Several years ago, I met Bill Waddell at a Lean Frontiers conference where we were both guest speakers. We kept in touch via LinkedIn and he recently sent me a message about his new book, titled Reclaiming American Manufacturing. His topic was so closely related to the topic of my last book, Rebuild Manufacturing – the key to American Prosperity that I was anxious to read it to see how he proposed to accomplish our common goal.

After reading his book, we had a short conversation via Zoom about how U.S. manufacturing has been devastated in the past 30 years, along with the devastation of the middle class. His book explains how we got here, and what it will take to set things right again. He draws from his experiences in a long career at the management level of several manufacturers, both domestic and foreign, as well as his experience as a manufacturing transformation consultant in the U.S. and Germany. He started his career in manufacturing in 1978 when he went to “work for a window and cabinet hardware manufacturer, Amerock, in Rockford, IL – which had recently been acquired by Anchor Hocking.” He said he loves everything about manufacturing, and I told him, “I do, too,” and I started as an engineering secretary at age 18 for a company that made electronic and electrical components and assemblies.

I asked why he wrote the book at this time in his life, and he said, “I had some health problems in the last year so I had the time to do it. For the first time, I wasn’t spending all my time in airports. Also, rebuilding manufacturing is what both candidates were saying. I thought it would be timely to put my two cents in from the standpoint of someone who was a manufacturing guy. I don’t know a lot about philosophy or economics, but I thought I could contribute to the discussion from the standpoint of someone who knows a lot about how manufacturing really works and how the decisions are really made about why we are going to build a plant in China rather than the U.S. and why we were not going to move it back. I thought I had a unique perspective. It hurts me personally to remember the glory days of manufacturing. I live in the Midwest, and every town around me has empty factories. I know what it could be and what it used to be. I think it is an important issue economically and not only hurts me, but my children and grandchildren. If we are not going to be a manufacturing nation, they will not have the quality of life that I have had.

We shared our experiences with the effects of NAFTA. Because I read, write, and speak Spanish, I used to sell to the maquiladoras in Baja California prior to NAFTA, but it became too complex and time consuming to continue after NAFTA went fully in effect. He said he learned the implications of NAFTA when he worked for McCulloch Corporation’s chain saw factory in Tucson, AZ that had a plant in Sonora, Mexico. He was “troubled by the openly abusive labor practices” he encountered and “by the poverty of the employees.”

He said that when he worked as a consultant at plants owned by American companies in China, “working conditions were often wretched, and worker safety was often non-existent.” I said that while I had never been to China, I had described the horrible working conditions in a chapter titled, “What Are the Effects of Industrialization on China and India,” in my first book, Saving U.S. Manufacturing, based on the research I had done.

Bill said that he was “very well acquainted with the people in manufacturing, from American middle managers to Chinese machinists to German engineers to Mexican electrical harness assemblers.”

In his chapter, “Hollowing Out the Middle Class,” he points out that “According to the U.S. Census Bureau, manufacturing jobs pay an average of a little over $61,000 a year. If we look at a weighted average of the Health, Education, Hospitality and Transportation jobs that replaced them, it is only $43,000 and change. For all practical purposes, 11 million people took an $18,000 a year pay cut – 30% – and went from the solid middle class to the high end of the lower class.”

I agreed with what he wrote in that same chapter about the “big financial winners in the NAFTA and Ch8ina trade deals have been the big multi-national manufacturers and the banks supporting them [whereas] 95% of American manufacturers are small or medium sized, most with one location, and privately owned – usually a single owner or a family business.”

I resonated with the points he made about NAFTA and the World Trade Organization in his chapter titled “Bill Clinton: Globalist in Chief.” He mentions that Clinton had his work cut out to get NAFTA passed by Congress. While the Democrats controlled both the House and Senate, more Republicans than Democrats supported it. He “garnered enough Democrat support to get it passed” with “a pledge to enter into side agreements with Mexico to assure their protection of the environment and human rights to get it done. They continued to promise that NAFTA” would create as many as a quarter of a million American manufacturing jobs.”

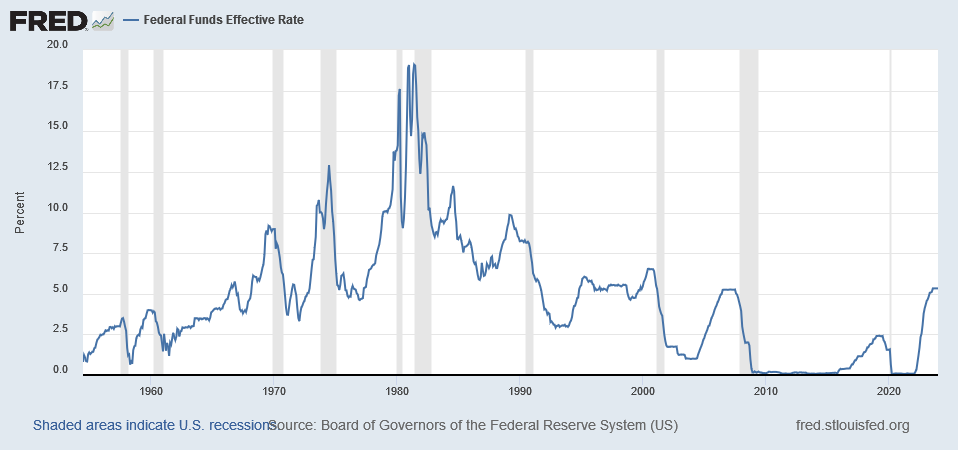

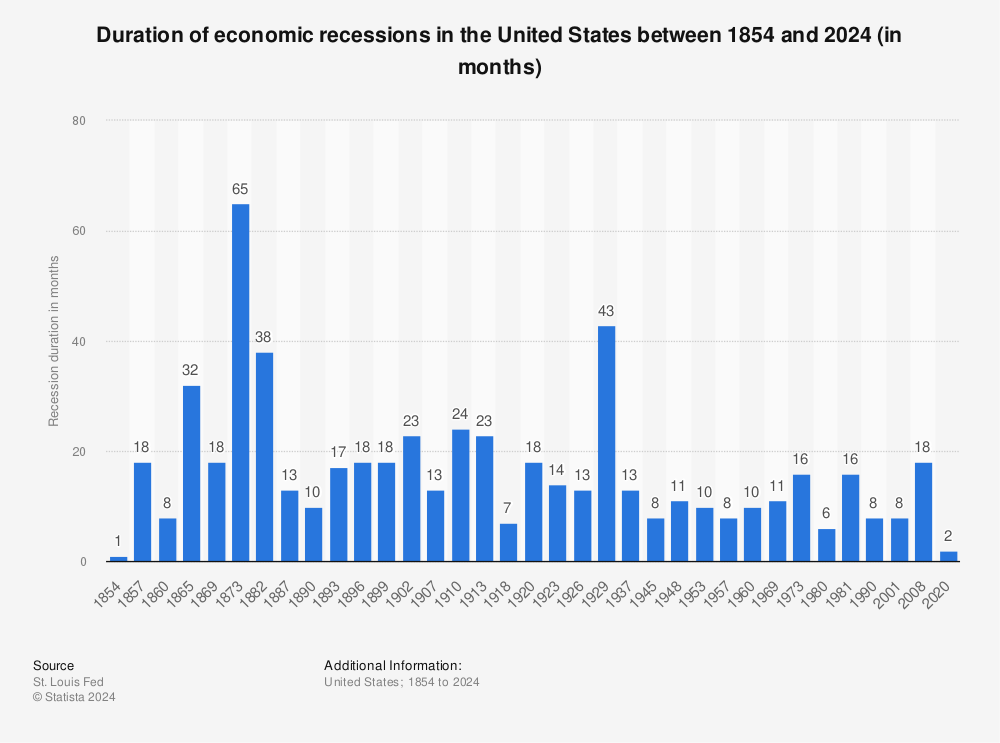

Bill wrote that this proved to be a lie because “By the time Clinton left office in 2001, 6 million American manufacturing jobs were gone, and the US trade balance was in a steep dive.”

He then describes how President Clinton “set about putting US policy and leadership in line with the World Trade Organization – WTO – in 1995” and then in the year 2000, “Clinton attained membership for China in the WTO (essentially giving them what used to be known as ‘most favored nation’ status).”

After defining globalism vs. nationalism in his chapter of the same name, he made a very astute observation: “The old Democrat Part no longer exists. It would be more accurately called the ‘Globalist Party. And the old Republican Party no longer exists. It would be more accurately called the ‘Nationalist Party.’” He states that the globalist ideology that “people, goods, and information ought to be able to cross national borders unfettered” to create a new economic order in the world explains everything from free trade agreements to climate change.

He then dissects David Ricardo’s Theory of comparative Advantage in his chapter titled “Giving Ivy League Degrees to the Illiterate.” He asserts that “they all seem to have missed Recardo’s fundamental principle and explains that “the Theory of Comparative Advantage is not about cheap labor or cheap production – it is about productivity, as it must be.” He concludes, “If global trade is based on sending work to the places where workers are the worse paid, the collapse of the economies in the developed national is inevitable.”

In his chapter “The Economists New Clothes,” he writes, “The intellect behind globalism comes from a fairly tightknit group. The Ivy League, Stanford, MIT, Oxford and a handful of other ‘elite’ schools make up the core of it.” He writes, “The problem isn’t a lack of intellect. It is lack of any real-world exposure or experience.” As a result, “the elite schools have not been in touch with or contributed anything meaningful to manufacturing since the 1980s…” He asserts, “The very notion that the Industrial Revolution has ended, or ever will end, is absurd…Manufacturing in this day and age is a very high-tech endeavor not just in a few select highly automated factories – all of it.” I told him that this is what I have been asserting in every article I’ve written in the past 20 years.

In his chapter, “It’s a Matter of Principle as Much as Economics, he describes the oppressive working conditions, human rights abuses, and air and water pollution of the low-cost labor countries like China, Vietnam, Bangladesh, and India. He comments, “No one should be surprised that the same countries that have a wretched track record of abusing human rights have atrocious air and water quality, and have their people living in dire poverty, struggling just to eat.” He concludes that “Every transaction requires a willing seller and a willing buyer. In globalizing manufacturing, unaccountable leaders were the willing sellers of their countries’ human and natural resources to the willing buyers at the multi-national companies.”

His last two chapters provide his solutions for reclaiming American manufacturing, two of which are so unique that I couldn’t do justice to summarizing his explanation of them. I want to make learning about them an incentive to buy and read his whole book. It will be well worth you time and money. You can buy his book from Amazon.