A trend is a pattern of gradual change in a condition, output, or process that moves in a certain direction over time. There are many trends that have occurred this year, but some are changing the way we work and conduct business. We will take a look at just a few of them that are beginning to have an impact and could dramatically impact our lies if they continue in the future.

Biomimicry: Humans have always looked to nature for inspiration to solve problems. One of the early examples of biomimicry was the study of birds to enable human flight. The Wright Brothers, who created and flew the first airplane in 1903, derived inspiration for their airplane from observations of pigeons in flight.

The term biomimicry was popularized by scientist and author Janine Benyus in her 1997 book Biomimicry: Innovation Inspired by Nature. Biomimicry is defined in her book as a “new science that studies nature’s models and then imitates or takes inspiration from these designs and processes to solve human problems”. Today, biomimicry is changing the way we research, invent, design, develop, and manufacture products.

The San Diego Zoo started its biomimicry programs in 2007, and the Zoological Society of San Diego recently partnered with Point Loma Nazarene University on an economic impact report looking into the feasibility of bringing another spoke into the region’s burgeoning green economy. The report titled Biomimicry: An Economic Game Changer and estimated that biomimicry would have a $300 billion annual impact on the US economy, plus add an additional $50 billion in environmental remediation.

“The completed report articulates a compelling case for making the San Diego region a global biomimicry hub,” said Randy M. Ataide, executive director of the Fermanian Business & Economic Institute at Point Loma Nazarene University. “Biomimicry could represent a revolutionary change in our economy by transforming many of the ways we think about designing, producing, transporting and distributing goods and services.”

An informal alliance to transform an esoteric concept into what they hope is the beginning of a future industry cluster has formed the Biomimicry Bridge (Business, Research, Innovation, Development, Governance and Education). A memorandum of understanding to facilitate growth of the Bridge organization has been in place since 2008 between the San Diego Zoo, the City of San Diego, CONNECT, UC San Diego, San Diego State University, Point Loma Nazarene University, and the University of San Diego.

“The key to biomimicry is the value we place on natural systems and species,” said Paula Brock, chief financial officer for the San Diego Zoo. “Biomimicry offers an opportunity to bring successful economics together with conservation. We hope this study will inspire new companies and entrepreneurs to focus upon the development of this field.”

A key finding of the report is that biomimicry holds the potential to attract sizable capital inflows, driven by the prospects of rapid growth and high rates of return, and that venture capital potentially could flow into the field at a pace at least equal to that of biotech, estimated to be about $4.5 billion in the U.S. in 2010.

The San Diego Zoo and San Diego Zoo Safari Park house nearly 8,000 animals representing 840 species, and the San Diego Zoo’s accredited botanical garden has close to 40,000 species. Allison Alberts, chief conservation and research officer for the San Diego Zoo, said “We are poised to offer the opportunity to be a living laboratory in helping biomimicry-based businesses grow.” She added that the inspiration that comes from studying animals and plants could also be a revenue generator for the zoo. The study determined that the zoo is the only facilities-based provider of biomimicry services in the world and a natural to drive research and commercial applications.

A range of businesses in the region already are incorporating aspects of biomimicry in the design of products or ones they have on the drawing boards, said Ruprecht von Buttlar, director of finance and commercialization programs at CONECT, which serves as a networking group for investors, entrepreneurs and high-tech and life sciences professionals.

The San Diego Zoo’s Biomimicry website features a page on the latest news, research, and development of biomimetic products, a few of which are:

GreenShield: An environmentally friendly stain-resistant fabric finish inspired by lotus leaves:

Mirasol®, a display innovation by Qualcomm, mimics the microstructure of a butterfly’s wing to generate color without pigment in their handheld display technologies:

Biomatrica has developed DNA and RNA preservation technology based on the process in nature called anhydrobiosis:

Columbia Forest Products developed PureBond by manipulating soy proteins to behave like mussel byssal threads. Is the only urea-formeldehyde (carcinogen) free plywood glue on the market:

Cloud Computing: Cloud computing has become one of the hottest buzzwords in technology and its birth as a term can be traced “to 2006, when large companies such as Google and Amazon began using ‘cloud computing’ to describe the new paradigm in which people are increasingly accessing software, computer power, and files over the Web instead of on their desktops. It is an expansion of what has been known as software as a service (SaaS) in which cloud computing providers deliver applications via the internet that are accessed from web browsers and desktop and mobile apps, while the business software and data are stored on servers at a remote location.

This type of data center environment allows companies to get their applications up and running faster, with easier manageability and less maintenance, and enables IT to more rapidly adjust IT resources (such as servers, storage, and networking) to meet fluctuating and unpredictable business demand.

Cloud computing is all the rage. “It’s become the phrase du jour,” says Gartner senior analyst Ben Pring, echoing many of his peers. The problem is that (as with Web 2.0) everyone seems to have a different definition.

On the Hyland blog, Glenn Gibson offers a simpler definition: “The Cloud” is a term used to describe a wide range of technologies, which are accessible through high-speed connections to the internet and private networks.

Cloud computing is at an early stage, with a growing number of providers large and small delivering a variety of cloud-based services, from full-blown applications to storage services to spam filtering. Today, for the most part, IT must plug into cloud-based services individually, but cloud computing aggregators and integrators are already emerging.

Cloud computing is a long-running trend with a far-out horizon. This year, TechAmerica San Diego added the new category of SaaS/Cloud for the first time at the 2011 High Tech Awards held on October 28th. Four companies were finalists, and the winner, ServiceNow develops and delivers a comprehensive suite of cloud-based services for enterprise IT management. For a single low subscription price, ServiceNow customers have access to nearly 20 native applications built on a common, extensible platform. ServiceNow supports all common ITIL processes including incident, problem, change, request fulfillment, service level management and others. The three other finalists were: Kyriba, Syntricity Inc., and The Active Network.

Cloud computing is also changing the way manufacturing companies can become ISO Certified at a price affordable for companies as small as less than 25 employees and under $1.5 million in sales. ION Quality Systems provides an innovative Quality Management System designed to revolutionize businesses. Their customizable management tools, experience, and exemplary customer service make them a partner in quality assurance. They can prepare you to get your AS9100, ISO 9001:2008 or other certification more efficiently, economically, and effectively than a traditional quality system in as little as 90 days.

However, there are concerns about the cyber security of cloud computing, and the June issue of National Defense magazine featured an article on “Cloud Computing Trend Sparks Compliance Concerns.” Because the Obama administration has focused on cloud computing for future information technology needs, there is concern that “data stored in the cloud must always be accessible from any location, thereby increasing hacker vulnerability and the need ? without degrading fast encryption and decryption ? for robust measures to deflect security breaches.” This same cyber security concern was the focus of a symposium on “CLOUD.GOV?

The Promise, Limits, and Reality” held by the San Diego chapter of the National Defense Industry Association on October 11-13, 2011.

Social Media: Social networking is not new; social networks have been around for far longer than people have been online. Everyone has belonged to social networks, and they still participate in social networks whether they know it or not. What is new is social media that provides online social networking. In addition to the more popular, Facebook, LinkedIn, and Twitter, there are Foursquare, Yelp, Groupon, and Living Social. The BLÜ Group – Advertising & Marketing has published a free social media guide to help businesses of all sizes, particularly small and mid-sized businesses, connect with customers and potential customers, stay engaged with them, and ultimately grow their bottom line.

LinkedIn, Facebook and Twitter: Most of us have been adding to our social media network to expand business opportunities, express opinions, and keep connected with people who change from one job to another. Now, it is literally changing the way people conduct business, and view customers’ opinions and product ideas. .

In the September 2011 issue of Industry Week, the article “Fueling Auto R&D with Social Media,” reported that Kia Motors Corporation “decided to modify the seat design for their 2012 Optima as a result of a groundswell of complaints from consumers and automotive writers percolating on the Internet.” Kia uses business intelligence software to monitor online comments about it vehicles and determined that it was bigger problem than they realized and needed to be fixed before the next major change in the model in a few years.

Ford also pays close attention to what people say about its products on social media such as Facebook and Twitter, and elsewhere on the internet. Nissan Motor Company is also trying to grow it fan base on social media sites such as Facebook and Twitter to leverage the maximum impact when it launches new models. Nissan is also using social media as a research tool. In August 2011, Nissan invited its more than 300,000 Facebook fans to suggest names for a new optional interior package for the Nissan Cube. Eric Marx of Nissan said using social media to make ”real business decisions it absolutely the future. “ A cottage industry is emerging to aggregate the vast amount of online comments into actionable data. Nielsen Online’s BuzzMetrics software promises to deliver consumer insights and real-time market intelligence, and WiseWindow’s MOBI (Mass Opinion Business Intelligence) software to predict consumer purchasing intent and behavior.

According to one of my friends that owns a staffing agency, LinkedIn is actually changing the way people seek and are being recruited for jobs. Having a good LinkedIn profile can mean the difference between being hired or not.

Recruiters are searching the LinkedIn database to find candidates for specific positions. They can use the free, “Advanced People Search” function available to all LinkedIn members. They can search members and activities within specific LinkedIn groups, and many others are using a paid service called LinkedIn Recruiter that provides significantly more search functionality.

In addition, similar to the way job seekers sign up for “job alerts” to get notified via email whenever a new job gets posted that meets a certain set of criteria, recruiters can also sign up for candidate alerts to notify them of new candidates who fit their requirements.

Unemployed people and those seeking better jobs need to learn how to optimize their LinkedIn profile to align with this process of job search and recruiting. According to Marci Reynolds, CEO of J2B Marketing, a “Job Seeker 2 Business,”™ there are many things a job seeker can do to optimize their profile to help ensure that they “show up in the appropriate search results, show up higher than other candidates (LinkedIn SEO), and stand out among the search results. Some of her tips are:

- Your profile should be 100% “complete,” per LinkedIn standards

- Include a detailed work history, with clear job titles and well written job descriptions that describe both your responsibilities and your key accomplishments

- Make sure your “industry” selection is tied to the job you want, not the job you had.

- Make sure you have some recommendations from your connections

- Use a professional, flattering profile photo that looks like you already have the role you’re seeking

- Use a headline to effectively market your skills and abilities. Your LinkedIn headline is like your personal tagline

Klout: If you’re new to Twitter and haven’t heard of Klout, you will soon. Klout is the gold standard for measuring your influence on Twitter. Klout uses several measurements to come up with a Klout Score for each and every Twitter user.

The Klout Score measures influence based on your ability to drive action. Every time you create content or engage you influence others. The Klout Score uses data from social networks in order to measure:

- True Reach: the number of people you influence. When you post a message, these people tend to respond or share it.

- Amplification: how much you influence people. When you post a message, how many people respond to it or spread it further? If people often act upon your content you have a high Amplification score.

- Network Impact: the influence of the people in your True Reach. How often do top Influencers share and respond to your content? When they do so, they are increasing your Network score.

Klout assigns a number between 0 and 100 to represent how influential you are on Twitter. This number may seem arbitrary, but it’s important for several reasons.

Firstly, Klout is a much better measurement of how “well” you’re doing on Twitter than your follower count. Not all followers may really be interested in what you have to say, so using this to measure your Twitter success is not a great strategy. Klout uses a robust suite of different measurements – which includes engaged follower count – to come to one single Klout Score.

Secondly, Klout is important because it’s the standard measurement for influence in social media, and knowing your Klout score shows that you know a thing or two about tweeting.

Thirdly, focusing on increasing your Klout score will make you a better tweeter. Klout emphasizes things like getting retweets and using @mentions to engage with your community. So if you change your Twitter strategy to try and increase your score, you will likely end up tweeting more frequently, replying to more users, and sharing more retweetable tweets.

There are several other contenders for influence measurement on Twitter, but Klout is the most talked-about, well-known influence measure out there, so it’s a good idea to familiarize yourself with it so you can join in the conversation.

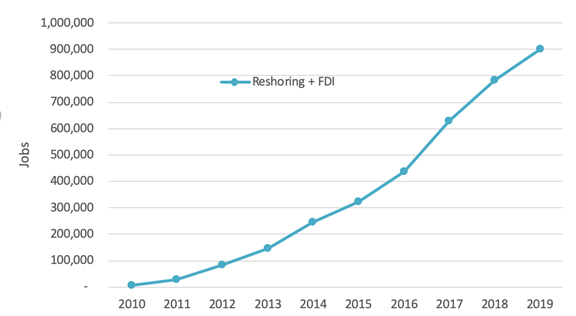

Reshoring: Reshoring simply means returning manufacturing to America from offshore.

To help accelerate this trend, there is a new initiative with a plan to efficiently reduce our imports, increase our “net exports” and regain manufacturing jobs in a non-protectionist manner. The Reshoring Initiative was founded by Harry Moser, retired president of GF Agie Charmilles LLC, a leading machine tool supplier in Lincolnshire, Illinois. The Initiative shows how outsourcing within the United States can reduce a company’s Total Cost of Ownership (TCO) of purchased parts and tooling and offer a host of other benefits while bringing U.S. manufacturing jobs home.

Harry Moser said, “Reshoring breaks out of the waiting-for-policy-decisions problem, the economic zero-sum-game and the increases in consumer prices and assures that the pie grows to the advantage of all Americans. Reshoring also focuses on the manufacturing sector that has suffered so many job losses for decades and the Small-to-Medium Enterprises (SMEs) that offer the best potential for job growth.”

The Initiative documents the benefits of sourcing in the United States for large manufacturers and helps suppliers convince their U.S. customers to source local. Archstone Consulting’s 2009 survey showed that 60% of manufacturers use “rudimentary total cost models” and ignore 20% of the cost of offshoring. If a manufacturer is not accounting for 20% of their costs to offshore, offshoring may not be the most economical decision. In tough economic times and stiff global competition, no company can afford this. To help companies make better sourcing decisions the Reshoring Initiative provides:

- A free Total Cost of Ownership (TCO) software that helps manufacturers calculate the real offshoring impact on their P&L

- Publicity to drive the reshoring trend

- Access to NTMA/PMA Contract Manufacturing Purchasing Fairs to help manufacturers find competitive U.S. sources.

Manufacturing companies can reshore to:

- Reduce pipeline and surge inventory impacts on Just-in-time operations

- Improve the quality and consistency of products

- Cluster manufacturing near R&D facilities, enhancing innovation

- Reduce Intellectual Property and regulatory compliance risk

- Reduce Total Cost of Ownership (TCO)

The Initiative has received increasing visibility and influence: recognition by Industry Week magazine through inducting Harry Moser into its 2010 Manufacturing Hall of Fame, inclusion of the TCO concept in Cong. Wolf’s (R VA) “Bring Jobs Back to America Act” (H.R.516); numerous webinars; dozens of industry articles; presentations in major industry and government policy conferences in Chicago and Washington, DC; and coverage by CBS, CNBC, WSJ, USA Today and the Lean Nation radio show.

The Initiative is succeeding in changing OEMs’ behavior. Companies have committed to reshore after reading Initiative articles. Fifty-seven representatives from large manufacturers and 113 custom U.S. manufacturers attended the May 12, 2011 NTMA/PMA Contract Manufacturing Purchasing Fair, where OEMs found competitive domestic suppliers to manufacture parts and tooling. Sixty-four percent of the OEMs brought back to the U. S. at least some work that was currently offshored.

Of all the trends mentioned above, the Reshoring Initiative has the potential to provide the most benefit for America as a whole by reducing our trade deficit and providing increased job opportunities jobs for the millions of unemployed. Let’s embrace these present trends to create a better future!

?