depression that lasted 43 months, followed by a shorter recession of 13 months prior to the beginning of WW II.

The recession that began in the fall of 2008 was the longest lasting recession since the recession that began in 1981. The cause of the brief, two-month recession of 2020 was the shutdowns of non-essential manufacturing during the beginning of the COVID pandemic.

Judging by the number of recessions since 1913, I don’t think that the monetary policies of the Fed have been successful in preventing “booms and busts.” However, it has protected the banking industry from widespread bank failures.

We need to understand that contrary to what many people think, the Federal Reserve is not a government-owned national bank. The Federal Reserve was established by Congress in 1913 with the enactment of the Federal Reserve Act. It was established to be the central bank of the U.S. “Its primary purpose is to enhance the stability of the American banking system. The Federal Reserve System is composed of a central, independent governmental agency, the Board of Governors, in Washington, D.C., and 12 regional Federal Reserve Banks located in major cities throughout the U.S…. The Fed introduced Federal Reserve notes, which became the predominant form of U.S. currency and legal tender.”

According to the website USA Facts, “The Fed is an independent body and is not tied to an administration or partisan agenda. The system has three key entities: The Board of Governors, the Federal Reserve Banks, and the Federal Open Market Committee (FOMC).

The Fed oversees five key functions. These five key functions laid out by the Fed are “…to conduct the nation’s monetary policy, promote the stability of the financial system, promote the soundness of financial institutions, facilitating US dollar transactions, and promoting consumer protection.

The president appoints the Board of Governors, pending Congressional confirmation. The Board of Governors is tasked with supervising the five functions, overseeing 12 Federal Reserve banks, and creating financial regulations.”

What is the Outlook for the Future?

On January 29, 2024, the article “When Will the Fed Start Cutting Interest Rates?” by Preston Caldwell, on MorningStar, states “We expect the Fed to start cutting rates beginning with the March 2024 meeting. The Fed will pivot to monetary easing as inflation falls back to its 2% target and the need to shore up economic growth becomes a top concern…since July 2023, the Federal Reserve has kept the federal-funds rate at a target range of 5.25% to 5.50%, far above typical levels over the past decade. But we expect the Fed will begin cutting rates in March 2024—bringing the federal-funds rate to 3.75%–4.00% by the end of 2024.”

We can only hope that when the Fed does cut rates, it will not lead to a recession of equal time. The sooner that the Fed reduces its fund rates, the better.