The non-profit Industry Reimagined 2030 was pleased to speak at the second annual Imperial Capital Advanced Manufacturing & Supply Chain Conference, held on April 13-14 in Santa Monica, CA and sponsored by Moss Adams, The Association for Manufacturing Technology, Smart Room, and Marsh.

On April 14th, presentations during breakfast were given by Kevin Frisch, Managing Director and Head of Industrial Investment Banking, Imperial Capital, Brian Ruttenbur, Institutional Research Managing Director, Imperial Capital, and Guy Knuf, Partner, Moss Adams.

Mr. Frisch explained that Imperial Capital, LLC is a full-service investment bank offering a uniquely integrated platform of comprehensive services to middle market companies and institutional investor. He said,” We have approximately 150 employees worldwide, across 10 offices throughout the United States and Europe. Our comprehensive and integrated service platform, expertise across the global capital structure, and deep industry sector knowledge enable us to provide clients with research driven ideas, superior advisory services, and trade execution. We have a dedicated focus in Advanced Manufacturing, including additive manufacturing, robotics, automation, laser components, specialty metals, specialty chemicals, semi-conductor equipment, optics/photonics, industrial software, and subtractive manufacturing.”

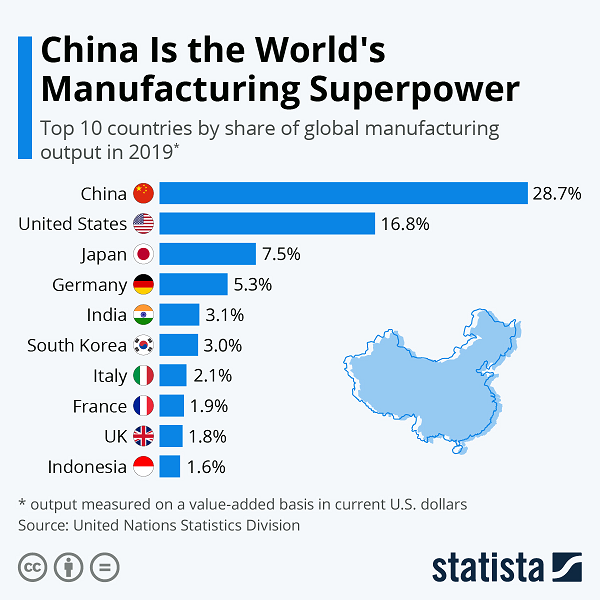

He provided a brief overview of the $26.3 trillion global Advanced Manufacturing market.

The trending Industry Segments

- Specialty Materials – new light-weight materials, nanotechnology and carbon fibers and new applications are reducing waste and increasing efficiency

- Aerospace & Defense – Light-weighting demand for planes, rockets, spacecraft will continue to drive demand for superior materials, AM production and other break-throughs

- Medical – This industry drives demand for superior material advances and new technologies like AM, advanced laser manufacturing as well as design software etc.

- Optics & Photonics – This industry cuts across the Advanced Manufacturing landscape

- MR&O demand

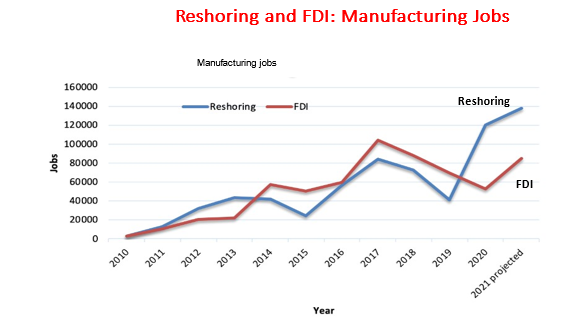

- Increased Reshoring/near shoring in all sectors

Trending Manufacturing Processes

- Faster product development and shorter product life

- Internet of Things – data acquisition and AI-enabled features

- Digital Factory – data integration and overall productivity increasing

- Reshoring/next shoring

- Mass customization in production

- Faster product development and shorter product life

- New technologies – 3D printing, software, robotics

- Light-weighting material demand

- Internet of Things

- Reshoring/next shoring

- New Materials – nanotechnology, carbon fibers, powders

- Mass customization in production

- MR&O demand

Sector Valuation and Vibrancy

Deal volume for capital markets and M&A activity hit a record high at the end of 2021, the dramatic increase in deal flow was driven by optimistic executives, cheap financing and a stock market rebound from the 2020 COVID-19 pandemic. “U.S. Private Equity deal making is expected to continue at high levels. Mega-funds are predicted to raise $250 billion in 2022, including some of the largest ever buyout funds.”

Brian Ruttenbur, Managing Director of the Institutional Research Group of Imperial Capital covered macro trends in Advanced Manufacturing that influence their security and industrial research coverage.

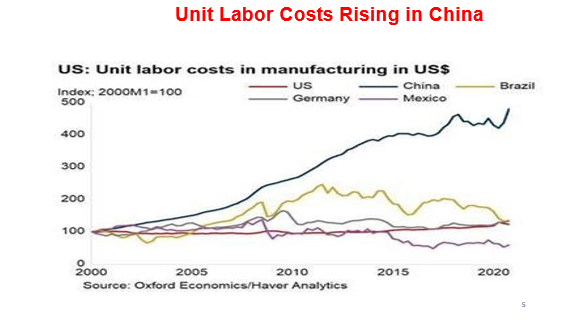

Demand for manufactured products is up across most end-markets and private and public valuations have remained solid. The challenge to meet demand is inflation and material price increases, a tight and expensive labor market, and overall supply chain disruption. Industry is adapting through:

- Automation to alleviate labor shortage issues

- Niche players filling gaps

- Rethinking Onshoring or Nearshoring driven by advanced manufacturing technologies, logistics complexity and national health and security sourcing.

- On-time delivery and just-in-case supply chain resilience are commanding a premium

Guy Knuf, Partner, Transaction Services, Moss Adams was the third speaker covering “The Modern Quality of Earnings (QoE). He said the “drivers of change are:

- More intense buy-side process

- Increased multiples

- Drive for efficiency

- RWI [Reps and Warrants Insurance]

- Credibility”

The benefits of working with a QoE provider are: “maximize value, mitigate surprises, speed (more efficient & effective), prepare management team for buy-side diligence, and credibility.”

After breakfast, the period from 9:00 – 11:50 was divided into Sector Focused Panel Discussions. The presenters in advanced manufacturing technology were:

3DEO Inc. – one of the highest volume metal 3D printing companies in the world

ADDMAN Engineering LLC – metal and polymer 3D printed parts, precision machining to make parts for aerospace and defense, space, medical, and automotive, including niobium parts for hypersonics

Humtown Products – manufacturer of conventional and 3D printed sand cores and molds for the foundry industry

Optomec, Inc. – offers a full range of Additive Manufacturing systems, including their patented Aerosol Jet Systems for printed electronics

Clinkenbeard – specialized expertise in engineering, advanced machining, fabrication and foundry tooling capabilities come together to form a unique mix of services to serve Aerospace, Defense, Heavy Truck, Power Gen and Automotive applications

HB Aerospace Holdings, LLC – provides high quality, specialized aerospace products and value-added services that includes hardware, shims, spacers, handles, brackets, and rubber products such as grommets, seals and gaskets

Tribus Aerospace Corporation – provides precision machining of complex components and assemblies primarily, but not exclusively, for “Power, Propel, Control” applications for turbine engines, auxiliary power units, motion control and flow control

Valence Surface Technologies – provides a comprehensive set of metal processing capabilities and approvals for high-value, mission-critical parts, including NDT, sot peen and blast, chemical processing, plating, painting, and spray coatings

FormAlloy Technologies, Inc. – provides 3D metal additive manufacturing using the Directed Energy Deposition process for making parts, repairing parts, and cladding existing parts

Optomec, Inc. – provides a full range of Additive Manufacturing systems, including their patented Aerosol Jet Systems for printed electronics

pureLiFi – LiFi is high speed bi-directional and fully networked light communications and pureLiFi is the world leader in Light Fidelity (LiFi) innovation

Syntec Optics – offers injection molding, diamond turning, precision machining, optical assembly and coating services for optics and photonics

I was especially delighted to be reunited with Melanie Lang, CEO of FormAlloy as I had the pleasure of being one of her company’s mentors in the CONNECT Springboard program for startup companies in 2017. I was very proud to hear of the progress the company had made, going from a startup with only two customers in 2017 to doing over $4 million in sales last year.

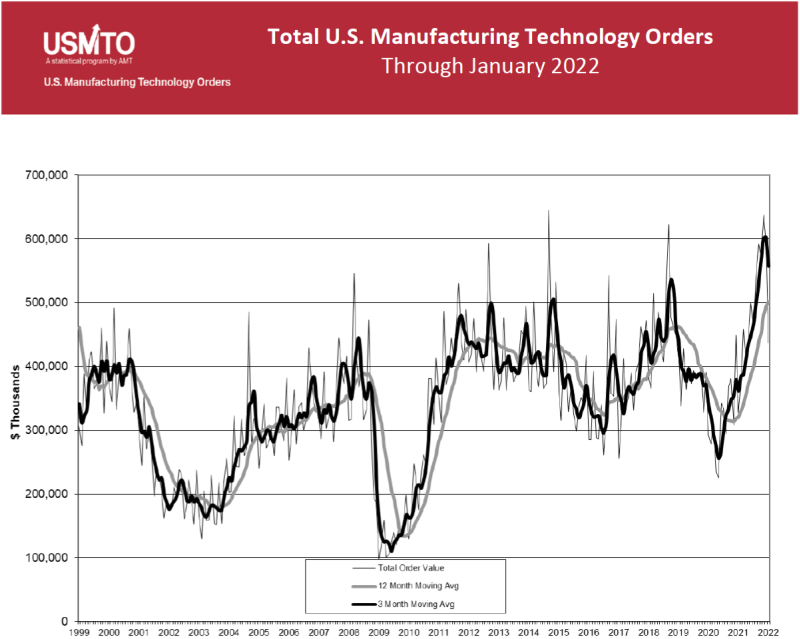

Tim Shinbara Jr, Vice President & Chief Technology Officer, The Association for Manufacturing Technology, delivered the lunch keynote on “The State of U.S Manufacturing –A Macro Analysis.” He reported that manufacturing technology orders were the highest in two decades for first two months of 2022. The key market trends are higher automation, increased reshoring, and Made in America supply chain focus. The industry segments for 2022 growth are: motor vehicles, agriculture implements, metal valves, and medical equipment and supplies. AMT is predicting increasing demand for commercial aerospace and decreasing demand for defense aerospace. Deliveries are improving with suppliers at 70% capacity.

The afternoon sessions were devoted to single company presentations in two tracks. Each presentation was 25 minutes long, starting at 1:15 PM and ending at 4:15 PM

I gave my own presentation on Industry Reimagined 2030: transforming the prevailing worldview of American manufacturing from ‘inevitable decline’ to one of ‘vibrant opportunity’ brought the theme of the conference home. The U.S. has a window of opportunity to recognize the importance of manufacturing and to revitalize our investment in plant, equipment and workforce. The common thread of all companies participating in the panels and individual company presentations was one of vibrant opportunity. We can feasibly imagine having 50,000 world class manufacturers by 2030 if the adoption of these trends and technologies crosses the chasm from early adopters to the mainstream of manufacturers.