Because the U.S. trade deficit in goods and services continues to surge, many people wonder if reshoring is really happening and whether it is having a beneficial effect and increasing.

According to data from the U.S. Bureau of Economic Analysis, the U.S. trade deficit surged to a new record in January. The “goods and services deficit was $131.4 billion in January,” ballooning up by 34% from December’s deficit of $98.1 billion. “This was the widest deficit for a month on record, dating back to 1992, and the expansion was more than analysts anticipated.”

As usual, China ($29.7) topped the list of countries with which we have trade deficits. The other top ten were the “European Union ($25.5), Switzerland ($22.8), Mexico ($15.5), Ireland ($12.4), Vietnam ($11.9), Canada ($11.3), Germany ($7.6), Taiwan ($7.5), [and] Japan ($7.4).”

The good news is that reshoring is increasing and improving our country’s self-sufficiency capacity for goods essential to our economy and national security according to a number of recent surveys and reports.

The article titled, “The Rise of Onshore Manufacturing” in the January-February 2025 issue of Design2part magazine, reports that “Research released in November by global management consultancy Bain & Company revealed an acceleration in strategic reshoring moves by businesses worldwide—to shift operations and supply chains closer to their home markets…The survey found that the percentage of CEOs and chief operating officers who reported their companies are planning to bring supply chains closer to market rose from 63 percent of those surveyed in 2022, to 81 percent in 2024—a sharp 18 percent increase…Survey results show that the proportion of companies reporting moves to shift operations out of China rose from 55 percent in 2022, to 69 percent in 2024.”

The research stated “Factors such as geopolitical turbulence, rising costs, and pressures for reduced carbon footprints are fueling the trend toward onshoring” In addition, “reshoring as having been further stimulated by the 2022 Inflation Reduction Act (IRA). The IRA offers U.S. companies subsidies and tax credits that incentivize reshoring and near-shoring to boost domestic manufacturing and job creation…Moves toward reshoring of semiconductor manufacturing have also been intensified by the U.S. CHIPS Act, which put in place tax incentives and $52 billion in funding to stimulate U.S. domestic production of chips.”

The results of this research are corroborated by “Kearney’s 2024 annual Reshoring Index (KRI) report, which “concludes that as reshoring and nearshoring activity increase, ‘Made in America, for America’…describes the foreseeable future of industrial manufacturing in the Western hemisphere.”

The KRI was launched in 2018 to track the extent to which manufacturers are reshoring manufacturing from Asia back to the US. “The Reshoring Index is determined by dividing the import of manufactured goods from the 14 Asian low-cost countries by the US domestic gross manufacturing output to calculate a manufacturing import ratio (MIR)”

Based on data from 2023, the report showed “US imports from 14 Asian LCCRs declined by $143 billion, from $1,021 billion in 2022 to $878 billion in 2023. The majority of the drop in Asian LCCR imports was caused by a 20 percent (or $105 billion) reduction in Chinese imports.” However, “Mexico surpassed mainland China as the largest exporter to the US. US imports of Mexican manufacturing goods grew from $320 billion to $422 billion (32 percent).”

The Kearny report also stated: “Thirty-eight percent of manufacturing executives responding are looking to continue to reshore or nearshore operations from mainland China, while another 25 percent are discussing moving operations away from India, and 14 percent are thinking about exiting Vietnam.”

The organization that originated the term “reshoring” is the Reshoring Initiative founded by Harry Moser in 2010 to help manufacturers return manufacturing to the U. S. by changing the mindset from “offshored is cheaper” to “local reduces the Total Cost of Ownership.” A Free Total Cost of Ownership (TCO) worksheet calculator is available at www.reshorenow.org.

The latest e-news by the Reshoring Initiative includes this link to take the annual industry-wide Reshoring Survey that examines manufacturers’ decisions on whether to reshore factories and supply chains. The results of the survey will be released in April.

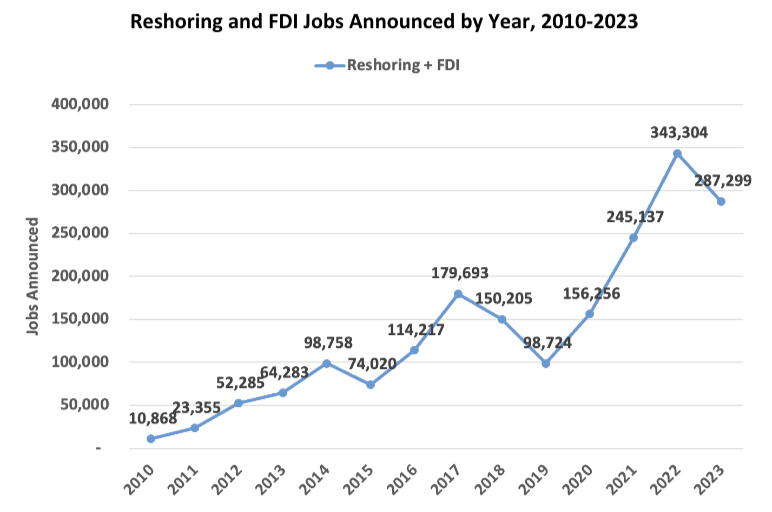

Last year’s report featuring 2023 data showed that reshoring is continuing to climb, adding 263,583 jobs, the second highest year on record compared to 349,408 jobs in 2022. The preliminary data for 2024 is 244,940. The website reports “As of March 2023, we have recorded over 6400 cases of manufacturing companies that have brought work back to the U.S.” The total number of jobs created by reshoring and FDI came to 1,214,3343 at the end of 2024.

Reprinted with permission of the Reshoring Initiative

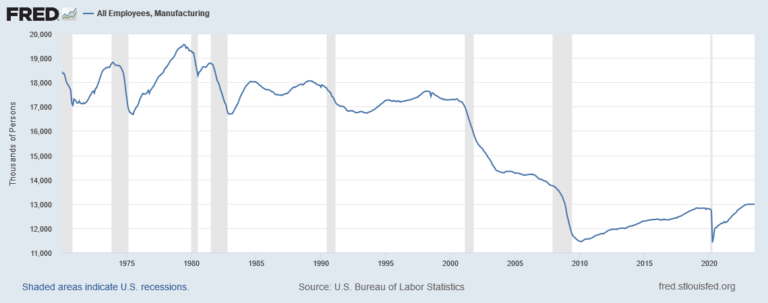

We lost 5.8 million jobs between 2000 to 2020, and it’s taken 11 years to add the first million jobs, but only three years to add the second million. Even at the current faster rate, it would take at least another 12-15 years to recoup the 3.8 million jobs we lost.

The key findings of the 2024 report were:

- Geopolitical Risk is a top driving force in the reshoring and FDI trends.

- Skilled workforce is another top factor

- The Southern U.S. remains the most competitive manufacturing region

- Nearshoring and trade with allies are becoming more prevalent in the shifting global dynamics

- Wall Street is embracing reshoring, with mentions in earnings calls up sharply and

- a 300% increase in spending on reshoring and FDI data

Foreign Direct Investment refers to foreign companies either investing in the U.S. by expanding existing U.S. plants or building new plants.

The report noted:

- Israel – “the October 7 Hamas attack was too late in 2023 to impact 2023 data, but we anticipate it will have a ripple effect across various industries with broad economic and supply chain disruptions that will influence costs, availability of materials, and production schedules.”

- Taiwan – “U. S. Chinese tension has been mounting for several years. Geopoliticians and corporate strategists are anticipating reshoring as insurance.”

- China – China has the highest combination of huge trade dependency, single sourcing and geopolitical risk. Reshoring and FDI from China are near historical highs, with reshoring alone at an all-time high of 87%.”

Since these geo-political threats have only increased in the past year, there is a greater incentive to consider reshoring. According to this report, the number of CEOs actively reshoring went from under 10% in 2012 to nearly 90% in 2023.

The latest e-news from the Reshoring Initiative states: “the mere threat of tariffs seems to be doing a sufficient job of defining the objective: the U.S. must boost domestic manufacturing to strengthen national security, reduce the trade deficit, and support economic stability. And the Trump administration appears serious about making that happen. Regardless of how tariffs are implemented, the pressure is driving companies to rethink their supply chains and commit to localization.”

However, the e-news cautions: “While the mere threat of tariffs could be enough to firm up some of the plans, many projects will only move forward when the tariffs are in place and likely to remain in place for at least the next four years. As Michael Todd Speetzen?of Polaris said, “We have a presence that we would be able to leverage if we viewed this as a more permanent situation.” The Reshoring Initiative’s industrial policy says that if tariffs are used, they should be “forever” or at least until trade in the product or with the other country becomes balanced. Companies will not make large investments if the rules are likely to change.”

While tariffs are being criticized by economists and those who would be subject to the tariffs, it appears that tariffs could become the major driver of reshoring by American manufacturers. It could also accelerate Foreign Direct Investment as more foreign companies expand existing plants in the U.S. or build new manufacturing plants in the U.S. to avoid tariffs.

Some economists say that tariffs protect and prop up inefficient American manufacturers that should be allowed to fail if they can’t compete against foreign competitors.

I agree with the Victor Davis Hanson’s opinion about President Trump’s tariffs in his article, “Are Trump’s Tariffs Really Tariffs?” He wrote, Consider the various Trump “tariffs” leveled by an exasperated, and now $36 trillion-indebted, America. Almost none of them meet the traditional definitions of an industry-protecting tariff. Instead, they are the last-gasp tools of American leverage used only when decades of bipartisan diplomacy, summits, entreaties, and empty threats have all failed…The Trump tariffs are the last, desperate effort to reestablish global reciprocity and keep America safe.”

American manufacturers have had to compete on an unlevel playing field in international trade for decades. We need to do whatever it takes to rebuild our manufacturing industry to ensure that we have the commercial and military/defense products needed to keep Americans healthy and safe. If tariffs would level the playing field for American manufacturers and accelerate reshoring significantly, I’m all in favor of implementing tariffs until our trade is balanced.