· Autodesk Fusion 360 Software -Free Fusion 360 software for Urban Workshop and for all members.

After the NACCE summit I attended on April 27th formally ended at 1:30 PM, I went on the optional tour of a nearby makerspace, the Urban Workshop in Costa Mesa. It is the largest makerspace I have visited in my travels around the country and is the largest makerspace in southern California.

“Urban workshop was born out of my engineering and manufacturing company called Automotive Technology Group Inc., which opened in 2001. Prior to the economic downturn, we were one of the top EV and hybrid vehicle engineering houses in the country doing advanced R&D for the large auto makers and smaller startups such as Fisker Automotive. We also did a small number of professional motorsports.

When the economy slowed, most of the engineering services and manufacturing dried up but the motorsport business swelled. The rich guys who were racing cars weren’t affected by the downturn of the economy so we did well. Around January 2013, I started doing STEM presentations to kids at local high schools and colleges to tell them about the race cars hoping to peak their interest in the sciences. I had heard about makerspaces and started asking some of the teachers their opinion about them. Jokingly, they started to introduce me as the guy who is opening “The Shop.” I didn’t correct them, and before I knew it, people were showing up at ATG asking if this was “The Shop” and if it was open yet.

The Urban Workshop was founded by, and is privately owned by, Steve Trindade. During the tour, Steve told the story of how he started the makerspace, and later emailed me the following story:

“By January 2014, I had become very frustrated with the engineering services business due to customers not paying or going out of business leaving me holding the bag. Simultaneously, three to five people per week were stopping by to look for “The Shop.” That was when I decided to go for it. We wound down the projects we were working on, and signed a lease for a 5,500 square foot R&D space in May 2014.”

Steve said, “Our facility was basically built, painted, and set up by volunteers. People who walked in the front door and asked, is this “The Shop?” I said, It’s Urban Workshop, but we aren’t open yet. Almost always they replied, can I help? I said yes, and put them to work.

In the end, we renovated the facility and got ready to open with nearly all volunteer help. Using all volunteer help, we set up the new facility and opened as Urban Workshop on July 2014. We had a similar experience with volunteer help when we moved into our current larger building in April 2015.

Since then, the business has grown significantly, and our membership is over 1,700. Our small business members do approximately $20M in annual revenue directly out of our facility, and collectively they have raised nearly $70M in angel and venture funding. In 2015, we added youth programing similar to the old school shop classes and now serve over 1,000 students age 10 to 16 years old annually.”

I was impressed by the kind of equipment and resources the Urban Workshop provides. It is a full-scale DIY workshop and makerspace meaning that it includes all aspects of engineering, prototyping and manufacturing equipment. Steve said, “We have nearly $1M worth of equipment and because we used to be a professional services company, all of the equipment is current state of the art industry relevant equipment as opposed to the typical hobby level equipment you find in all other makerspaces. We teach classes on all the equipment and continue to add classes as fast as we can generate the course materials.

The equipment I saw on the tour included computers and software, large format plotters and printers, 3D printers, laser etchers, sheet metal fabrication equipment, manual and CNC machines, MIG and TIG welding, a vacuum forming machine, an autoclave, a silicone molding pressure pot, an extensive wood shop with a large CNC router, a composites fabrication shop, a vinyl cutter, sewing equipment, an electronics lab, and an auto shop with five auto lifts.

On their website, the following companies are listed as commercial partners/supporters:

· Epilog Laser Etchers – Educational pricing on equipment and extended warranty support to Urban Workshop

When I asked what “Making” meant to him, he said, “In one word, opportunity. Opportunity for our members to learn new skills, open a new business, fix something, help others, learn a new skill, make a new friend, complete a personal project or who knows what. It has been very satisfying to watch people come in the shop with one idea and end up making five more things they never thought of before on equipment they have never used before with the help of someone they met at Urban Workshop.”

· Haas CNC Machines Educational pricing on equipment, extended warranty support, free computerized training and simulation station to Urban Workshop.

· Autodesk HSMWorks Free HSMWorks CNC programming software for members to use on site.

· SolidWorks– Free engineering software for members to use on site.

· Laguna Tools – Educational pricing on equipment, software and extended warranty support to Urban Workshop.

· National Instruements – Free Virtual Bench all-in-one test equipment and LabView software for members to use on site.

· Ingersoll-Rand – Educational discount on machine tooling and fixtures to Urban Workshop.·

Steve said, “The initial response to Urban Workshop was overwhelmingly positive, and the level of enthusiasm was incredible. The response continues to be great and the level of excitement and comradery continues to grow. Almost weekly a member comes to my office to thank me for opening the shop and enabling them to be able to make their dream project or start their new business. I knew this would be fun and satisfying, but I never imagined the extent that it would be so well received.”

One other observation he made is that whether you call it hacking, making, or tinkering, “the desire people have to use their hands is universal and fundamental. It is extremely satisfying to figure something out, address a problem or need one has or create something from scratch. I believe it has a therapeutic value and allows one to focus on something for a time without distraction. This is something that is unusual in these days of smart phones and social networking.”

In describing the projects his members are working on, he said, “Theyvaryjust as much as the members do. We have young professionals who are starting their own businesses all the way to the “burning man” crowd. It is impossible to nail it down and give a simple example. I have seen everything from ruggedized super tablets designed and manufactured in the shop to an Arduino controlled dog feeder and a talking Wi-Fi enabled Christmas tree. Urban Workshop’s membership is approximately 45% startups developing and manufacturing new products, 40% hobbyist, and 15% students. The hobbyists are the most diverse and work on home projects, vehicle restorations, boats, motorcycles, gifts, tons of wood working and cabinetry, arts and crafts, holiday decorations, cosplay, prop making, toys, and you name it.”

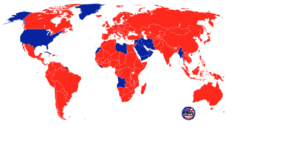

When I asked what his future plans are, he said, “Our long term the goal is to open additional locations. Currently, we are expanding our class offering to include many more project classes that will help guide people on the path of making. The youth program continues to grow, and additional levels will be added. Our most promising new product is the licensing of our operational procedures and class documentation to other makerspaces world-wide, providing operational training, and instructor training to enable them to prosper and help even more people.”

I’ve only visited one other makerspace about which I wrote, Vocademy in Riverside, that had a plan to expand to other locations, but its focus was on working with high schools to provide the career technical training that high schools used to provide. With the depth and breadth of Steve’s business experience, he is more likely to succeed with his future plans than others.