We’ve heard a great deal about “drones” or unmanned vehicles over the last decade of the “war on terror” in Iraq and Afghanistan. While these terms are used interchangeably in the news media, the members of the Association for Unmanned Vehicle Systems International (AUVSI) are quick to point out that the term “drone” was originally coined to refer to pilotless aircraft used for “target” practice by the military while an unmanned vehicle includes the technology on the ground, often with a human at the controls.

The mission of AUVSI is to advance the unmanned systems and robotics community internationally through education, advocacy and leadership. AUVSI represents more than 7,000 individual members and more than 600 corporate members from 60+ allied countries involved in the fields of government, industry and academia. AUVSI members work in the defense, civil and commercial markets.

In March 2013, AUVSI released a report, titled “The Economic Impact of Unmanned Aircraft Systems Integration in the United States” to document the economic benefits to the U.S. once Unmanned Aircraft Systems (UAS) are integrated into in the National Airspace System (NAS) after the federal government tasked the Federal Aviation Administration (FAA) to determine how to integrate UAS into the NAS in 2012. This report estimates the economic impact of this integration and estimates the jobs and financial opportunity lost to the economy if there is a delay in enacting the regulations needed to do the integration.

The report states that “the main inhibitor of U.S. commercial and civil development of the UAS is the lack of a regulatory structure.” Non-defense use of UAS has been extremely limited because of current airspace restrictions.

The combination of greater flexibility, lower capital and lower operating costs could allow unmanned vehicles to transform fields as diverse as urban infrastructure management, farming, and oil and gas exploration to name a few. The use of UAS in the future could be” a more responsible approach to certain airspace operations from an environmental, ecological and human risk perspective.”

Present-day unmanned vehicles have longer operational duration and require less maintenance than earlier models and are more fuel-efficient. These aircraft can be deployed in a number of different terrains and may not require prepared runways.

The Executive Summary states, “While there are multiple uses for UAS in the NAS, this research concludes that precision agriculture and public safety are the most promising commercial and civil markets. These two markets are thought to comprise approximately 90% of the known potential markets for UAS.”

UAS are already being used in a variety of applications, and many more areas will benefit by their use, such as:

- Wildfire mapping

- Agricultural monitoring

- Disaster management

- Thermal infrared power line surveys

- Law enforcement

- Telecommunication

- Weather monitoring

- Aerial imaging/mapping

- Television news coverage, sporting events, moviemaking

- Environmental monitoring

- Oil and gas exploration

- Freight transport

While there are a number of different markets in which UAS can be used, the report concentrates on the two markets, commercial and civil, with the largest potential. A third category (Other) summarizes all other markets: Precision agriculture, Public safety, and Other.

“Precision agriculture refers to two segments of the farm market: remote sensing and precision application. A variety of remote sensors are being used to scan plants for health problems, record growth rates and hydration, and locate disease outbreaks. Such sensors can be attached to ground vehicles, aerial vehicles and even aerospace satellites. Precision application, a practice especially useful for crop farmers and horticulturists, utilizes effective and efficient spray techniques to more selectively cover plants and fields. This allows farmers to provide only the needed pesticide or nutrient to each plant, reducing the total amount sprayed, and thus saving money and reducing environmental impacts.”

Public safety officials include police officers and professional firefighters in the U.S., as well as a variety of professional and volunteer emergency medical service providers who protect the public from events that pose significant danger, including natural disasters, man-made disasters and crimes.”

If sensible regulations are put in place, authors Darryl Jenkins and Dr. Bijan Visagh foresee few limitations to rapid growth in these industries because these products use off-the-shelf technology and thus impose few problems to rapidly ramping up production. The parts comprising these unmanned systems can be purchased from more than 100 different suppliers so prices will be stable and competitive. They can all be purchased within the U.S. or imported from any number of foreign countries without the need of an import license. For this report, they assume necessary airspace integration in 2015, which is on par with current legislation.

UAS have a durable life span of approximately 11 years and are relatively easy to maintain. The manufacture of these products requires technical skills equivalent to a college degree so there will always be a plentiful market of job applicants willing to enter this market. “The average price of the UAS is a fraction of the cost of a manned aircraft, such as a helicopter or crop duster, without any of the safety hazards. For public safety, the price of the product is approximately the price of a police squad car equipped with standard gear. It is also operated at a fraction of the cost of a manned aircraft, such as a helicopter, reducing the strain on agency budgets as well as the risk of bodily harm to the users in many difficult and dangerous situations. Therefore, the cost-benefit ratios of using UAS can be easily understood.”

The authors estimate enormous economic benefits to our country. To calculate the benefits, they forecast the number of sales in the three market categories. Next, they forecast the supplies needed to manufacture these products. Then, they forecast the number of direct jobs created using estimated costs for labor. Finally, using these factors, they forecast the tax revenue to the states.

In addition to direct jobs created by the manufacturing process, the authors state that there would be additional economic benefit by the new jobs created and income generated spread to local communities. “As new jobs are created, additional money is spent at the local level, creating additional demand for local services which, in turn, creates even more jobs (i.e., grocery clerks, barbers, school teachers, home builders, etc.). These indirect and induced jobs are forecast and included in the total jobs created.”

The economic benefits to individual states will not be evenly distributed. Ten states are predicted to see the most gains in terms of job creation and additional revenue as production of UAS increase, totaling more than $82 billion in economic impact from 2015-2025. In rank order they are:

- California

- Washington

- Texas

- Florida

- Arizona

- Connecticut

- Kansas

- Virginia

- New York

- Pennsylvania

“The economic projections contained in this report are based on the current airspace activity and infrastructure in a given state. As a result, states with an already thriving aerospace industry are projected to reap the most economic gains. However, a variety of factors—state laws, tax incentives, regulations, the establishment of test sites and the adoption of UAS technology by end users—will ultimately determine where jobs flow.”

The authors conclude:

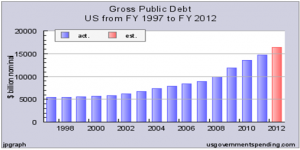

1. The economic impact of the integration of UAS into the NAS will total more than $13.6 billion in the first three years of integration and will grow sustainably for the foreseeable future, cumulating to more than $82.1 billion between 2015 and 2025.

2. Integration into the NAS will create more than 34,000 manufacturing jobs and more than 70,000 new jobs in the first three years.

3. By 2025, total job creation is estimated at 103,776.

4. The manufacturing jobs created will be high paying ($40,000) and require technical baccalaureate degrees.

5. Tax revenue to the states will total more than $482 million in the first 11 years following integration (2015-2025).

6. Every year that integration is delayed, the United States loses more than $10 billion in potential economic impact. This translates to a loss of $27.6 million per day that UAS are not integrated into the NAS.”

They base the 2025 state economic projections on current aerospace employment in the states and presume that none of the states have enacted restrictive legislation or regulations that would limit the expansion of the technology. Future state laws and regulations could also cause some states to lose jobs while others stand to gain jobs. States that create favorable regulatory and business environments for the industry and the technology will likely siphon jobs away from states that do not.

In conclusion, the study “demonstrates the significant contribution of UAS development and integration in the nation’s airspace to the economic growth and job creation in the aerospace industry and to the social and economic progress of the citizens in the U.S.

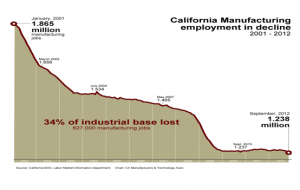

As the top ranked state and home to UAS manufacturers General Atomics and Northrop Grumman, California has active chapters of AUVSI, and the San Diego region chapter is AUVSI San Diego Lindbergh. Since both General Atomics and Northrop UAS plants are located in San Diego’s north county, in 2012, the North San Diego Chamber of Commerce commissioned the National University System Institute for Policy Research to conduct an economic assessment of the industry’s impact on San Diego’s defense economy. The report is titled, “Unmanned Aerial Vehicles: An Assessment of Their Impact on San Diego’s Defense Economy. The report states, “Unmanned aerial vehicle (UAV) production neared $1.3 billion in San Diego during 2011, according to analysis of federal government Depart of Defense (DoD) contract spending. UAV spending has grown significantly in San Diego over the past five years, nearly doubling since 2008. This growth parallels the increasing role played by UAVs in the U.S. military and the leadership position San Diego companies occupy in the UAV industry.”

While San Diego is still struggling to emerge from the 2008 national economic downturn, “the bright spot in the San Diego economy in recent years has been defense-related spending. Local defense expenditures grew substantially the past decade while military base operations and payrolls expanded. “Many economic observers, including the National University System Institute for Policy Research (NUSIPR), conclude that absent San Diego’s prowess in defense manufacturing and its role in hosting major military facilities, the local unemployment rate would have been significantly higher.”

At the peak of the recession, civilian unemployment in the county climbed to nearly 11 percent, and todaystill hovers around 9 percent. Companies have shed more than 50,000 jobs in the region. Local wages have fallen the past two years, while per capita income remains well below pre-recession peaks.

The important role of UAVs to the San Diego economy is emphasized by the fact that “UAV contracting activities in 2011 supported 7,135 direct and indirect jobs throughout San Diego County,” and “UAVs now comprise the largest segment of San Diego’s defense manufacturing sector. UAV production comprises more than 12 percent of all DoD contracting activities in San Diego County.” While DoD contracting in San Diego started to decrease in the past three years, UAV activity continued to expand.

“Since 2004, San Diego’s aerospace employment, now primarily focused on unmanned aircraft systems, has increased by 1,200 jobs. Just since early 2010, the sector has added 600 jobs. The two major UAV firms locally, Northrop Grumman and General Atomics Aeronautical Systems, each conduct billions of dollars in UAV unclassified contract work in San Diego County. According to Northrop Grumman Vice President Jim Zortman, ‘The center of the unmanned business for aerial vehicles is right here in San Diego.’”

The report states, “Production of UAVs is forecast to double by the end of the decade. Several forecasting firms have predicted the global demand for UAVs will reach $12 billion by 2019, even in the face of significant reductions in U.S. military spending.” There is every reason to believe San Diego is positioned to benefit from this trend given the leadership of Northrop Grumman and General Atomics Aviation in UAV technology.

However, several other states and regions are actively working to attract UAV researchers and manufacturers, and their efforts include the development of specialized educational programs and the preservation of airspace assets. Many states are setting aside dedicated airspace to support the UAV industry. Before the end of this year, the FAA will designate six areas around the country as UAS test sites.

In April of this year, the AUVSI San Diego Lindbergh Chapter joined the San Diego Regional Economic Development Council (EDC), the San Diego Military Advisory Council (SDMAC), the Imperial County EDC, County of Imperial, Holtville Airport, Indian Wells Valley Airport District (IWVAD), and defense contractors including General Atomics, Cubic Corporation, and Epsilon Systems Solutions, Inc. to respond to the Federal Aviation Administration’s (FAA) Screening for Information Request (SIR) and develop an Unmanned Aerial Systems (UAS) Test Range in a partnership with civil and military government agencies, academia, and industry. This coalition has joined an already established entity called the California Unmanned Systems Portal (Cal UAS Portal), which is based in Indian Wells, to create a proposed UAV Test Site that would extend from the NAS China Lake/Edwards Air Force Area, West to the Pacific Ocean, South to the Mexican border, and East to the Arizona border.

If San Diego wants to continue as a leading region for unmanned vehicles, it will be necessary for leaders in the private and public sectors to determine how best to support this industry and influence policymakers to address the high cost of doing business in California that is creating cost pressures on UAS manufacturers’ competitiveness in the worldwide UAS industry. As the report concludes, “Complacency could cause the region [and our country] to lose its leadership position and miss an opportunity to support an industry posed for growth.”