On July 11, 2017, the Coalition for a Prosperous America released a paper titled, “The Threat of U.S. Dollar Overvaluation: How to Calculate True Exchange Rate Misalignment & How to Fix It” by Michael Stumo (CEO), Jeff Ferry (Research Director) and Dr. John R. Hansen, a 30-year veteran of the World Bank and Advisory Board member.

The purpose of the paper is to explain the problem of the dollar overvaluation, to show how to accurately calculate the dollar’s misalignment against trading partner currencies, and to propose a solution this serious threat to America’s future.

The authors point out that “In past centuries, the only reason that people would choose to hold a foreign currency would be to trade with it… But in the last few decades, and especially since the early 1990s, international speculators and traders have invested in dollars, including stocks, bonds, and cash, at the rate of hundreds of billions of dollars a year. The dollar investments of private investors now far outweigh the investments of government investors.”

These private investments shrunk from $1 trillion in 2007 down to $200 billion in 2010 during the recession and have grown back up to about $400 billion.

The authors explain that private investors buy dollars for many reasons: to purchase goods that are priced in dollars (like oil), “as a hedge against depreciation of their own local currencies,” to invest in the U.S. economy, to make a speculative investment, and “in many cases simply because in an uncertain world, the U.S. dollar is viewed as a rock of reliability and stability.”

In economic terms, the authors explain that the current account deficit is “the trade deficit with overseas remittances and other small items added in.” In the past when currency markets still maintained a link between exchange rates and balanced trade, the value of the dollar and the account deficit affect each other; i.e., “When the dollar rises, the current account worsens (larger negative figure as a percent of GDP), and when the dollar falls, the current account improves.”

However, the authors point out this hasn’t been happening for years. For example, “The current account deficit has been strongly negative throughout the last ten years, yet the dollar has not fallen to bring trade back into balance. On the contrary, in mid-2014, despite a trade balance close to -3% of GDP, the dollar suddenly rose more than 15%, and stabilized in 2016, only to rise yet again after the November election.”

They add, “These exchange rate increases are likely to worsen the trade deficit in the next two to four years. The ability of the U.S. dollar to defy gravity despite huge and persistent trade deficits has played an important role in the persistence of those deficits.”

The consequences are: “A dollar that is too high keeps our exports too expensive and makes imports too cheap, prompting Americans to consume more imports and to export less. The impact of an overvalued dollar is hard to overstate.”

Why this is critical is that, “According to Fred Bergsten and William Cline, both of the Peterson Institute, “every 10 percent rise in the dollar adds about $350 billion to the trade deficit and reduces the level of U.S. economic activity by about 1.65%, with a corresponding loss of about 1.5 million jobs.” Since the U.S. has had a more than $500 billion trade deficit since 2003, except for 2009, this helps explain why we lost 5.8 million manufacturing jobs between 2000 – 2010.

Calculating the Currency Misalignment

In 2008, Fred Bergsten and his Peterson Institute for International Economics colleagues developed a methodology to calculate a Fundamental Equilibrium Exchange Rate (FEER) of a currency that will enable a country’s trade to balance (i.e. exports and imports equal) in a reasonably short timeframe. The authors state, “The traditional FEER methodology generally targets getting a nation’s current account to within plus or minus 3 percent of balance…In 2015, Peterson suggested targeting absolute, true-zero trade balances and recalculated FEER levels based on targets of balanced trade. Moving from a target of +/-3% of GDP to a true-zero balance is very important for the United States. Our present current account deficits equal to 3% of GDP cost us the needless unemployment of about three million American workers, according to most estimates of the job cost of imports.”

After “the Peterson Institute issued new global FEER estimates in May using the traditional +/- 3% balance target methodology,” Dr. John Hansen “converted these FEER estimates into true-zero FEER estimates using a methodology agreed with Peterson.”

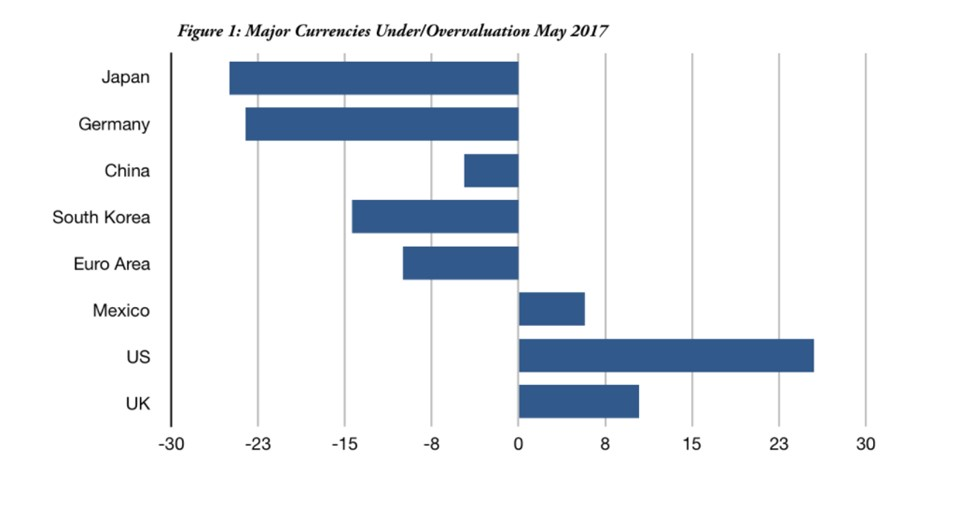

According to his calculations, “The U.S. dollar is currently 25.5% overvalued compared to its FEER,” which makes it “more seriously misaligned than the currency of any other major trading partner country. “

In contrast, “Germany and Japan – are misaligned in the opposite direction. They are undervalued while the U.S. dollar is overvalued.” Japan’s currency is undervalued by 25% and Germany’s by 23.6%.

What was surprising to me was that according to Dr. Hansen’s FEER calculations, China only had a 4.7% undervaluation. For the last ten years, I have read article after article about China’s undervaluation of their currency, estimated to be anywhere from 25% – 40%. I didn’t realize this had changed until I searched and found an article from November 18, 2016 by Fred Bergsten of the Peterson Institute, in which he wrote, “China was the champion currency manipulator of all time from 2003 through 2014. During this “decade of manipulation,” China bought more than $300 billion annually to resist upward movement of its currency by artificially keeping the exchange rate of the dollar strong and the renminbi’s exchange rate weak. China’s competitive position was thus strengthened by as much as 30 to 40 percent at the peak of the intervention. Currency manipulation explained most of China’s large trade surpluses, which reached a staggering 10 percent of its entire GDP in 2007.”

According to Bergstrom, China is no longer undervaluing their currency because they have “experienced large outflows of private capital that have driven its exchange rate down and indeed sparked market fears of disorderly renminbi devaluations. To their credit, the Chinese have intervened heavily on the opposite side of the market: Instead of buying dollars to keep the renminbi weak, they have sold large amounts of dollars to prevent it from sliding further.”

As a consequence of the misalignment of the dollar against the currency of two of our major trading partners and to a lesser degree with other countries, “The dollar’s gross overvaluation imposes a tax on the selling price of all U.S. products that can be traded internationally – even if they are not actually traded. It is a tax on U.S. producers trying to export. On U.S. producers competing with imported goods. And it is even a tax on U.S. producers who face the threat of imports. For example, the threat of imported shirts from China can force a New England shirt manufacturer to sell his shirt for 25 percent less than he would otherwise be able to charge if the dollar were not so overvalued.”

Because this tax is a tax on the selling price and not on profits like the income tax, “…the dollar’s overvaluation is such a serious threat to the survival of manufacturing and farming in the United States. The dollar’s overvaluation threatens not only the existence of these two critical sectors. It also threatens the entire economy because these two sectors are by far the most important sources of the exports we need to pay for our imports.”

Contrary to popular opinion, the overvaluation of the dollar is not caused by government currency manipulation The authors assert that “The dollar’s misalignment is primarily caused by the buying and selling decisions of private traders…the dollar is overvalued because private investor decisions are unrelated to the fundamental performance of trade or production in the U.S. or any other economy, and the global monetary system no longer has a mechanism to bring exchange rates back to levels consistent with balanced trade.”

What is the solution?

Dr. John Hansen has developed a Market Access Charge (MAC) “as a system to discourage overseas private investors and return-sensitive official investors such as sovereign wealth fund managers from excessive speculation and trading in U.S. dollar assets.” (For further details, go to his website.)

He believes that “By reducing the incentive for foreigners to invest in dollars, we can gradually and safely reduce its overvaluation, benefiting the U.S. economy and restoring control over our own currency.”

His proposal is to initiate the MAC with a 0.5% charge “on any purchase of U.S. dollar financial assets by a foreign entity or individual…As a one-time charge, the MAC will discourage would-be short-term investors, many of whom hold dollars or dollar-denominated securities overnight or even for minutes for the sake of a tiny profit.

The MAC rate would operate on a sliding scale, geared to the value of the trade deficit as a percentage of GDP. The MAC tax would rise if the trade deficit rose, and fall as the trade deficit falls… Most importantly, the MAC would have a substantial impact on the dollar’s value, moving it gradually and safely to a trade-balancing exchange rate and keeping it there, regardless of what other countries do. If the trade deficit goes to zero, so would the MAC.”

Dr. Hansen and the Coalition for a Prosperous America believe that this small charge “would be sufficient to discourage foreign inflows of hot money, with no material impact on foreign direct investment in factories and other directly productive activities.”

They agree that, “if properly implemented, the MAC could eliminate the full 25% overvaluation of the dollar, and this could lead to the complete elimination of the trade deficit over the subsequent three to four years.”

How could it be implemented?

The authors believe the MAC could be implemented unilaterally by the U.S. federal government. because “it does not violate IMF rules, which explicitly allow member nations to implement policies needed to rectify international financial imbalances [and] It does not violate WTO rules either.”

However, they “recommend a period of international consultation with G20 members to reduce the risk of misunderstandings and, hopefully, to get them to implement their own versions of the MAC…[which] would benefit the U.S. and the world by restoring a stable foundation for balanced, sustainable global growth.”

They envision that, “The MAC would be a self-financing system since it would generate revenue. We expect the MAC would generate at least $1 billion in annual revenues, and probably more, depending largely upon how much foreign exchange trading in the dollar declines due to increased transaction costs from the MAC.

Because the goal of the MAC is “to reduce and ultimately eliminate the trade deficit,” the revenue would be temporary and would go to zero when the goal is achieved. They propose that at “MAC revenue be earmarked for a “U.S. Competitiveness Fund” supporting short-term spending projects such as infrastructure investment.”

They also clarify that “no Americans would pay the MAC charge. Only foreign-based individuals and entities are liable to pay the MAC.” Until the MAC achieves its goal, the Government will enjoy increased tax revenue because the MAC will greatly stimulate U.S. competitiveness and thus overall output, profits, wages – and thus the tax base.”

They “believe the MAC could eliminate the trade deficit entirely over a period of several years,” but emphasize that “there is still a clear need for other U.S. trade policies focused on eliminating unfair trade practices and non-tariff barriers. The MAC should be seen as complementary to, not competitive with, such trade policies. Though in remission now, currency intervention and manipulation by governments is likely to resume, and the U.S. government should not hesitate to act to stop or counteract such activities.”

The Coalition for a Prosperous America “favors actions to strengthen the monitoring, definition, and enforcement of remedies to counteract currency manipulation, dumping, and other unfair trading practices.” I strongly agree with their recommendation to implement a Market Access Charge to reduce dollar overvaluation, discourage unwanted investment in the dollar, bring down the dollar’s value, significantly reduce America’s trade deficit and stimulate economic growth, employment and personal income.