On June 21, 2022, the Information Technology & Innovation Foundation conducted a webinar entitled, “Assessing the Competitiveness of North America: The North American Subnational Innovation Competitiveness Index,” based on a report by Luke Dascoli and Stephen Ezel of ITIF, and prepared in collaboration with the Macdonald-Laurier Institute, Fundación IDEA, and the Bay Area Economic Council Institute.

I was unable to attend the webinar, but later read the 49-page report with the goal of identifying examples of the vision of Industry Reimagined 2030 to convert the narrative of American manufacturing from one of “inevitable decline” to “vibrant opportunities.”

The purpose of the report was “to identify economic differences among states and provinces and highlight regions needing more federal attention, identify cross-national innovation performance, and track the continent’s overall competitiveness in the innovation-driven global economy.”

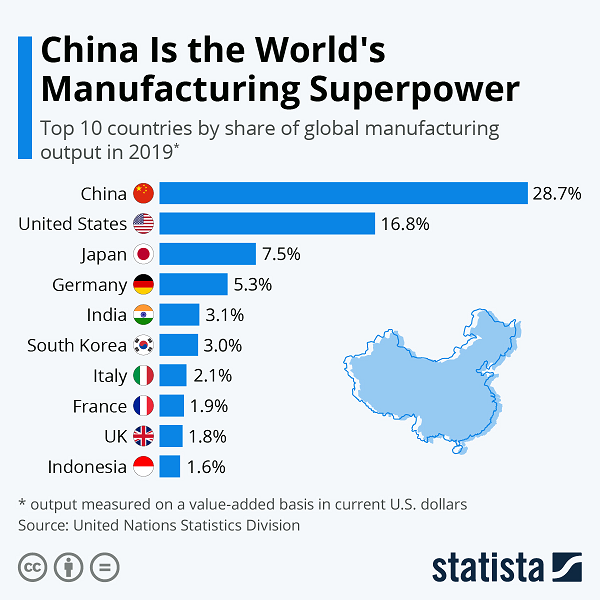

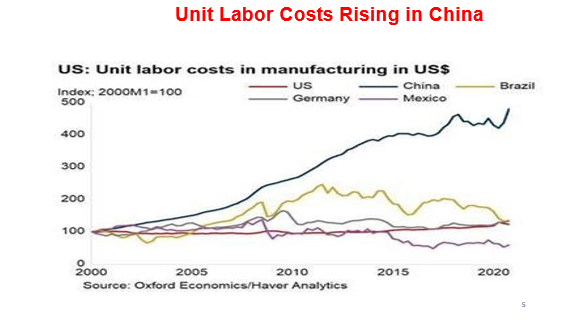

A vibrant opportunity was identified in the first paragraph of the Overview: “North America—Canada, Mexico, and the United States—represents one of the world’s most economically vibrant regions, accounting for 28 percent of global economic output. The region also forms one of the world’s largest free trade zones, with deeply integrated supply chains…the three nations form a high-wage/low-wage partnership, bringing complementary labor forces, infrastructure, innovation capacities, and industry strengths together to create a highly competitive economic region. This relationship is poised to make North American manufacturing value chains globally cost competitive with Asian ones and thus make North America a leading global innovation and manufacturing powerhouse.”

“This report assesses how prepared North American states are to compete in today’s increasingly innovation-driven economy. The North American Subnational Innovation Competitiveness Index (NASICI) uses 13 measures across 3 categories to quantify the extent to which each state’s economy is knowledge based, globalized, and innovation ready and form composite scores (between 0 to 100) that identify each state’s level of performance in the innovation economy.”

Knowledge Economy

•Immigration of knowledge workers – number of highly educated foreign-born residents as a share of total state population

•Workforce Education – total workforce finishing postsecondary education (including universities, trade schools, and colleges)

•Professional, scientific, tech – total employment enrolled in professional, scientific,

and technical activities

•Manufacturing Gross Value Added per worker – measures the average GVA per manufacturing worker

Globalization

•Inward foreign direct investment – flow of funds into a state from foreign-based enterprises to purchase that state’s existing facilities or to develop new ones

•High tech exports – (NAICS 333, 334, & 335) as a Share of GDP

Innovation Capacity

•R & D Intensity – Total R&D Investment Relative to GDP

•R & D Personnel – as a Share of Total State Employment

•Patents (per capita) – PCT Patents Issued per Million Persons

•Venture Capital Investment – shows a state’s total VC investment (based on VC-receiving firms located therein) relative to the size of its GDP.

•Broadband telecommunications – Share of all Households Subscribing to Broadband Internet

•Decarbonization (CO2 emissions) – Tons of CO 2 Emissions per Capita

The Composite NASICI scores for the top ten states/provinces are:

| Ranking | State/Province | Country | NASICI SCORE |

| 1 | Massachusetts | United States | 91.5 |

| 2 | California | United States | 83.9 |

| 3 | Ontario | Canada | 75.2 |

| 4 | Maryland | United States | 75.0 |

| 5 | Washington | United States | 74.2 |

| 6 | British Columbia | Canada | 70.4 |

| 7 | New Jersey | United States | 70.2 |

| 8 | New Mexico | United States | 68.3 |

| 9 | Quebec | Canada | 68.1 |

| 10 | Oregon | United States | 66.0 |

Notice that Canada has three provinces in the top ten, but Alberta was the only other Canadian province to rank in the top 30. Arkansas, Mississippi, and South Dakota came in last for U. S. states, with South Dakota at number 60. The ranking of Mexico’s states was “concentrated at the low-scoring end of the subnational index (61–92).”

The report commented that “Massachusetts ranks first due to the state’s massive network of software, hardware, and biotech firms in the Greater Boston area. Boston also holds one of the country’s most densely populated clusters of top-performing research universities, many of which focus on science, technology, engineering, and mathematics (STEM) education. California places second due to its bustling tech economy of Silicon Valley and other southern Californian innovation hubs with access to leading research universities such as Stanford, Caltech, and the University of California, San Diego. Maryland earns its spot due to the state’s abundance of D.C.-commuting knowledge workers employed in scientific, technical, and professional activities, alongside its R&D and innovation activities attributable to a plethora of federal contracts. Washington state ranks fifth because of its high-tech exports, cutting-edge tech businesses bringing in foreign investment, patent generation in areas such as artificial intelligence (AI) and cloud computing, and digitalization of the service sector.”

The report goes into some detail regarding the rankings in the 13 subcategories which are too complex for this article to cover. With regard to high tech exports, it discusses the successful cross-border region of the Pacific Northwest states of Oregon and Washington with the Canadian province of British Columbia, as well as the cross-border regions of California, Arizona, and Texas with the Mexican states of Chihuahua, Baja California, and Tamaulipas…These Mexican “states include the major manufacturing cities of Ciudad Juarez, Tijuana, and Matamoros, which together comprise most of Mexico’s

“maquiladora” manufacturing plants.”

The report makes the following policy recommendations for the United States:

Expand the R&D Tax Credit to Be Competitive with Canada – Canada’s “overall federal subsidy rate of 19.1 percent on business R&D investment” is “above the 16.6 percent median among 34 developed countries observed” and considerably higher than the U.S. “sub-median federal-state subsidy rate of 9.5 percent.”

Build Globally Competitive North American Supply Chains – This recommendation advocates the partnering of companies in the U.S. and Canada with the low-wage states of Mexico to “nearshore their production of innovative goods and the low-tech complementary manufacturing of products in high-tech industries into Mexico….This collaboration of complementary labor forces would help North American supply chains perform as a region that’s globally competitive with the supply chains of Asian low-cost competitors.”

Promote Industry-University Partnerships – “Firms on the cutting edge of new research can benefit from tapping the skills of the next generation of scientists and engineers early on by collaborating with neighboring universities via internships, fellowships, and other resource sharing with academic institutions. As federal funding for intramural research in states/provinces lags behind, industry investment in university research is increasingly important.”

Expand Collaborative Research Between U.S. and Canadian Leaders – “Firms engaging in international research collaboration tend to generate more valuable research than firms not collaborating in research or only collaborating among domestic firms do… Firms of U.S. and Canadian states/provinces should thus pursue greater research collaboration and co-patenting, given the proven benefits in international research collaboration and diversifying with new research partners. Doing so would help expand the network of shared research knowledge to drive more frequent and impactful innovations for both U.S. and Canadian states.”

Fully Embrace USMCA’s Commitments to Create a Free-Flowing North American Digital Economy – The USMCA provided stronger rules for digital services across industries such as finance, e-

commerce, and software, for cross-border data transfers. The United States, Canada, and Mexico must “utilize the full economic value of data and remain competitive in the global digital economy.”

Expand National Place-Based Development Projects – The report recommends thatnational and regional policymakers should use the NASICI rankings to identify regions or states that are lagging behind in economic development. The authors note that the efforts of the U. S. Economic Development Agency and regional commissions have “fallen off” and that the EDA’s budget had been reduced over time. “Federal investment to build up economic attractiveness for underperforming states can improve their competitive edge and reduce economic hardships for the populations of those states.”

Improve Economic Indicator Data Availability Among North American States – “…the NASICI, ITIF and its Canadian and Mexican partners were only able to identify 13 indicators for which data was uniformly and readily available across North America’s 92 subnational regions. Statisticians from Canada, Mexico, and the United States should collaborate to make more such indicators available.”

In conclusion, the report states: “Today’s 21st-century economy has different success markers than the post-war economy experienced in the latter half of the 20th century. There are many more global competitors in the space of advanced technology production, R&D, and digital services.” For the United States, “NASICI scores are helpful to bring to light regions needing more federal attention to support innovation competitiveness.”

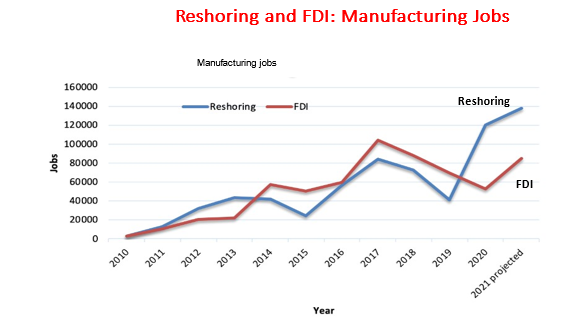

Th9is report confirms that the narrative of the “inevitable decline” of American manufacturing of American manufacturing is no longer true and “vibrant opportunities” already exist. These “vibrant opportunities” need to be expanded to be achieve the goal of fostering 50,000 more world-class companies and creating five million more manufacturing jobs by 2030.