On June 29, 2021, the U.S. International Trade Commission (USITC) released a report on the economic impact of the many bilateral, regional, and multilateral trade agreements that the U.S has signed since 1984. These include NAFTA, that went into effect in 1994, the multilateral trade deal that created the World Trade Organization in 1995, as well as bilateral trade agreements such as KORUS (Korea-U. S). It also examined the one-year-old U.S.-Canada-Mexico Agreement, which replaced the original NAFTA. However, it did not examine the effects of the agreement struck by the United States to pave the way for China to enter the WTO in 2001.

The press release stated, “The USITC, an independent, nonpartisan factfinding federal agency, conducted the investigation pursuant to Section 105(f)(2) of the Bipartisan Congressional Trade Priorities and Accountability Act of 2015 (19 U.S.C. § 4204(f)(2)). This is the second of two reports that are required by the statute.” Congress ordered the report as part of the 2015 Trade Promotion Authority law, which expired on July 1st. TPA facilitated the approval of trade agreements by allowing the president to submit them to Congress for a straight up-or-down vote without any amendments.

Each of these trade agreements were projected to expand “market access through both tariff and nontariff provisions, which both lowered barriers to trade and reinforced market certainty that such free trade regimes will remain in effect.”

The ITC press release states, “the Commission has used a variety of quantitative and qualitative approaches to analyze the impacts of these agreements, and specific provisions within them, on U.S. industry and workers.”

A highlight from the report states:

- “The Commission estimates that, to the extent quantifiable, the agreements have had a small but positive effect on the U.S. economy as a whole. U.S. energy product exports to Korea rose sharply in both value and volume in recent years, as U.S. producers and exporters took advantage of broad reductions in trade barriers under the U.S.-Korea Free Trade Agreement (KORUS).”

Public Citizen, a nonprofit consumer advocacy organization that champions the public interest –in the halls of power, published their analysis of the ITC report, pointing out the following:

- “Estimates that U.S. trade agreements have increased the wage gap in America between higher-and lower-skilled workers (page 122).

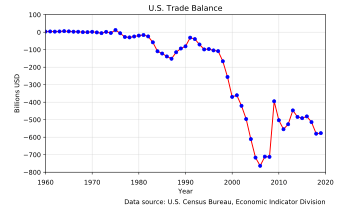

- Tried to cover up the reality that the United States has a large and growing trade deficit with its Free Trade Agreement (FTA)partners. The aggregate U.S. trade deficit with FTA partners has increased by about $141 billion, or 418 percent, since the FTAs were implemented while the aggregate trade deficit with all non-FTA countries has decreased by about $46 billion, or 6 percent, since 2005 (the year before the median entry date of existing FTAs).

- Estimates all the U.S. bilateral and regional FTAs combined have led to an increase in real GDP and aggregate U.S. employment by less than 1 percent (page 122).

- Fails to discuss or review the 2.9 million jobs certified by Trade Adjustment Assistance (TAA)as trade job losses since the passage of the North American Free Trade Agreement (NAFTA)…

- Finds that certain trade agreements have lowered employment levels in many industries including autos as well as textiles and apparel.

- Finds that all the U.S. FTAs since 1985 have increased real GDP by a minuscule0.21 percent (page 127).”

In an article on 6/29/21 in Politico, Doug Palmer commented, “Nearly four decades of U.S. trade agreements have had only a “small, positive effect” on U.S. economic growth and employment, the U.S. International Trade Commission…Using 2017 as its base year, the ITC estimated the trade deals had increased U.S. economic output by $88.8 billion or 0.5 percent. The trade pacts increased overall U.S. employment by 485,000 full-time equivalent jobs or 0.3 percent, based on a model that assumes the economy is at its long-run full employment level.”

Proponents of all of the trade agreements projected increases to our national Gross Domestic Product and the creation of more U.S. jobs. China’s entry into the WTO in 2001 was supposed to require China to open its markets to imports from the U. S. and other nations by reducing Chinese tariffs and addressing nontariff barriers to trade. Proponents argued that the U. S. would benefit because of increased exports to a large and growing consumer market in China. However, history has shown that the reverse has been true.

In a 2003 article, “The high price of ‘free’ trade,” Robert E. Scott of the Economic Policy Institute wrote, “Since the North American Free Trade Agreement (NAFTA) was signed in 1993, the rise in the U.S. trade deficit with Canada and Mexico through 2002 has caused the displacement of production that supported 879,280 U.S. jobs. Most of those lost jobs were high-wage positions in manufacturing industries.”

On January 30, 2020, Robert E. Scott and Zane Mokhiber of the Economic Policy Institute released the report, “Growing China trade deficit cost 3.7 million American jobs between 2001 and 2018.” Key findings include:

- “1.7 million jobs lost since 2008 (the first full year of the Great Recession, which technically began at the end of 2007). Three-fourths (75.4%) of the jobs lost between 2001 and 2018 were in manufacturing (2.8 million manufacturing jobs lost due to the growth in the trade deficit with China).

- The U.S. trade deficit with China rose from $347billion in 2016 to $420 billion in 2018, an increase of 21.0%

- The growing trade deficit with China has cost jobs in all 50 states and in every congressional district in the United States.

- The five hardest-hit states based on total jobs lost were California (654,100 jobs lost), Texas (334,800), New York (185,100), Illinois (162,400), and Florida (150,700).

- The trade deficit in the computer and electronic parts industry grew the most, and that is reflected in job losses:1,340,600 jobs were lost in that industry, accounting for36.2% of the 2001–2018 total jobs lost.

- Global trade in advanced technology products—often discussed as a source of comparative advantage for the United States—is instead dominated by China.”

According to the U. S. Census Bureau, the U. S. trade deficit with China dropped from $418.2B in 2018 to $310.3B in 2020. We also had a trade deficit of $344.3B for 2019. This downward trend may reflect the beneficial effect of the tariffs imposed by President Trump on specified Chinese imports.

However, according to an analysis by Jeff Ferry, Chief Economist for the Coalition for a Prosperous America, we are still losing jobs from trade deficits. “The Coalition for a Prosperous America’s research center has found, in an economic analysis of federal government data, that every $1 billion increase in imports causes a loss of 4,552 US jobs.”

Using the Census data, this means that we lost 1.9 million jobs in 2018, 1,6 million jobs in 2019, and 1.4 million jobs in 2020.

In my opinion, it’s time for the United States to stop this horrific loss of jobs by drastically changing our trade policies with China. China is not our friend; they are not just our competitor. They are our enemy. Perhaps it’s even time to withdraw from the World Trade Organization.